- Turkey

- /

- Infrastructure

- /

- IBSE:CLEBI

3 Middle Eastern Dividend Stocks Yielding Up To 6.2%

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced a cooling period, with UAE indices easing as oil prices slipped and profit-taking capped Dubai's rally after nine consecutive sessions of gains. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for investors seeking to navigate the fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.39% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.13% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.18% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.66% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.49% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.00% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.96% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.63% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

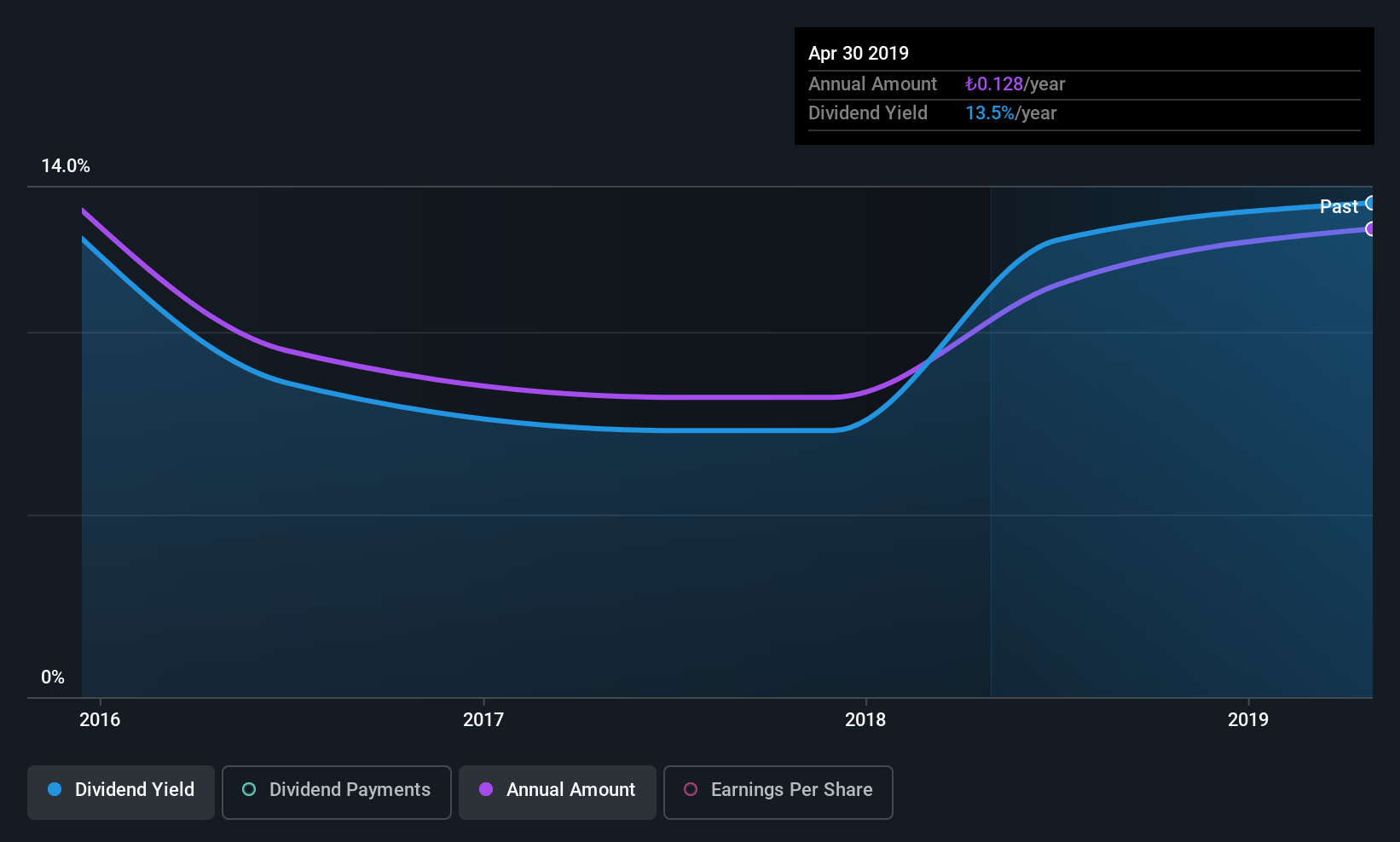

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines as well as private air cargo companies primarily in Turkey, with a market cap of TRY39.22 billion.

Operations: Çelebi Hava Servisi A.S. generates its revenue primarily from Airport Ground Services, including ground handling services, amounting to TRY15.02 billion, and Cargo and Warehouse Services totaling TRY7.13 billion.

Dividend Yield: 3.9%

Çelebi Hava Servisi's dividend yield of 3.9% ranks in the top 25% of Turkish market payers, yet its sustainability is questionable due to a high cash payout ratio of 221.2%, indicating dividends are not well covered by cash flows. Despite a reasonable earnings payout ratio of 52.3%, dividend reliability is undermined by volatility over the past decade and recent earnings reports show mixed results with stable quarterly but declining nine-month net income year-over-year.

- Click to explore a detailed breakdown of our findings in Çelebi Hava Servisi's dividend report.

- The analysis detailed in our Çelebi Hava Servisi valuation report hints at an inflated share price compared to its estimated value.

OYAK Çimento Fabrikalari (IBSE:OYAKC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OYAK Çimento Fabrikalari A.S., along with its subsidiaries, is involved in the production and sale of clinker and cement in Turkey, with a market capitalization of TRY120.96 billion.

Operations: OYAK Çimento Fabrikalari generates revenue from two main segments: Cement, contributing TRY27.01 billion, and Ready-Mixed Concrete, accounting for TRY16.23 billion.

Dividend Yield: 4%

OYAK Çimento Fabrikalari's dividend yield of 4.02% places it among the top 25% in Turkey, but sustainability concerns arise due to a high cash payout ratio of 346.2%, indicating dividends aren't well covered by cash flows. Although the payout ratio is reasonable at 66.2%, past dividend volatility and unreliability are notable drawbacks. Recent earnings show improved quarterly net income (TRY 3,394.04 million) but a slight nine-month decline in sales year-over-year (TRY 40,527.52 million).

- Navigate through the intricacies of OYAK Çimento Fabrikalari with our comprehensive dividend report here.

- According our valuation report, there's an indication that OYAK Çimento Fabrikalari's share price might be on the expensive side.

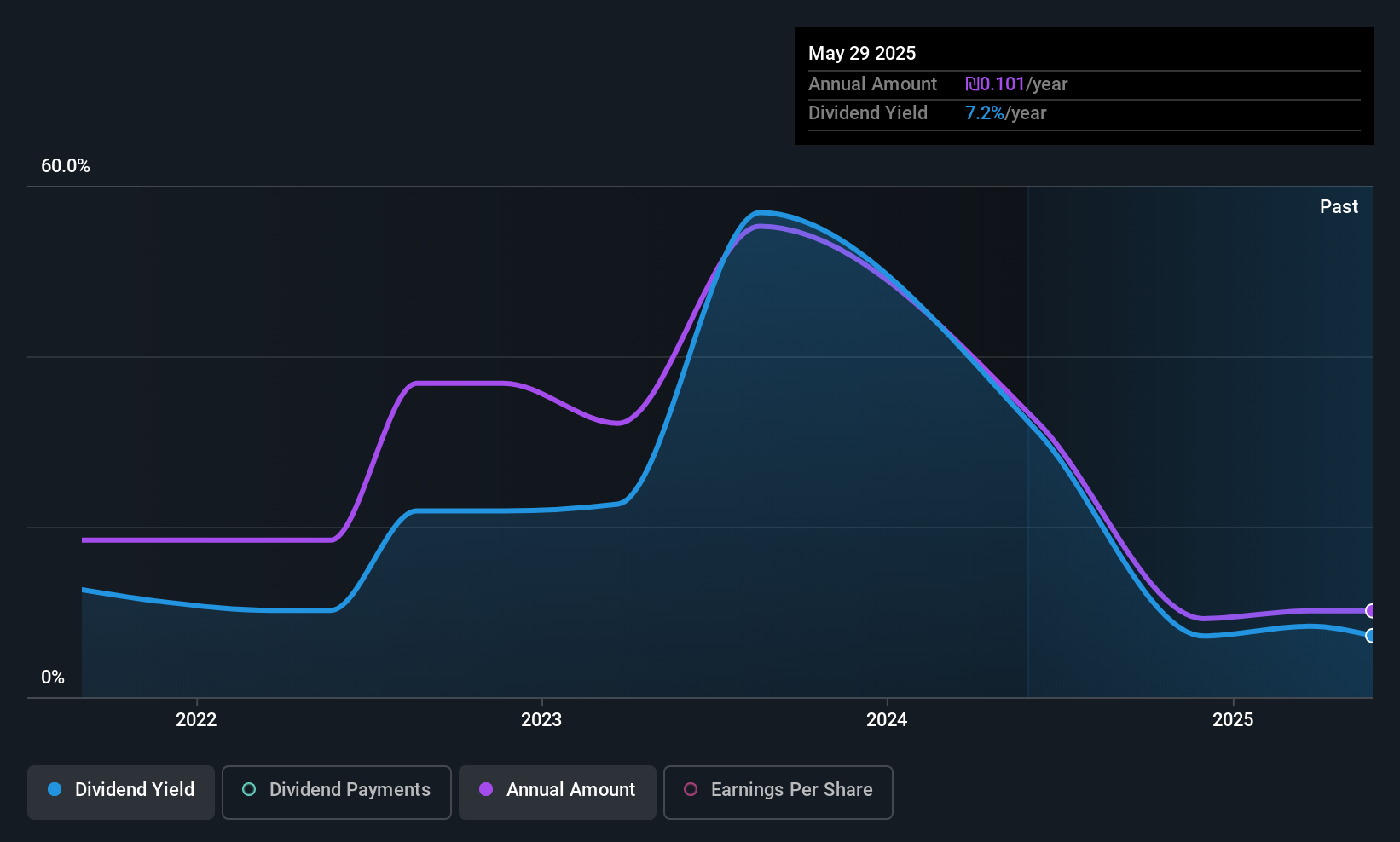

Suny Cellular Communication (TASE:SNCM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suny Cellular Communication Ltd operates in Israel by importing and marketing cell phones, accessories, and storage devices, with a market cap of ₪352.93 million.

Operations: Suny Cellular Communication Ltd generates revenue primarily from the sale of cellular phones and accessories, amounting to ₪987.08 million.

Dividend Yield: 6.3%

Suny Cellular Communication's dividend yield of 6.3% ranks it in the top 25% of IL market payers, yet its track record is unstable with volatile payments over four years. Despite this, dividends are well covered by earnings and cash flows, given payout ratios of 30.4% and 43.6%, respectively. Recent earnings show a decline in sales to ILS 249.83 million for Q3 and net income at ILS 8.05 million compared to last year’s figures.

- Click here to discover the nuances of Suny Cellular Communication with our detailed analytical dividend report.

- The analysis detailed in our Suny Cellular Communication valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click here to access our complete index of 60 Top Middle Eastern Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:CLEBI

Çelebi Hava Servisi

Provides ground handling, cargo, and warehouse services to domestic and foreign airlines, and private air cargo companies primarily in Turkey.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)