High Growth Tech Stocks Including Zhejiang Meorient Commerce Exhibition And Two More

Reviewed by Simply Wall St

As global markets navigate the impacts of the Federal Reserve's interest rate cuts and mixed economic signals, small-cap stocks like those in the Russell 2000 Index have shown resilience, even as concerns about tech valuations weigh on indices like the Nasdaq Composite. In this environment, identifying high-growth tech stocks requires a focus on companies with strong fundamentals and innovative capabilities that can capitalize on emerging trends despite broader market volatility.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Meorient Commerce Exhibition Inc. operates in the exhibition and trade show industry, with a market cap of CN¥4.03 billion.

Operations: The company focuses on organizing and managing exhibitions and trade shows. It generates revenue primarily through event participation fees, sponsorships, and related services.

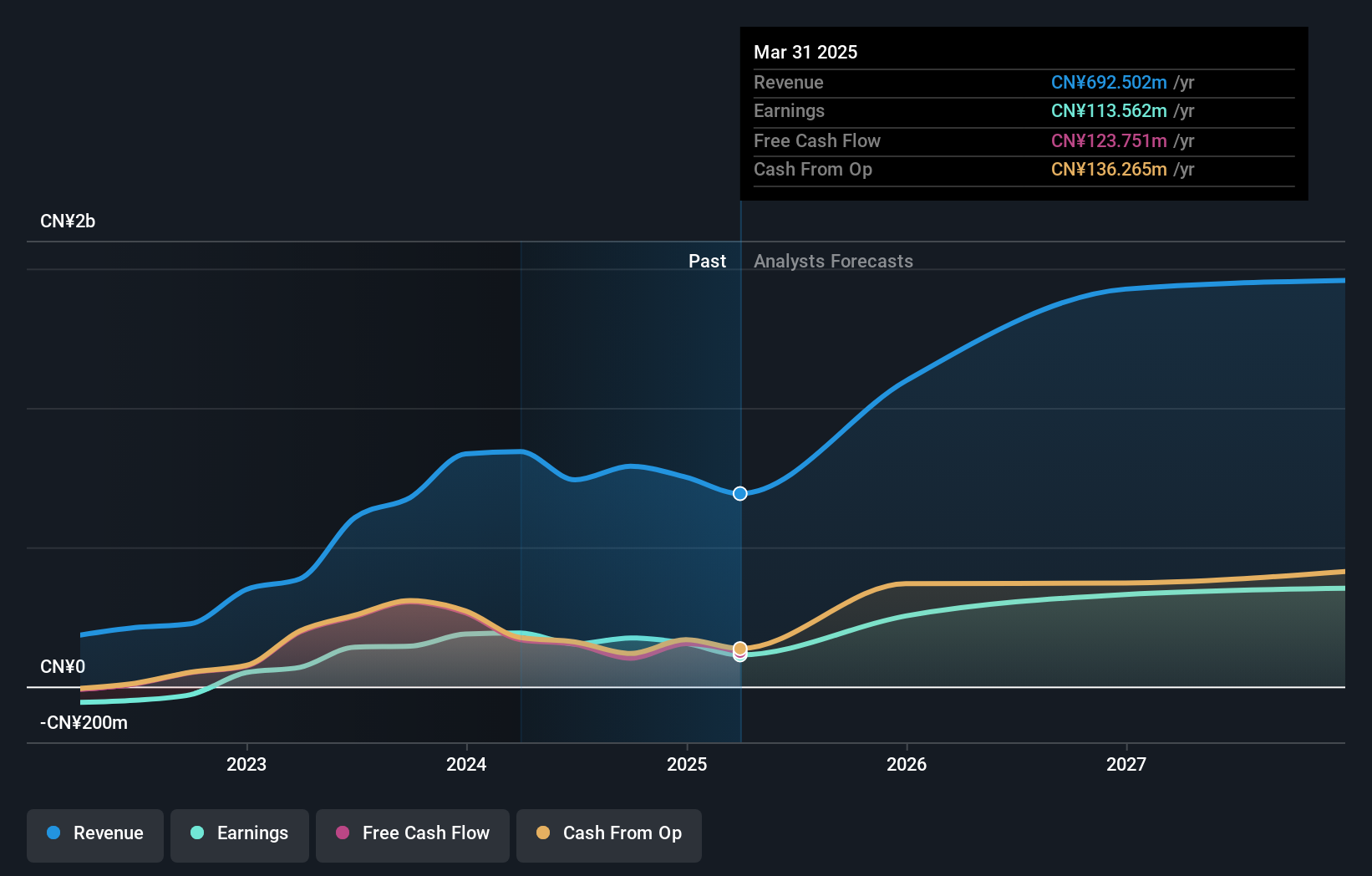

Zhejiang Meorient Commerce Exhibition, despite a challenging year with earnings growth contracting by 30.3%, is set to outpace its industry with projected annual revenue and earnings growth rates of 27% and 36.7%, respectively, significantly above the Chinese market averages of 14.5% and 27.1%. This robust forecast is supported by recent strategic moves including proposed amendments for H-share offerings aimed at enhancing capital structure, as detailed in their extraordinary meeting on December 12, 2025. These initiatives could potentially bolster Meorient's competitive edge in the exhibition sector, leveraging its high-quality earnings base to capitalize on emerging market opportunities.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Meorient Commerce Exhibition.

Understand Zhejiang Meorient Commerce Exhibition's track record by examining our Past report.

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants across various regions including the United States, Europe, the United Kingdom, Australia, Israel, and globally; it has a market cap of ₪5.34 billion.

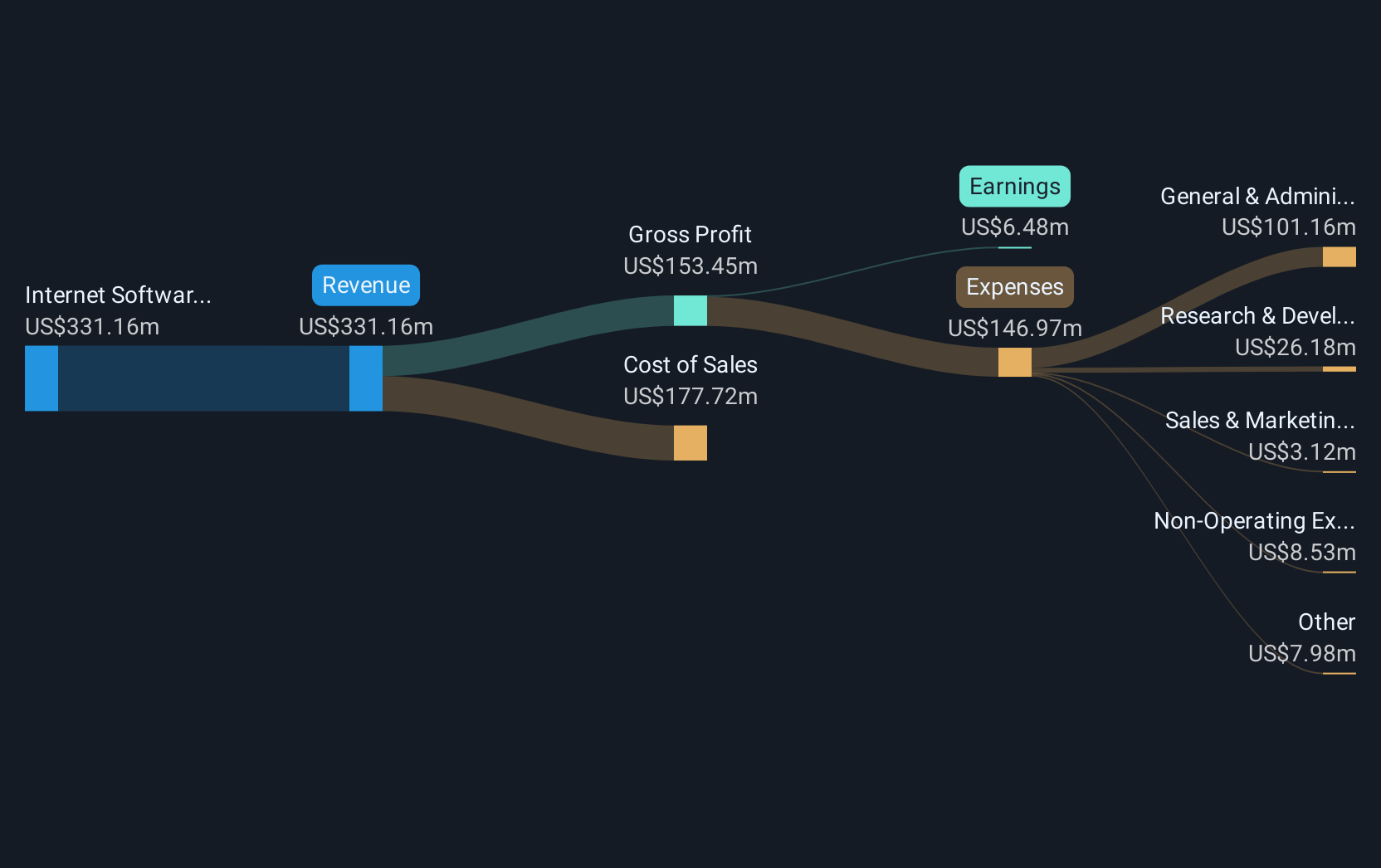

Operations: The company's revenue primarily comes from its Internet Software and Services segment, generating $369.94 million. With a market cap of ₪5.34 billion, it operates across multiple regions including the United States, Europe, and Australia.

Nayax has demonstrated a robust trajectory in the tech sector, particularly through strategic M&A and partnerships aimed at expanding its market reach and enhancing technological capabilities. With earnings expected to grow by 31.2% annually, outpacing the industry average of 15.2%, Nayax's proactive approach is evident. In Q3 2025 alone, revenue surged to $104.28 million from $83.01 million year-over-year, reflecting a significant uptake in its offerings amid aggressive expansion efforts such as the partnership with ChargeSmart EV to dominate the U.S. EV charging market. This growth is underpinned by a consistent focus on R&D, which remains integral to Nayax's strategy for maintaining technological leadership and driving future revenue streams, aligning with broader industry trends towards integrated payment solutions and smart technologies.

- Click to explore a detailed breakdown of our findings in Nayax's health report.

Assess Nayax's past performance with our detailed historical performance reports.

Mamezo Digital Holdings (TSE:202A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mamezo Digital Holdings Co., Ltd. offers IT solutions in Japan and has a market capitalization of ¥52.64 billion.

Operations: Mamezo Digital Holdings Co., Ltd. specializes in IT solutions within Japan, focusing on providing a range of digital services to its clients. The company generates revenue through various segments, though specific segment details are not provided here.

Mamezo Digital Holdings has been navigating the competitive tech landscape with a focus on enhancing shareholder value, as evidenced by its recent dividend affirmation and an adjusted year-end payout projection. The company's financial health is underscored by a consistent annual revenue growth rate of 11.8% and earnings growth of 11.7%, outperforming the Japanese market averages of 4.5% and 8.5%, respectively. These figures highlight Mamezo’s ability to sustain growth amidst market fluctuations, supported by strategic initiatives that bolster its standing in high-tech sectors, despite a highly volatile share price in recent months. This trajectory suggests Mamezo is well-positioned for continued progress, leveraging robust R&D investments that align with industry shifts towards more innovative tech solutions.

Where To Now?

- Reveal the 246 hidden gems among our Global High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Meorient Commerce Exhibition might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300795

Zhejiang Meorient Commerce Exhibition

Zhejiang Meorient Commerce Exhibition Inc.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)