As global markets navigate the final days of 2024, key indices have experienced moderate gains, although consumer confidence in the U.S. has shown signs of weakening alongside a decline in durable goods orders. Amidst these mixed signals, investors are increasingly looking towards small-cap stocks as potential opportunities for growth, particularly those that remain under the radar but demonstrate strong fundamentals and resilience in uncertain economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★☆☆

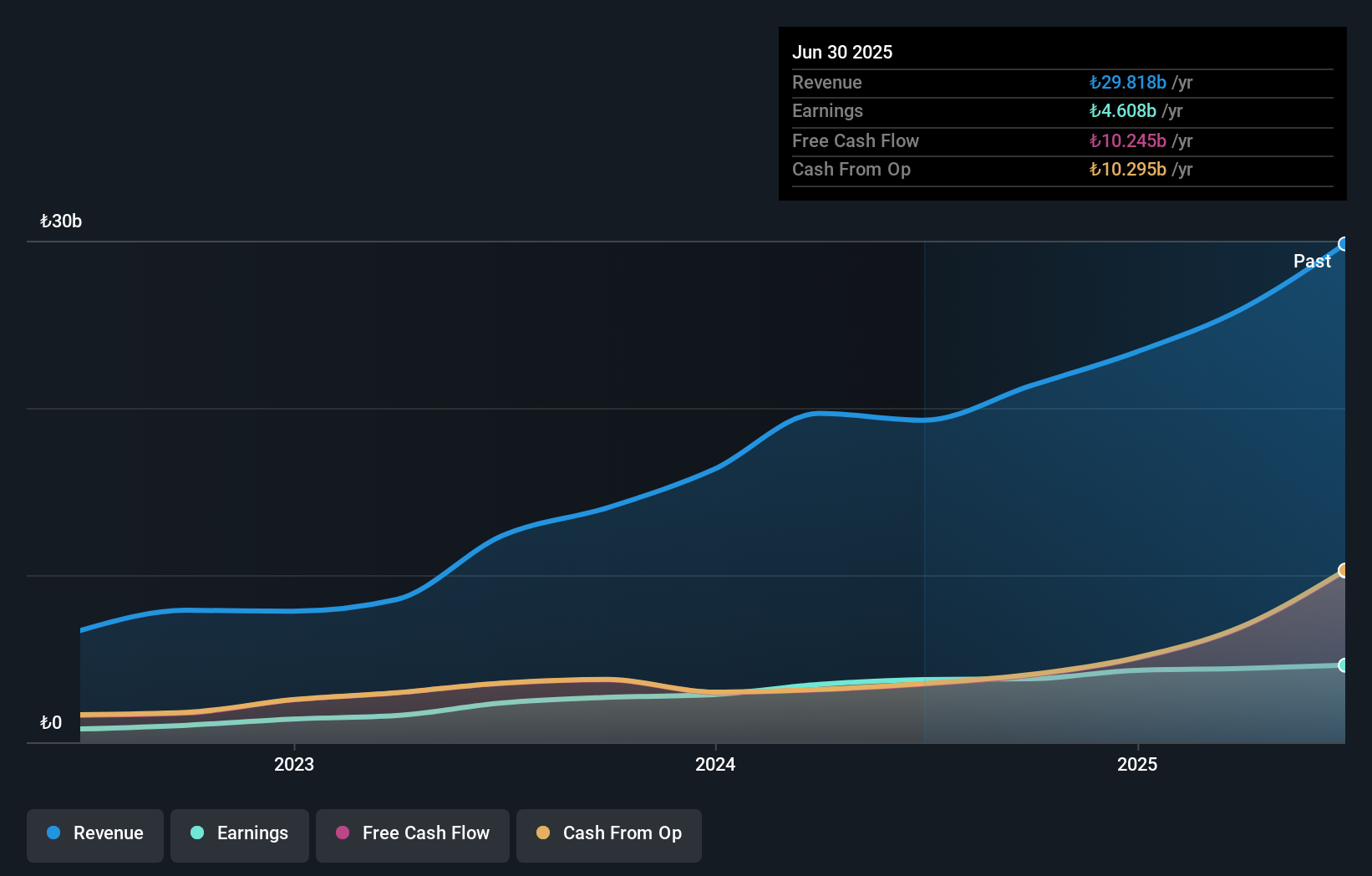

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey, offering individual and group insurance and reinsurance services across life, retirement, and personal accident sectors, with a market cap of TRY44.72 billion.

Operations: Anadolu Hayat Emeklilik Anonim Sirketi's primary revenue streams are derived from its life insurance segment, generating TRY15.36 billion, and its retirement services, contributing TRY3.84 billion. The company reported a net profit margin of 8%.

Anadolu Hayat Emeklilik, a notable player in the insurance sector, showcases a robust financial profile with earnings growth of 50.8% annually over five years. Despite not keeping pace with the industry's 79.1% growth last year, its price-to-earnings ratio at 11.8x remains attractive compared to the TR market's 16.2x. The company is debt-free, enhancing its financial stability and quality of earnings. Recent results highlight net income reaching TRY 776 million for Q3 and TRY 2,998 million for nine months ending September 2024, reflecting solid profitability with basic EPS from continuing operations at TRY 6.97 up from TRY 4.78 year-on-year.

- Click here and access our complete health analysis report to understand the dynamics of Anadolu Hayat Emeklilik Anonim Sirketi.

Understand Anadolu Hayat Emeklilik Anonim Sirketi's track record by examining our Past report.

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Simply Wall St Value Rating: ★★★★★☆

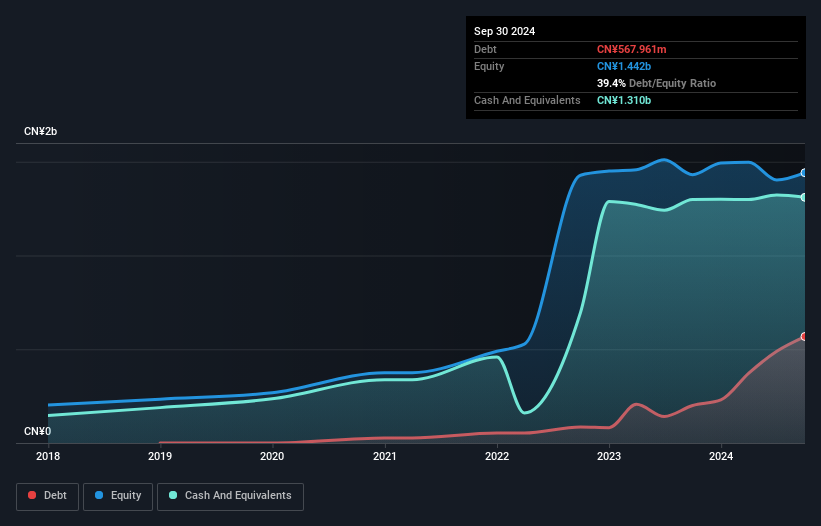

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. operates in the electrical and mechanical industry with a market capitalization of CN¥6.17 billion.

Operations: The company generates revenue through its operations in the electrical and mechanical industry. It has a market capitalization of CN¥6.17 billion.

Suzhou Alton Electrical & Mechanical Industry has shown significant growth, with sales reaching CNY 1.31 billion for the nine months ending September 2024, up from CNY 836.6 million the previous year. Net income climbed to CNY 184.58 million from CNY 124.75 million, reflecting robust earnings momentum with basic earnings per share rising to CNY 1.01 from CNY 0.68 last year. Despite a volatile share price recently, the company benefits from high-quality non-cash earnings and covers interest payments comfortably at a ratio of 27.6x EBIT to debt interest, suggesting strong financial health amidst industry challenges.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

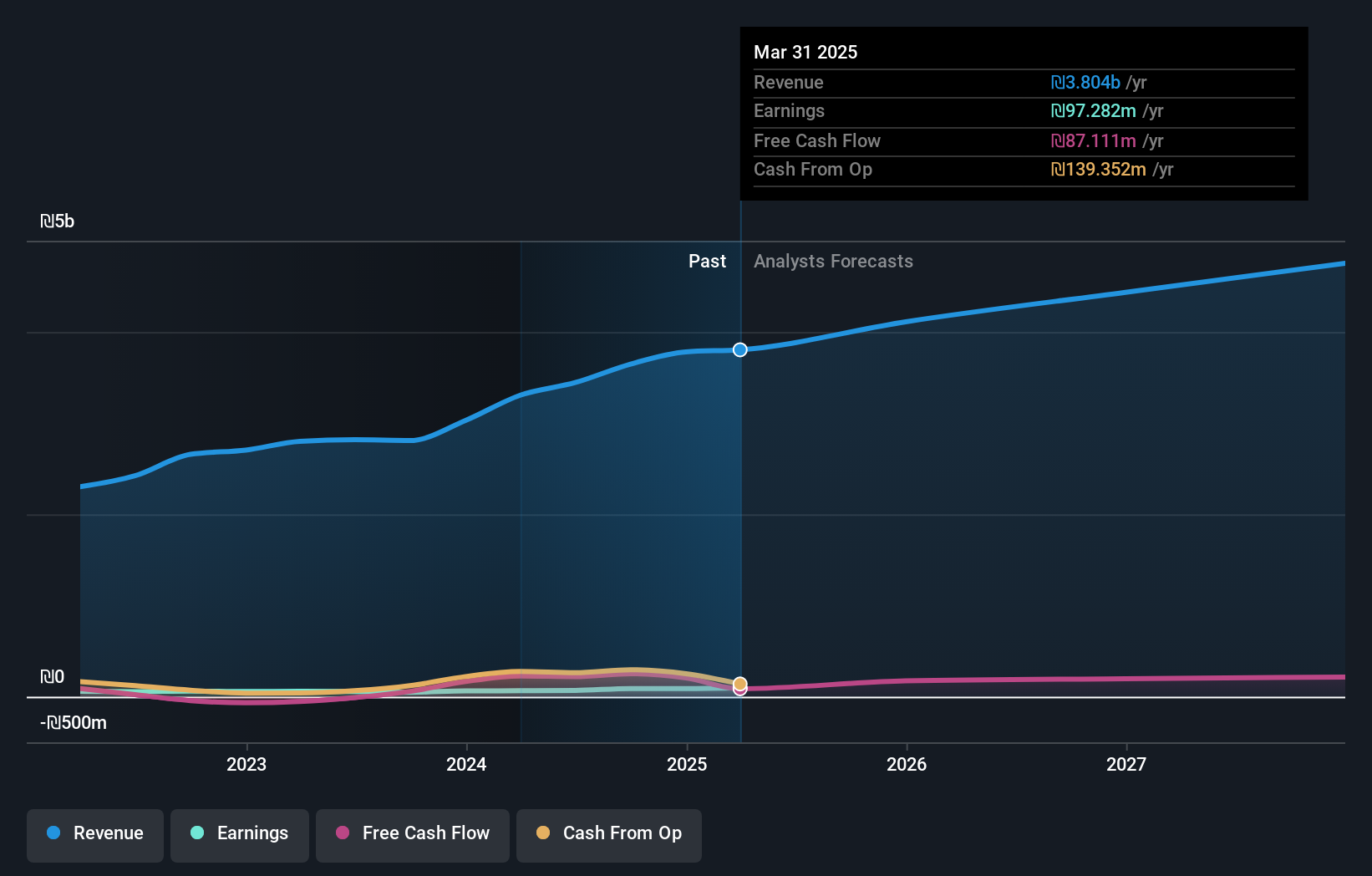

Overview: Malam - Team Ltd is an Israeli company that offers a range of information technology services, with a market capitalization of ₪1.73 billion.

Operations: Malam - Team Ltd generates revenue primarily from three segments: Hardware and Cloud Infrastructure (₪1.99 billion), Software, Projects, and Business Solutions (₪1.38 billion), and Salary Service, Human Resources, and Long-Term Savings (₪312.24 million).

Malam - Team, a small cap player in the IT sector, has shown significant earnings growth of 84% over the last year, outpacing the industry's 17.9%. Despite this positive performance, its debt to equity ratio has more than doubled from 50.5% to 102.9% over five years, indicating a rising debt load. The company’s interest payments are comfortably covered by EBIT at 3.4 times coverage, suggesting manageable financial obligations for now. Recent results show impressive sales growth with third-quarter revenue reaching ILS 909.55 million and net income climbing to ILS 31.02 million compared to ILS 10.17 million previously.

- Take a closer look at Malam - Team's potential here in our health report.

Gain insights into Malam - Team's past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 4638 Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Malam - Team, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MLTM

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives