In recent months, most Gulf markets have experienced gains driven by corporate earnings, although concerns about tariffs and U.S. monetary policy continue to pose challenges. As investors navigate these economic headwinds, identifying stocks with strong fundamentals and growth potential becomes crucial in capitalizing on opportunities within the Middle East's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Ackerstein Group (TASE:ACKR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ackerstein Group Ltd operates in the production, infrastructure, construction, and development sectors across Israel and the United States, with a market cap of ₪1.92 billion.

Operations: Ackerstein Group Ltd generates revenue primarily from its Engineering Segment, contributing ₪546.20 million, followed by the Industry Sector in Israel at ₪266.31 million and Real Estate Sector at ₪47.48 million. The Industry Sector Abroad adds another ₪58.74 million to the revenue stream.

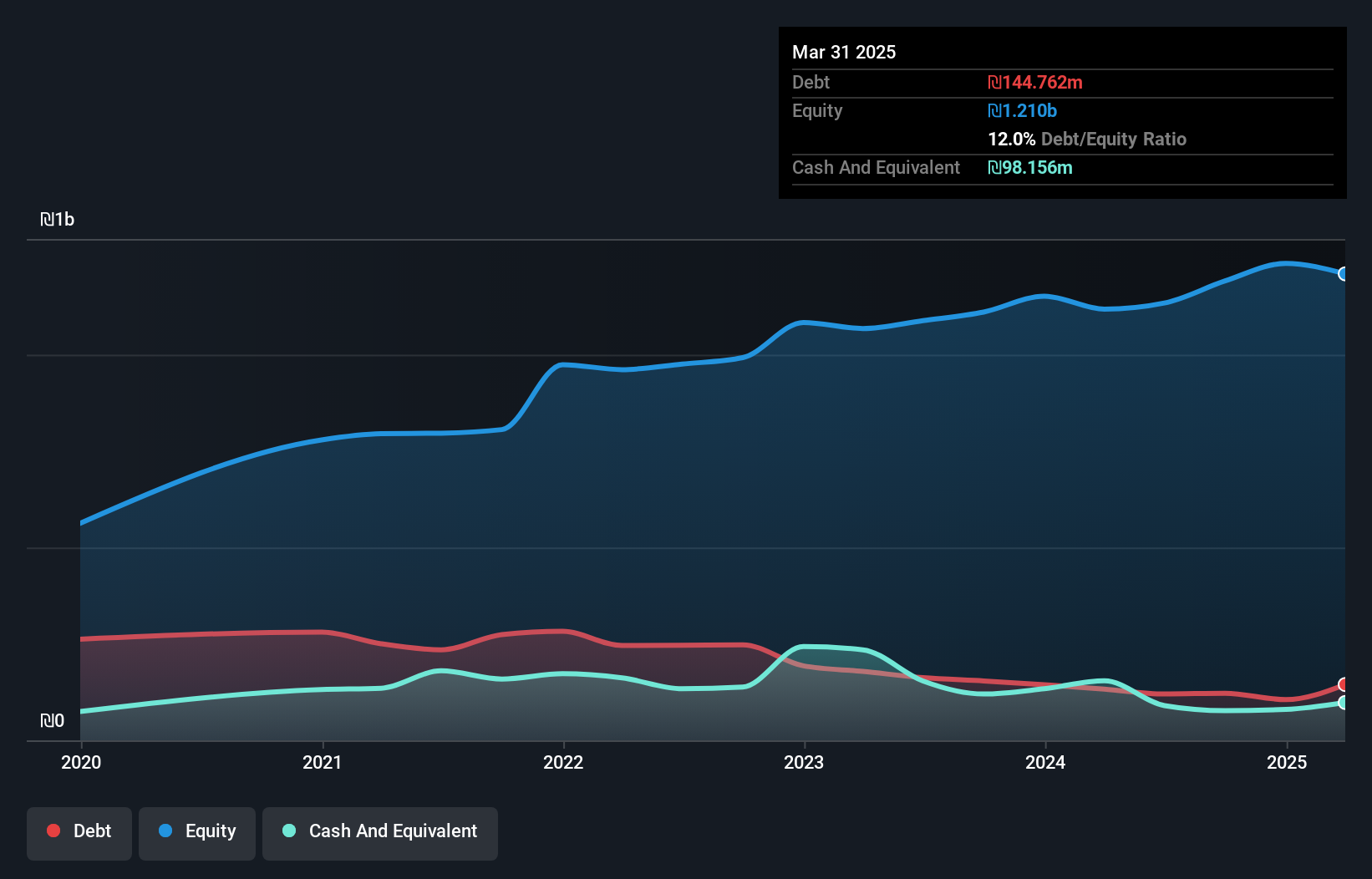

Ackerstein Group, a dynamic player in the Basic Materials sector, showcases robust financial health with a net debt to equity ratio of 2.1%, reflecting improved leverage from 46.6% five years ago. Its earnings growth outpaced the industry at 32% over the past year, highlighting operational efficiency despite sales dipping to ₪902.35 million from ₪1.04 billion previously. The company's P/E ratio of 15.5x suggests an attractive valuation relative to industry peers at 16.6x, while its interest coverage is strong at 29.8x EBIT over interest payments, ensuring solid financial footing and potential for future growth amidst market challenges.

- Delve into the full analysis health report here for a deeper understanding of Ackerstein Group.

Understand Ackerstein Group's track record by examining our Past report.

Formula Systems (1985) (TASE:FORTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Formula Systems (1985) Ltd. operates through its subsidiaries to offer a range of software solutions, IT professional services, and computer infrastructure integration, with a market cap of ₪5.06 billion.

Operations: Formula Systems generates revenue through proprietary and non-proprietary software solutions, IT professional services, software product marketing and support, as well as computer infrastructure integration solutions. The company focuses on diversifying its income streams across these segments to enhance financial stability.

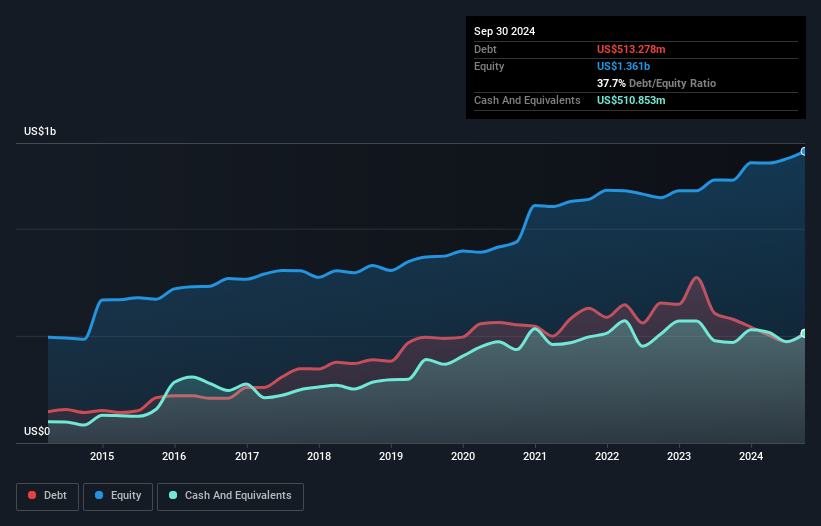

Formula Systems (1985) seems to be making strides with its earnings growing 12.6% annually over the past five years, reflecting a robust performance in the IT sector. Its debt management appears prudent, as the debt-to-equity ratio decreased from 55.1% to 34.5%, and interest payments are well-covered by EBIT at a ratio of 12.2x. The company’s P/E ratio of 17.2x is attractive compared to the industry average of 19x, suggesting potential value for investors. Recent events include a dividend increase to NIS 3.45 per share and improved annual net income reaching $79.67 million from $64 million previously.

Hiron-Trade Investments & Industrial Buildings (TASE:HRON)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hiron-Trade Investments & Industrial Buildings Ltd operates in the real estate sector in Israel with a market cap of ₪1.05 billion.

Operations: Hiron-Trade Investments & Industrial Buildings generates revenue primarily through its real estate operations in Israel. The company's financial performance is reflected in its market capitalization of approximately ₪1.05 billion.

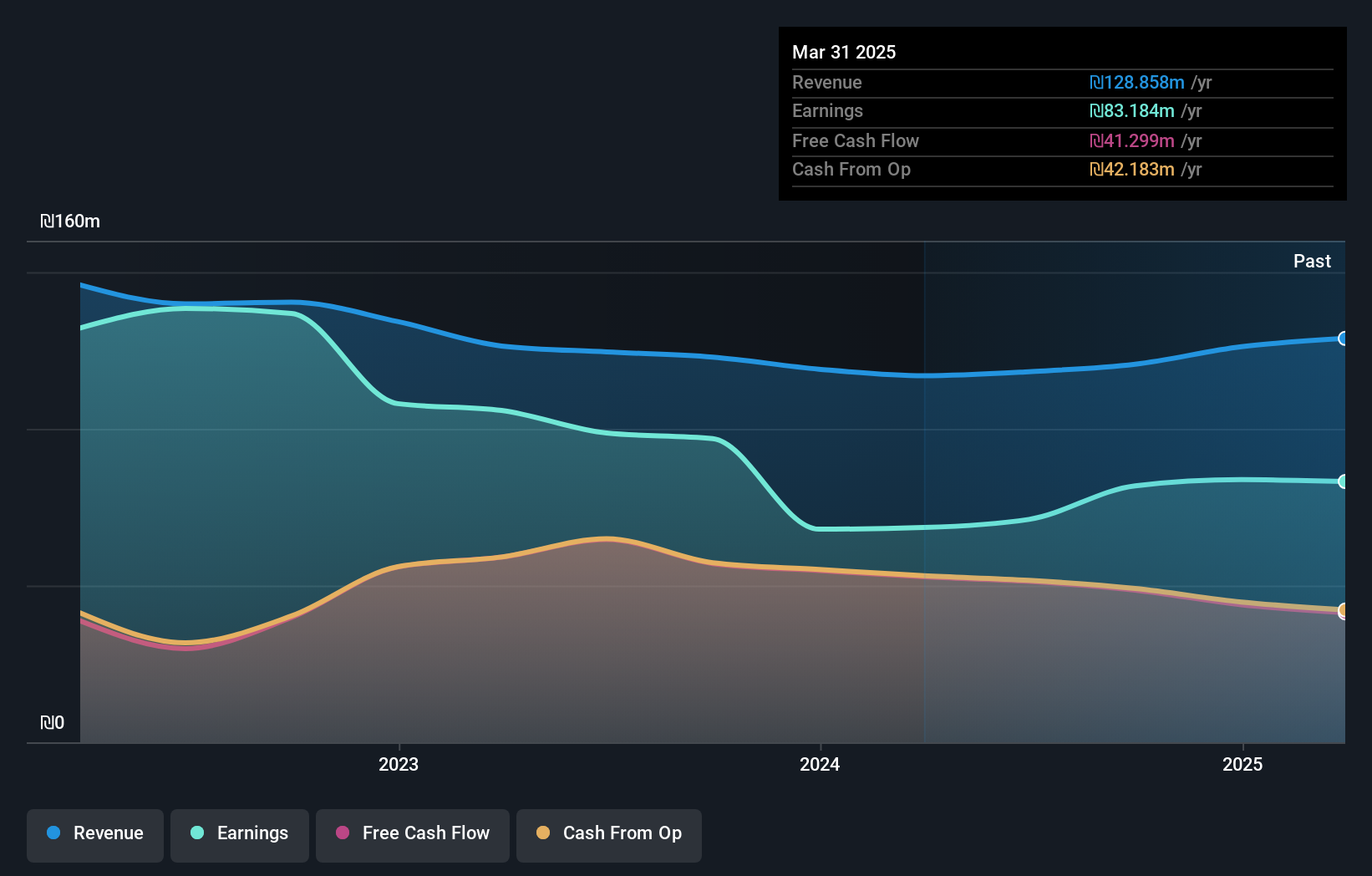

Hiron-Trade Investments, a small player in the real estate sector, has shown promising financial health with a net debt to equity ratio of 4.4%, indicating prudent management over the past five years from 21.7%. Despite earnings growth of 23.2% last year, it lagged behind the broader industry at 34.6%, though its price-to-earnings ratio of 12.5x remains attractive against the IL market's average of 13.8x. The company reported an impressive net income increase to ILS 83.78 million for the year ending December 2024, boosted by a one-time gain of ₪42.6M, suggesting robust profitability and sound operational strategies moving forward.

Seize The Opportunity

- Delve into our full catalog of 245 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FORTY

Formula Systems (1985)

Through its subsidiaries, provides proprietary and non-proprietary software solutions and information technologies (IT) professional services in Israel, the United States, Europe, Africa, Japan, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion