Terminal X Online Ltd. (TLV:TRX) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Despite an already strong run, Terminal X Online Ltd. (TLV:TRX) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 74%.

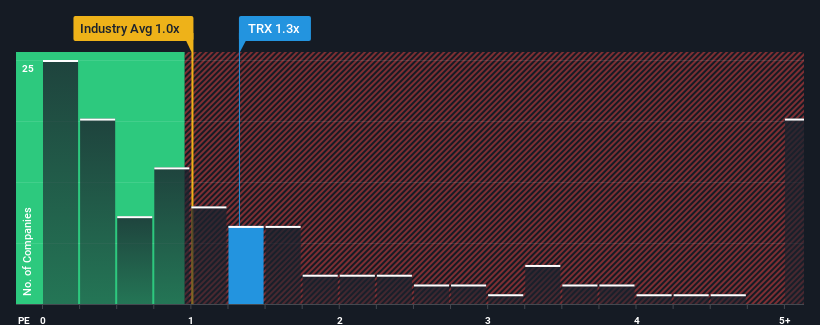

In spite of the firm bounce in price, it's still not a stretch to say that Terminal X Online's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Multiline Retail industry in Israel, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Terminal X Online

What Does Terminal X Online's P/S Mean For Shareholders?

Terminal X Online has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Terminal X Online's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Terminal X Online?

In order to justify its P/S ratio, Terminal X Online would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 10% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why Terminal X Online is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Terminal X Online appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears to us that Terminal X Online maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Terminal X Online with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Terminal X Online's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Terminal X Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TRX

Terminal X Online

Offers clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenager under various brands through online.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026