- Israel

- /

- Specialty Stores

- /

- TASE:DLTI

Exploring April 2025's Undiscovered Gems in the Middle East

Reviewed by Simply Wall St

As the Middle East grapples with the fallout from escalating global trade tensions, most Gulf markets have retreated, reflecting broader concerns about economic stability and market volatility. Despite these challenges, opportunities still exist for discerning investors who focus on resilient companies that can navigate turbulent times and capitalize on regional growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

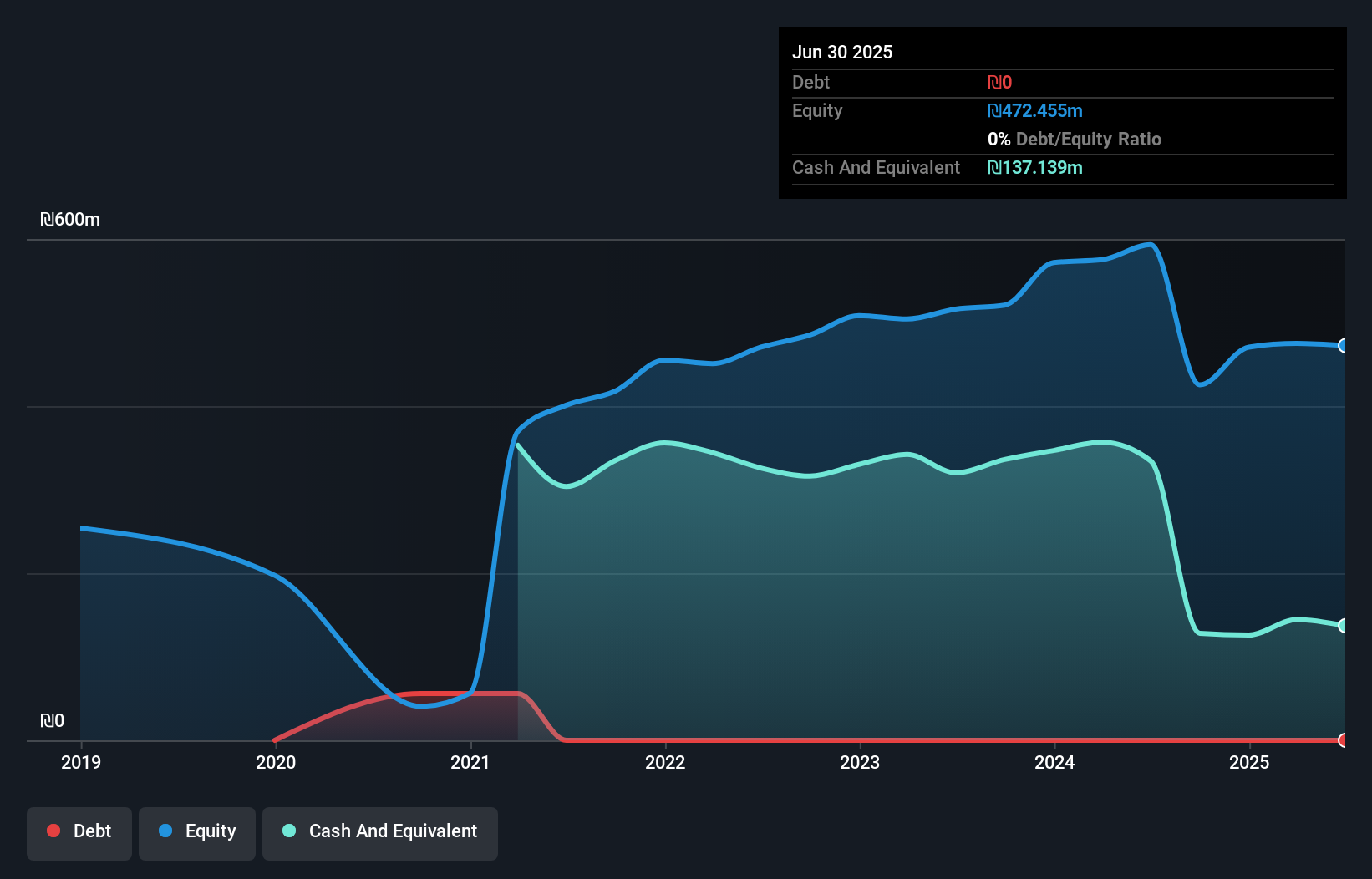

Pera Yatirim Holding Anonim Sirketi (IBSE:PEHOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pera Yatirim Holding Anonim Sirketi operates as a publicly owned real estate investment trust, with a market capitalization of TRY17.26 billion.

Operations: Pera Yatirim generates revenue primarily through creating and developing a real estate portfolio, with this segment contributing TRY30.87 million. The company's financial performance is influenced by its net profit margin trends over time.

Pera Yatirim Holding, a small player in the REITs sector, showcases intriguing dynamics with its net debt to equity ratio at a satisfactory 1.1%. Over the past year, earnings grew by 7%, outpacing the industry average of -58.7%. Despite generating less than US$1 million in revenue (TRY31M), it reported a robust net income of TRY 706 million for 2024, up from TRY 660 million previously. The company seems to manage interest payments effectively and has reduced its debt significantly over five years from 52% to just above 1%, indicating disciplined financial management amidst fluctuating market conditions.

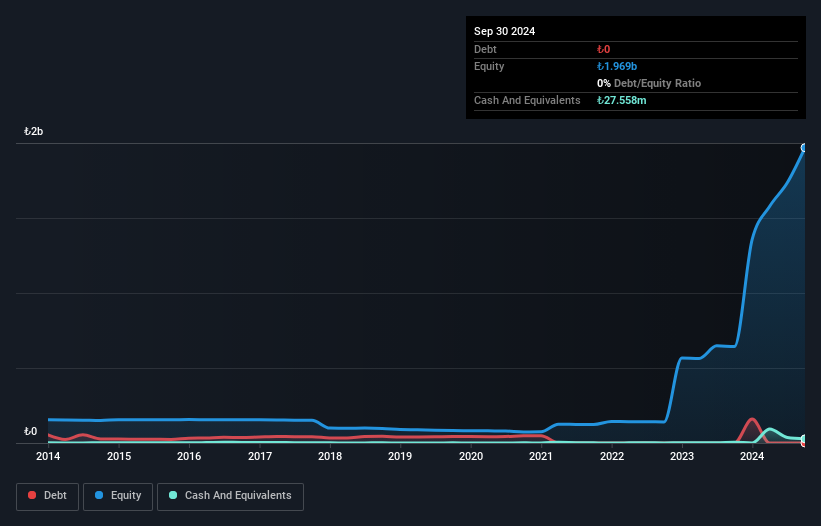

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Israel Brands Ltd. is a company that designs, develops, markets, and sells various clothing products in Israel with a market capitalization of ₪1.91 billion.

Operations: Delta Israel Brands generates revenue primarily from its owned brands, contributing ₪1.08 billion, and franchise brands, adding ₪108.47 million.

Delta Israel Brands showcases a promising profile, with earnings growth of 36.8% over the past year, outpacing the Specialty Retail industry. The company reported sales of ILS 1.19 billion for 2024, a significant rise from ILS 945.88 million in the prior year, while net income reached ILS 158.73 million compared to ILS 116.05 million previously. With high-quality earnings and no debt on its books for five years, Delta Israel is trading at about 10% below estimated fair value and remains free cash flow positive despite substantial capital expenditure of around -ILS 95 million in recent periods.

- Take a closer look at Delta Israel Brands' potential here in our health report.

Examine Delta Israel Brands' past performance report to understand how it has performed in the past.

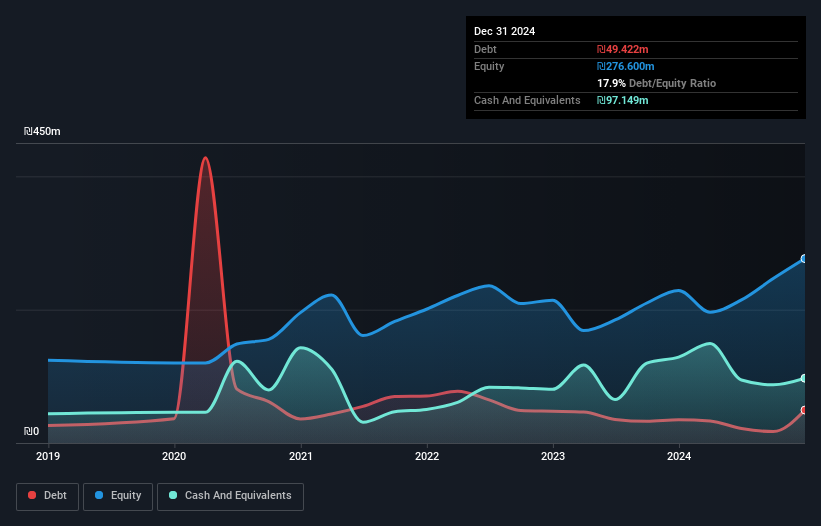

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Max Stock Ltd. operates a network of discount stores across Israel with a market cap of ₪1.99 billion.

Operations: Max Stock generates revenue primarily from its retail trade segment, amounting to ₪1.33 billion.

Max Stock, a promising player in the Middle East retail scene, reported sales of ILS 1.33 billion for 2024, up from ILS 1.12 billion the previous year. With net income climbing to ILS 108.76 million from ILS 81.01 million, their earnings per share increased to ILS 0.78 from ILS 0.58, reflecting robust growth of over 34% in earnings compared to the industry's modest rise of just over 1%. Their debt-to-equity ratio improved significantly over five years, dropping to a healthier level of around 17%, while EBIT comfortably covers interest payments at a multiple of nearly seven times, underscoring financial stability and quality earnings potential for investors seeking value opportunities in emerging markets.

- Click to explore a detailed breakdown of our findings in Max Stock's health report.

Gain insights into Max Stock's historical performance by reviewing our past performance report.

Next Steps

- Delve into our full catalog of 249 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLTI

Delta Israel Brands

Designs, develops, markets, and sells various clothing products in Israel.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion