- Turkey

- /

- Construction

- /

- IBSE:GLRMK

Undiscovered Gems In Middle East Stocks To Watch This April 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains ahead of earnings announcements, investors are closely watching the region's economic indicators and trade developments that shape market sentiment. In this dynamic environment, identifying promising stocks involves evaluating companies with strong fundamentals and potential resilience amid ongoing trade uncertainties and oil price fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Gulermak Aglr Sanayi Insaat ve Taahhut (IBSE:GLRMK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gulermak Aglr Sanayi Insaat ve Taahhut A.S. is a construction and engineering company with a market cap of TRY48.71 billion, specializing in large-scale infrastructure projects.

Operations: GLRMK generates revenue primarily from its operations in the West (TRY25.35 billion), Turkey (TRY8.92 billion), and East (TRY8.18 billion) regions, with eliminations of TRY7.93 billion affecting total figures. The company's financial performance is influenced by these regional contributions and eliminations, which play a significant role in shaping its overall revenue dynamics.

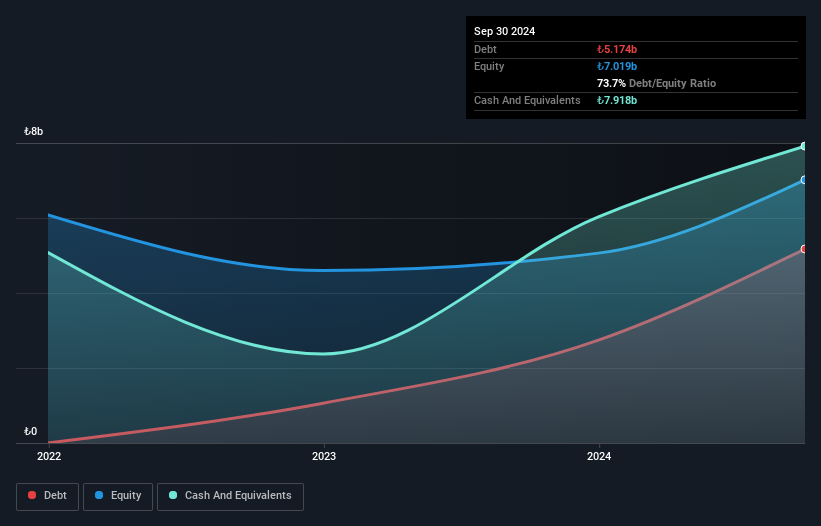

Gulermak Aglr Sanayi Insaat ve Taahhut showcases a robust financial profile with earnings growth of 115% over the past year, far outpacing the Construction industry's 40.5%. The company's net income surged to TRY 3.57 billion from TRY 1.64 billion the previous year, while its price-to-earnings ratio at 13.6x remains attractive compared to the TR market's 17.9x. With levered free cash flow standing at approximately TRY 1.62 billion as of April 2025, Gulermak seems well-positioned financially despite insufficient data on debt reduction over five years and a slight dip in basic earnings per share to TRY 18.78 from TRY 20.50 last year.

Castro Model (TASE:CAST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Castro Model Ltd. operates in the retail sector, offering fashion products, home fashion, fashion accessories, and cosmetics and care products in Israel with a market capitalization of ₪1.32 billion.

Operations: Castro Model Ltd. generates revenue primarily from apparel fashions and fashion accessories in Israel, with apparel contributing ₪1.45 billion and accessories adding ₪540.23 million. The care and cosmetics segment also contributes to its revenue stream with ₪80.13 million.

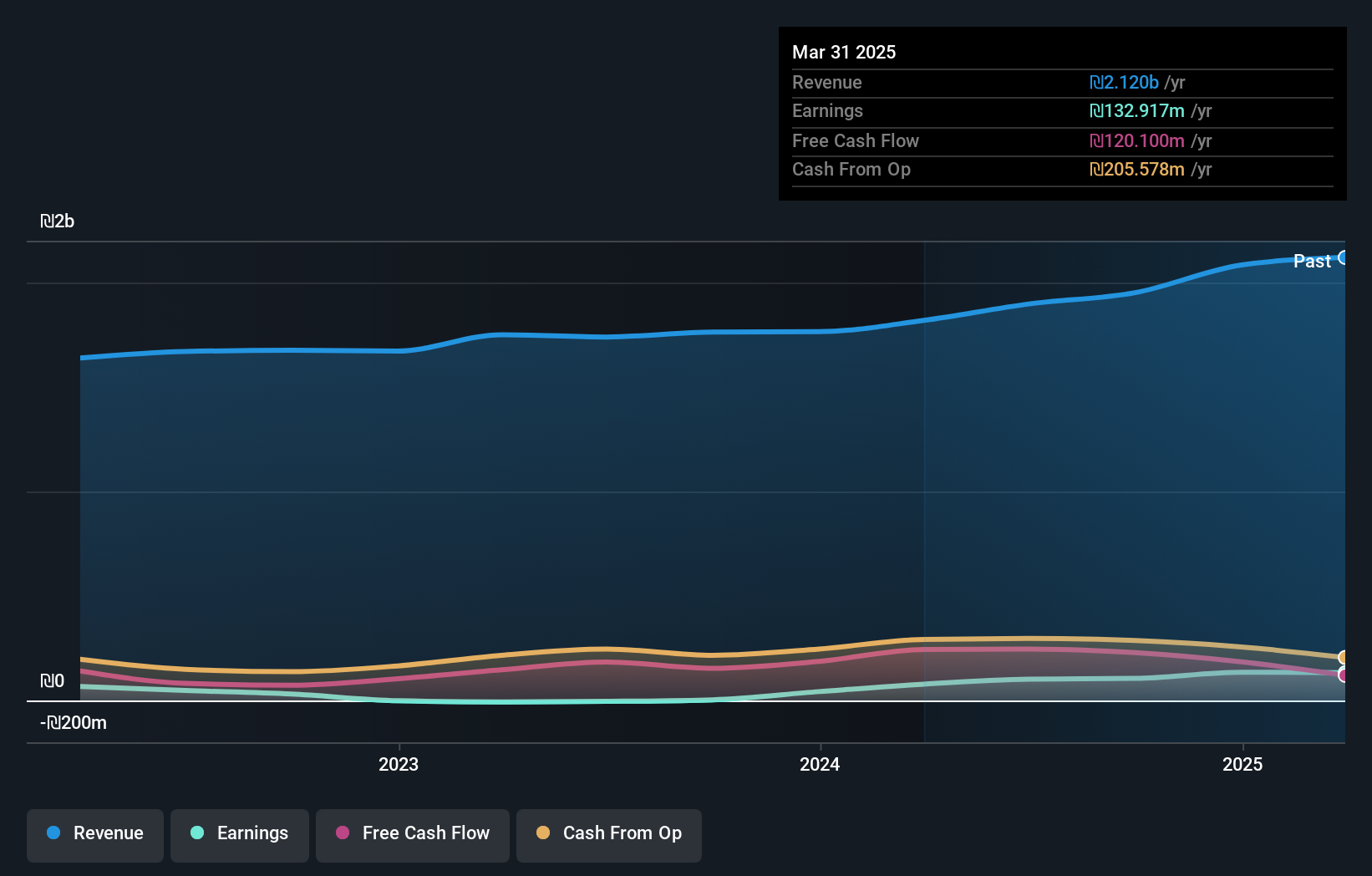

Castro Model, a compact player in the Middle East retail scene, has shown impressive financial strides. Over the past year, earnings surged by 218.4%, outpacing the Specialty Retail industry's growth of 36.8%. This performance is reflected in its net income jump from ILS 42.52 million to ILS 135.4 million and an increase in basic earnings per share from ILS 5.2 to ILS 16.4. Trading at about 23% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite recent share price volatility, Castro's debt-to-equity ratio improvement from 52% to just over 5% over five years signals robust financial health and strategic management decisions that could bolster future growth prospects further.

- Delve into the full analysis health report here for a deeper understanding of Castro Model.

Understand Castro Model's track record by examining our Past report.

Keystone Infra (TASE:KSTN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Keystone REIT Ltd. is involved in the asset management and custody banks industry, with a market cap of ₪1.42 billion.

Operations: Keystone Infra generates revenue primarily from its services segment, totaling ₪282.19 million.

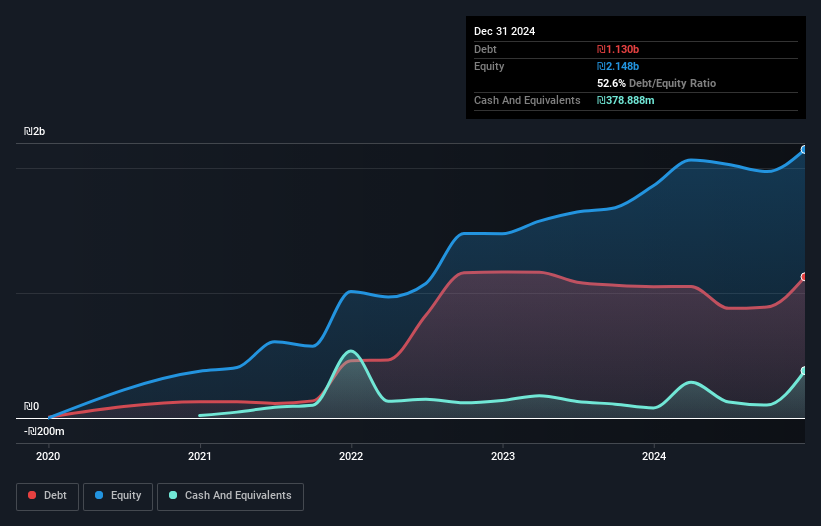

Keystone Infra, a smaller player in the Middle East market, has faced challenges with a significant earnings drop of 56.4% over the past year, contrasting sharply with the industry average growth of 19%. Despite this setback, its net debt to equity ratio stands at a satisfactory 34.9%, and interest payments are well covered by EBIT at 13.4 times coverage. The company's financial health is further underscored by its positive transition from negative shareholder equity five years ago to current profitability and free cash flow positivity. Recently reported figures show revenue at ILS 282.19 million and net income at ILS 193.36 million for the full year ending December 2024, reflecting a substantial decrease from previous levels but still offering potential value trading below estimated fair value by about 29%.

- Click to explore a detailed breakdown of our findings in Keystone Infra's health report.

Evaluate Keystone Infra's historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 247 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Gulermak Aglr Sanayi Insaat ve Taahhut, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GLRMK

Gulermak Aglr Sanayi Insaat ve Taahhut

Gulermak Aglr Sanayi Insaat ve Taahhut A.S.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives