- Israel

- /

- Specialty Stores

- /

- TASE:CAST

Middle Eastern Dividend Stocks To Consider: 3 Top Picks

Reviewed by Simply Wall St

As Gulf markets remain subdued due to weak oil prices and anticipation of key U.S. economic data, investors in the Middle East are closely monitoring dividend stocks for stability and potential income. In such a climate, selecting stocks with strong fundamentals and consistent dividend payouts can be a prudent approach for those seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.43% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.60% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.83% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.54% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.49% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.52% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.91% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.04% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia with a market cap of SAR76.60 billion.

Operations: Riyad Bank's revenue is primarily derived from its Corporate Banking segment at SAR8.94 billion, followed by Retail Banking at SAR4.23 billion, Treasury and Investments at SAR2.39 billion, and Investment Banking and Brokerage at SAR1.07 billion.

Dividend Yield: 6.8%

Riyad Bank's dividend yield ranks in the top 25% of Saudi Arabian market payers, but its dividend history has been volatile over the past decade. Despite this instability, dividends have grown over ten years and are currently covered by earnings with a payout ratio of 54.7%. Recent board changes, including new audit committee appointments, may influence governance positively. The bank's recent move to Riyad Bank Tower aligns with its strategic transformation plan, potentially impacting future financial performance positively.

- Click here and access our complete dividend analysis report to understand the dynamics of Riyad Bank.

- In light of our recent valuation report, it seems possible that Riyad Bank is trading behind its estimated value.

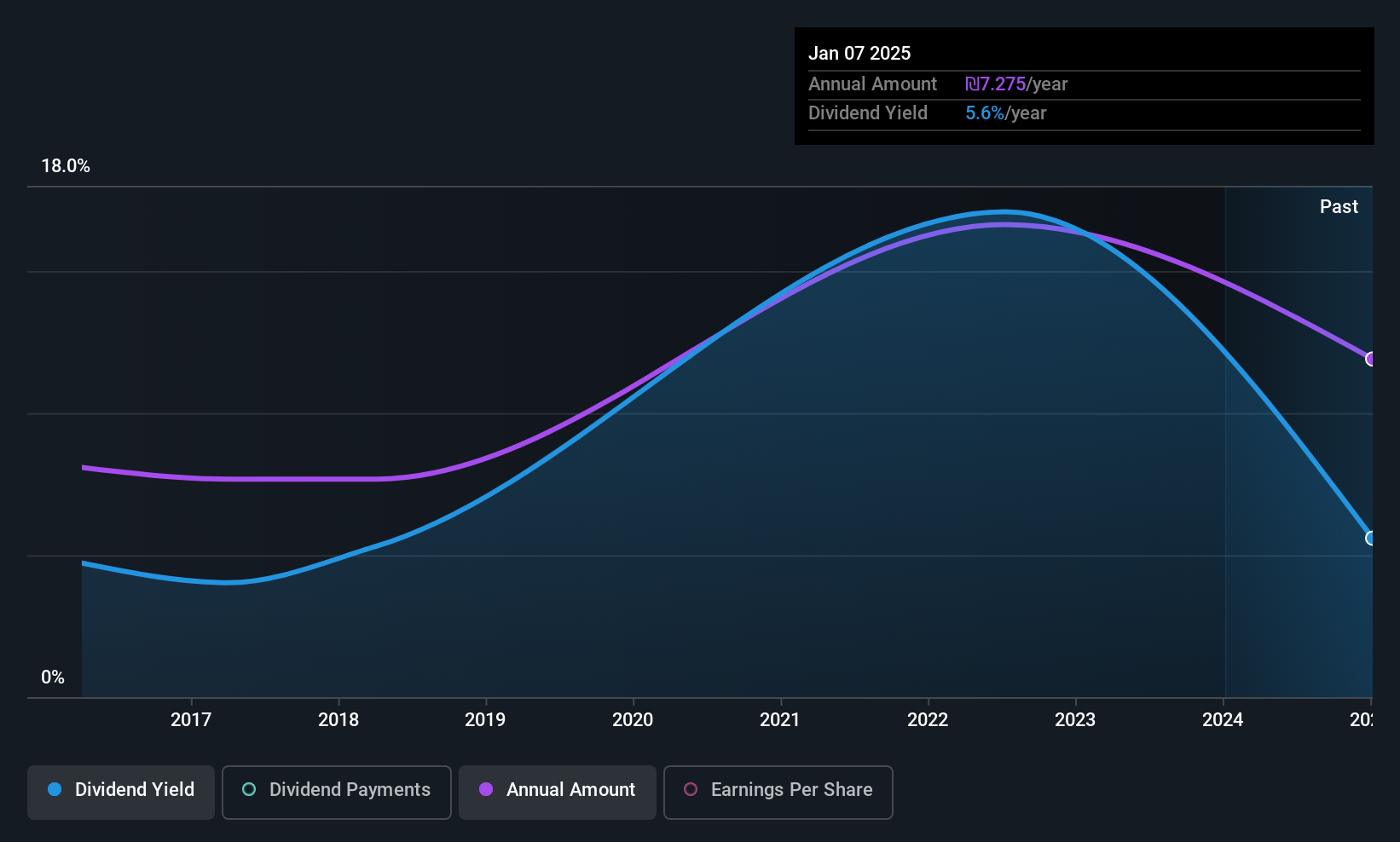

Castro Model (TASE:CAST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castro Model Ltd. operates in Israel, focusing on the retail sale of fashion products, home fashion, accessories, and cosmetics with a market cap of ₪1.25 billion.

Operations: Castro Model Ltd.'s revenue segments include fashion products, home fashion, accessories, and cosmetics and care products in Israel.

Dividend Yield: 14.7%

Castro Model's dividend yield is among the top 25% in the IL market, but its sustainability is questionable due to a high cash payout ratio of 156.1% and volatile dividend history with annual drops over 20%. Although earnings have grown at 22.8% annually for five years, recent income reports show mixed results; Q3 net income increased to ILS 24.76 million from ILS 16.65 million last year, yet nine-month figures declined compared to previous periods.

- Unlock comprehensive insights into our analysis of Castro Model stock in this dividend report.

- The valuation report we've compiled suggests that Castro Model's current price could be inflated.

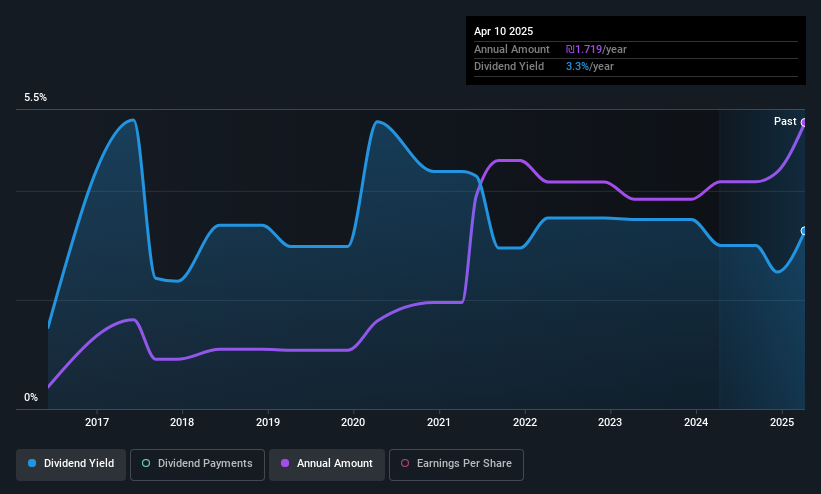

Tigbur - Temporary Professional Personnel (TASE:TIGBUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tigbur - Temporary Professional Personnel Ltd. operates in the staffing industry, providing temporary professional personnel services, with a market cap of ₪518.55 million.

Operations: Tigbur - Temporary Professional Personnel Ltd. generates revenue from providing temporary professional staffing services.

Dividend Yield: 3.1%

Tigbur - Temporary Professional Personnel's dividend yield of 3.07% is below the IL market's top 25% benchmark of 5.23%. Despite a low payout ratio of 9.6%, indicating dividends are well-covered by earnings, its cash payout ratio stands at a higher 82.3%. The company has struggled with unreliable and volatile dividend payments over the past decade, though recent earnings growth—Q3 net income rose to ILS 10.46 million—suggests potential for improvement in financial stability.

- Delve into the full analysis dividend report here for a deeper understanding of Tigbur - Temporary Professional Personnel.

- In light of our recent valuation report, it seems possible that Tigbur - Temporary Professional Personnel is trading beyond its estimated value.

Taking Advantage

- Get an in-depth perspective on all 63 Top Middle Eastern Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CAST

Castro Model

Engages in the retail sale of fashion products, home fashion, fashion accessories and cosmetics and care products in Israel.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026