Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Aura Investments (TLV:AURA). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Aura Investments

Aura Investments's Improving Profits

Over the last three years, Aura Investments has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Aura Investments's EPS shot from ₪0.12 to ₪0.24, over the last year. Year on year growth of 107% is certainly a sight to behold.

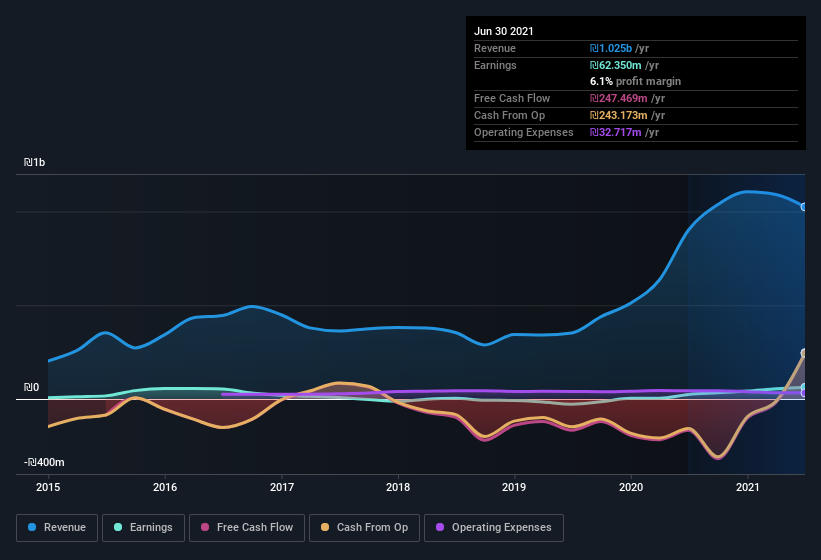

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Aura Investments is growing revenues, and EBIT margins improved by 3.4 percentage points to 10%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Aura Investments's balance sheet strength, before getting too excited.

Are Aura Investments Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Aura Investments insiders own a significant number of shares certainly appeals to me. In fact, they own 51% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about ₪586m riding on the stock, at current prices. That's nothing to sneeze at!

Is Aura Investments Worth Keeping An Eye On?

Aura Investments's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Aura Investments is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Still, you should learn about the 3 warning signs we've spotted with Aura Investments (including 1 which doesn't sit too well with us) .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:AURA

Aura Investments

Together with its subsidiaries engages in locating, initiating, planning, and building projects in the field of residential real estate in Israel and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives