- Israel

- /

- Real Estate

- /

- TASE:AFRE

Africa Israel Residences (TLV:AFRE) jumps 10% this week, though earnings growth is still tracking behind five-year shareholder returns

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Africa Israel Residences Ltd (TLV:AFRE) share price has soared 113% in the last half decade. Most would be very happy with that. Better yet, the share price has risen 10% in the last week.

Since the stock has added ₪191m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Africa Israel Residences

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

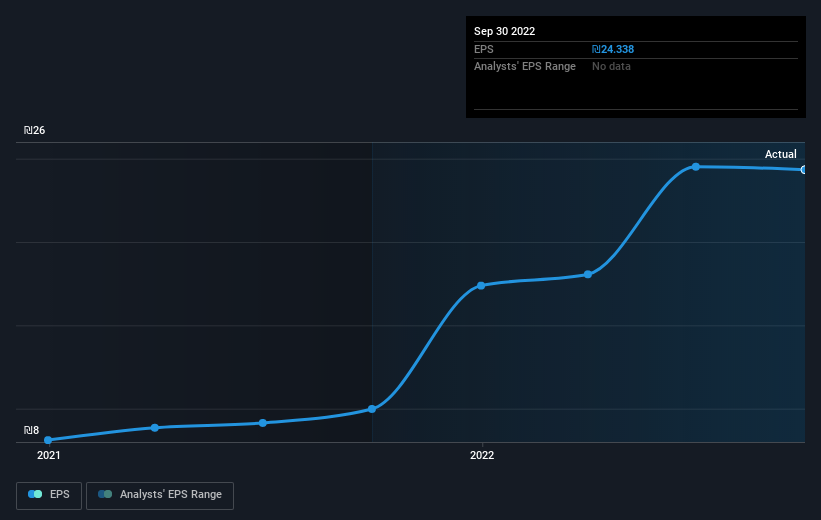

During five years of share price growth, Africa Israel Residences achieved compound earnings per share (EPS) growth of 12% per year. This EPS growth is lower than the 16% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Africa Israel Residences' key metrics by checking this interactive graph of Africa Israel Residences's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Africa Israel Residences' TSR for the last 5 years was 173%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Although it hurts that Africa Israel Residences returned a loss of 16% in the last twelve months, the broader market was actually worse, returning a loss of 18%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 22% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Africa Israel Residences better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Africa Israel Residences .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:AFRE

Africa Israel Residences

Engages in the development and sale of residential units under the Savyonim brand in Israel.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives