In the wake of a significant rally in U.S. stocks, driven by optimism around growth and tax reforms following a "red sweep" election outcome, small-cap indices like the Russell 2000 have shown impressive gains despite not reaching record highs. As investors navigate these dynamic market conditions, identifying lesser-known stocks with strong fundamentals and growth potential can be an effective strategy to enhance portfolio diversification and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Systex | 31.69% | 12.06% | -1.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

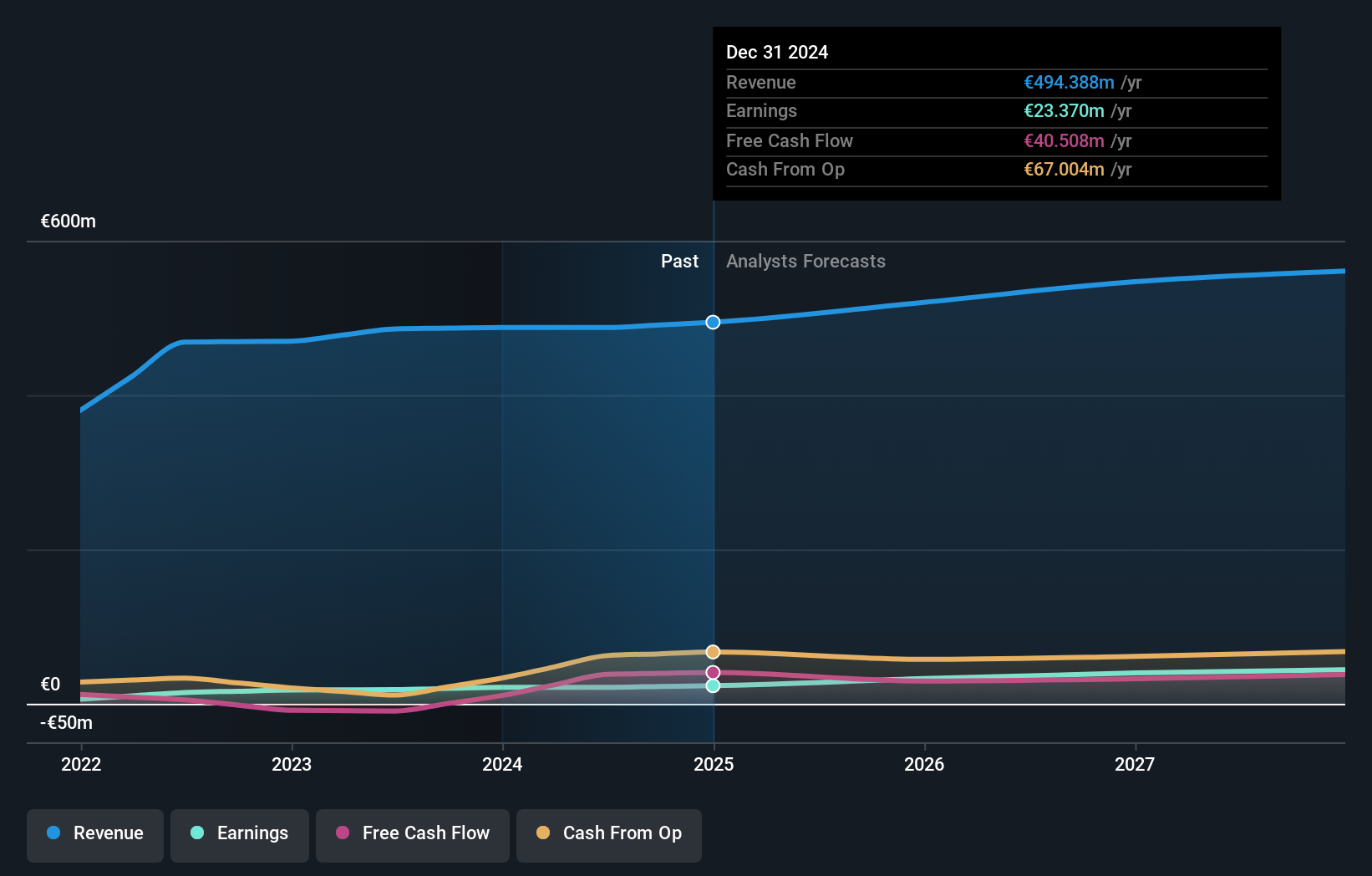

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of approximately €393.33 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €487.56 million.

EPC Groupe, a notable player in the chemicals sector, showcases robust financial health with high-quality earnings and a net debt to equity ratio of 42.6%, which is considered high but has improved over five years. Despite interest payments not being well covered by EBIT at 2.9x, the company trades at 50.5% below its estimated fair value, indicating potential upside for investors. Recent announcements highlight their innovative integration of Microsoft technologies like Copilot in Power BI, enhancing data analysis capabilities significantly. This strategic focus on AI and data analytics positions EPC Groupe for growth as they forecast earnings to rise by 25.15% annually.

- Dive into the specifics of EPC Groupe here with our thorough health report.

Evaluate EPC Groupe's historical performance by accessing our past performance report.

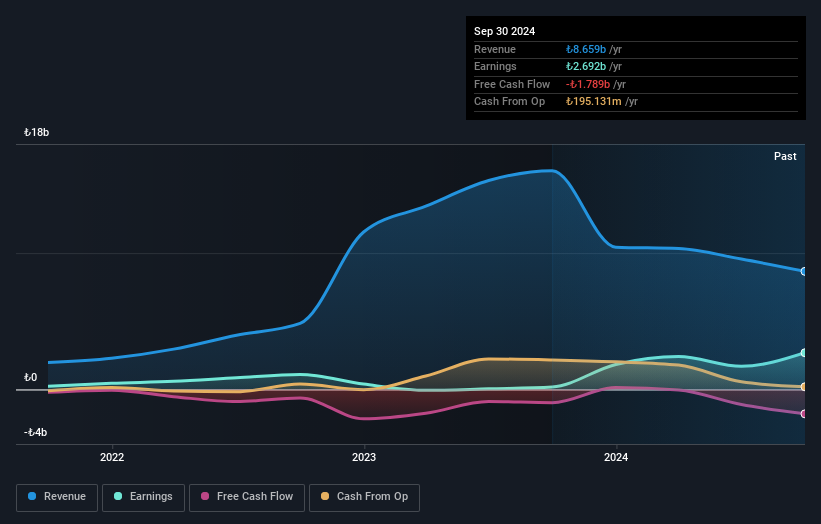

Bursa Cimento Fabrikasi (IBSE:BUCIM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bursa Cimento Fabrikasi A.S., along with its subsidiaries, is engaged in the production and sale of cement and ready-mixed concrete in Turkey, with a market capitalization of TRY10.62 billion.

Operations: Bursa Cimento Fabrikasi generates revenue primarily from the sale of cement and ready-mixed concrete in Turkey. The company's financial performance includes a focus on cost management, impacting its profitability metrics such as net profit margin.

Bursa Cimento Fabrikasi's recent performance paints an intriguing picture, with a notable earnings growth of 1379.5% over the past year, outpacing the Basic Materials industry’s 19.4%. Despite this impressive surge, sales figures for Q3 2024 were TRY 2.32 billion, down from TRY 3.14 billion a year earlier; however, net income turned positive at TRY 491.68 million from a previous loss of TRY 514.2 million. The company's price-to-earnings ratio stands attractively low at 3.9x compared to the TR market's average of 14.3x and its debt to equity ratio has risen to a still manageable level of 16.5% over five years, indicating room for financial maneuvering despite not being free cash flow positive currently.

- Get an in-depth perspective on Bursa Cimento Fabrikasi's performance by reading our health report here.

Gain insights into Bursa Cimento Fabrikasi's past trends and performance with our Past report.

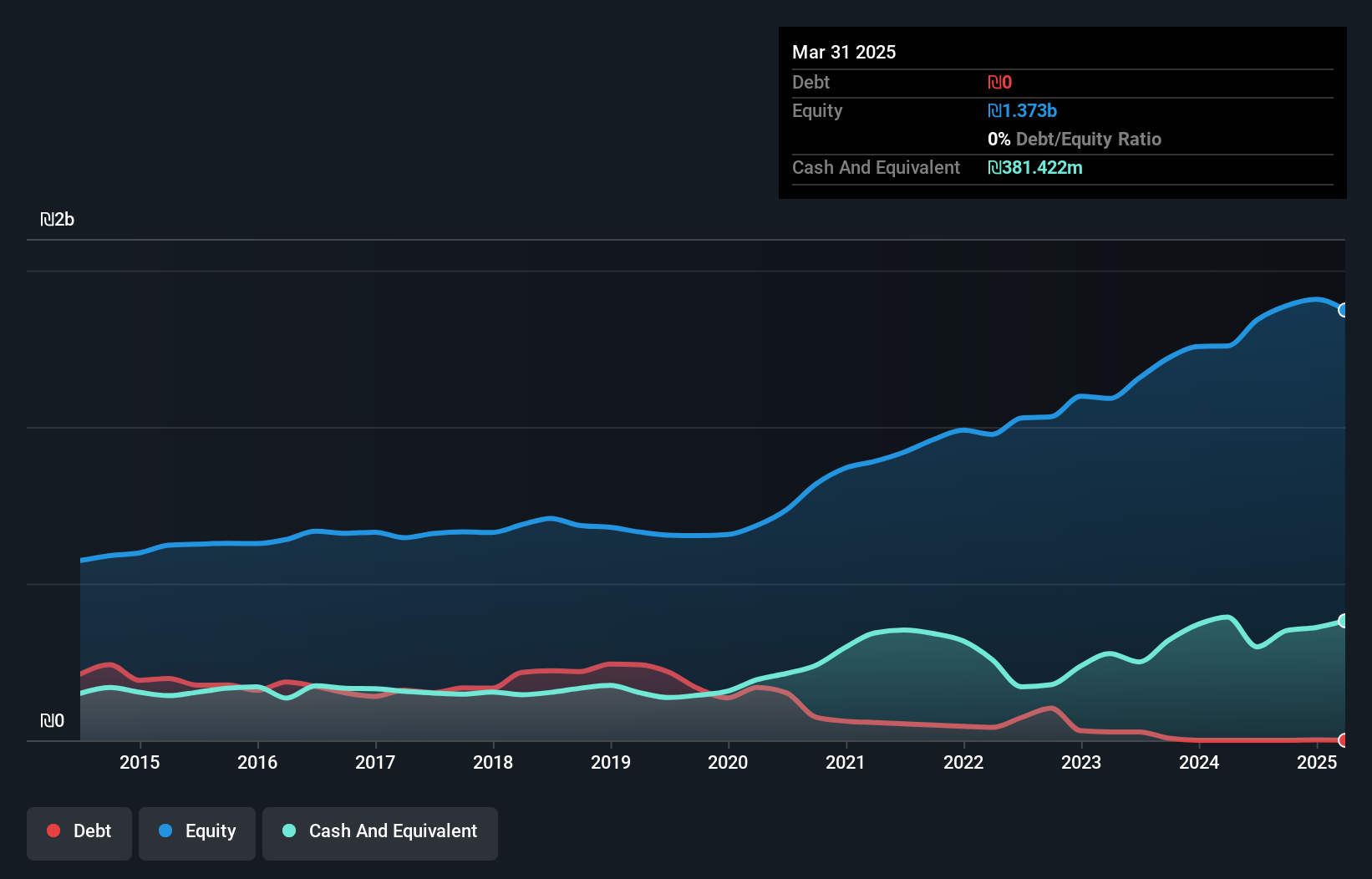

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Palram Industries (1990) Ltd is a company that manufactures and sells thermoplastic sheets, panel systems, and finished products in Israel and internationally, with a market capitalization of ₪1.79 billion.

Operations: Palram Industries generates revenue primarily from its Polycarbonate Sector, contributing ₪947.77 million, followed by the PVC and Canopia Sectors with revenues of ₪420.95 million and ₪259.90 million, respectively. The Pur-U Sector adds another ₪185.04 million to the company's total revenue streams.

Palram Industries, a notable player in the chemicals sector, is making waves with its impressive financial performance and strategic moves. The company's earnings surged by 71% over the past year, outpacing the industry growth of 7.5%, showcasing its robust operational strength. With no debt on its books now compared to a 33% debt-to-equity ratio five years ago, Palram's financial health seems solid. Trading at about 75% below estimated fair value adds to its appeal as an undervalued asset. Recently added to the TA-125 Index, Palram reported second-quarter sales of ILS 494 million and net income of ILS 66 million, reflecting significant year-on-year improvements in both metrics.

- Click here to discover the nuances of Palram Industries (1990) with our detailed analytical health report.

Learn about Palram Industries (1990)'s historical performance.

Where To Now?

- Gain an insight into the universe of 4666 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLRM

Palram Industries (1990)

Manufactures and sells thermoplastic sheets, and panel systems, and finished products in Israel and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives