A Fresh Look at Israel (TASE:ILCO) Valuation After Recent Share Price Rally

Reviewed by Kshitija Bhandaru

Israel (TASE:ILCO) shares have seen some fluctuation over the last week, with a nearly 10% gain in that period. The stock has still delivered a 20% return so far this year. Investors may be weighing valuation and long-term prospects.

See our latest analysis for Israel.

Israel’s share price momentum has picked up lately with a 9.9% jump over the past week, and its 1-year total shareholder return stands at an impressive 48%. This surge suggests the market sees greater growth potential or less perceived risk compared to earlier in the year, adding to a strong long-term track record.

If Israel’s rebound caught your attention, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying, the question now is whether Israel remains undervalued or if the recent gains reflect the market already pricing in future growth. Is there still a buying opportunity for investors?

Price-to-Earnings of 17.3x: Is it justified?

Israel’s shares currently trade at a price-to-earnings (P/E) ratio of 17.3x, well below the industry average. This points toward potential undervaluation relative to its sector peers.

The P/E ratio compares a company's share price to its annual earnings, helping investors gauge market expectations for growth and profitability. For Israel, the P/E of 17.3x suggests that the market may not fully reflect its earnings power, especially considering its recent rally.

Another noteworthy point is that Israel’s P/E is below both the regional average of 23.9x and its peer group’s 37.2x. This discount could indicate that the market is overlooking certain strengths or that past earnings volatility is keeping investor sentiment cautious. If the market begins to recognize sustained profitability or operational improvements, there may be a shift toward higher multiples similar to those of its peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.3x (UNDERVALUED)

However, risks such as recent earnings volatility or limited profit growth could reduce optimism if they persist in the coming quarters.

Find out about the key risks to this Israel narrative.

Another View: SWS DCF Model Perspective

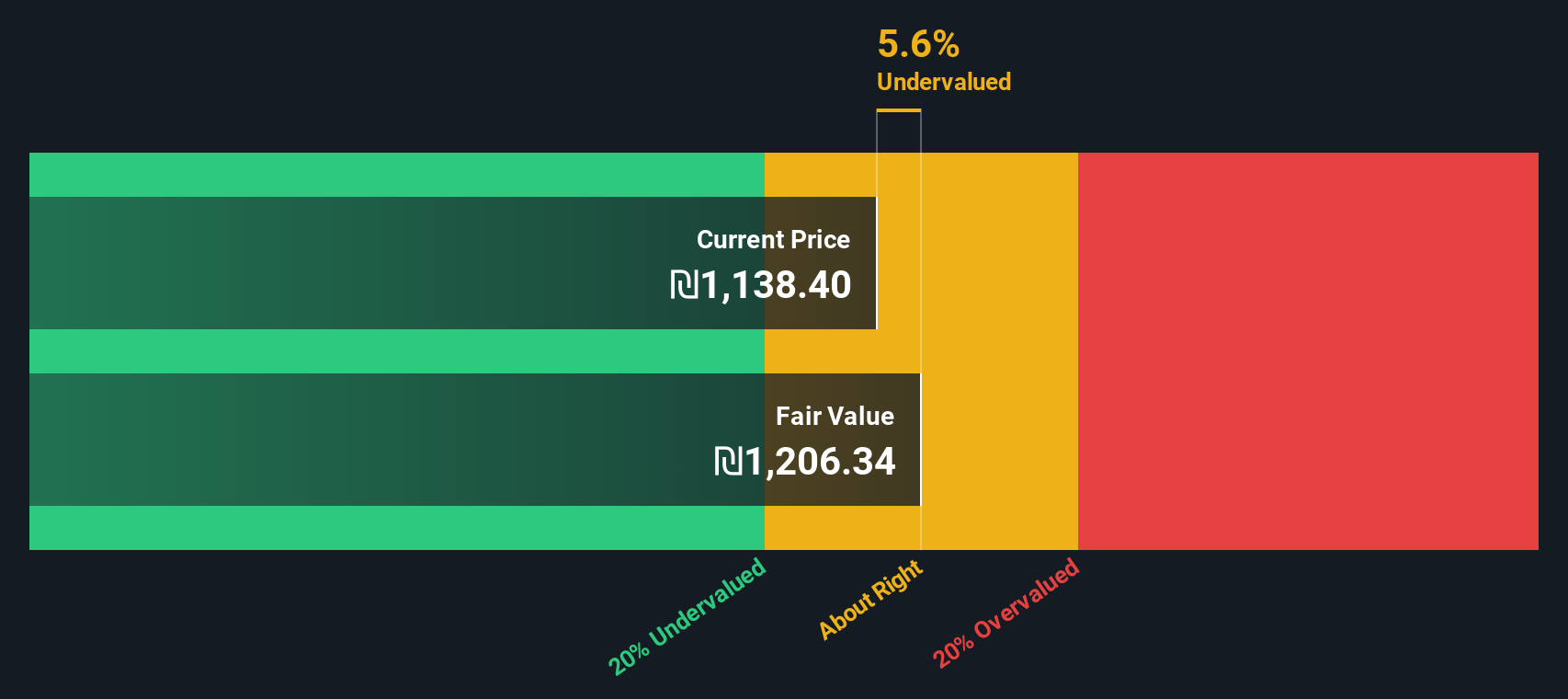

While Israel’s P/E ratio highlights potential undervaluation, the SWS DCF model also suggests that the shares are trading below estimated fair value. The price is currently 5.6% under what our model calculates as fair value. Could both methods be pointing to a lasting opportunity, or is there a hidden reason for caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Israel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Israel Narrative

If you think differently or want to see the story through your own lens, you can easily build your own narrative in just a few minutes. Do it your way.

A great starting point for your Israel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. Make your money work harder by quickly finding promising companies that match your strategy. Real winners are just a click away.

- Tap into the potential of next-generation industries by reviewing these 24 AI penny stocks, which are setting the pace in artificial intelligence innovation.

- Unlock value plays with these 891 undervalued stocks based on cash flows and secure stocks trading below their intrinsic worth, backed by solid fundamentals.

- Maximize your income with these 19 dividend stocks with yields > 3%, featuring stocks offering attractive yields above 3% and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ILCO

Israel

Operates in the specialty minerals and chemical businesses in Europe, Asia, South America, North America, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026