The Phoenix Holdings Ltd.'s (TLV:PHOE) Subdued P/S Might Signal An Opportunity

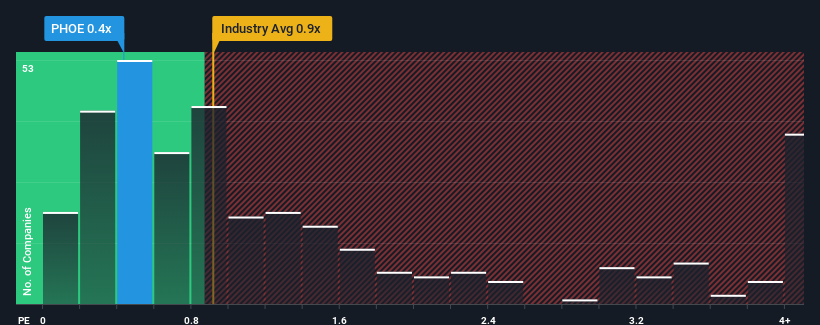

With a median price-to-sales (or "P/S") ratio of close to 0.2x in the Insurance industry in Israel, you could be forgiven for feeling indifferent about The Phoenix Holdings Ltd.'s (TLV:PHOE) P/S ratio of 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Phoenix Holdings

How Phoenix Holdings Has Been Performing

Recent times have been quite advantageous for Phoenix Holdings as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Phoenix Holdings' earnings, revenue and cash flow.How Is Phoenix Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Phoenix Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 83%. The strong recent performance means it was also able to grow revenue by 57% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to shrink 14% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that Phoenix Holdings' P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As mentioned previously, Phoenix Holdings currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Phoenix Holdings that you need to be mindful of.

If these risks are making you reconsider your opinion on Phoenix Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:PHOE

Proven track record and fair value.

Market Insights

Community Narratives