Phoenix Financial (TASE:PHOE): Assessing Valuation After Surging Profitability in Latest Earnings Report

Reviewed by Simply Wall St

Phoenix Financial (TASE:PHOE) just dropped its latest earnings report, and the outcome is hard to miss. The company saw its net income for the second quarter jump to ILS 957 million, well above last year’s ILS 372 million, while earnings per share more than doubled. Stronger numbers for the first half of 2025 underline improving profitability, which immediately shifts investor focus to whether this growth is sustainable or just a good quarter.

This earnings beat follows a period of powerful momentum for Phoenix Financial. Over the past year, the stock has surged 126%, and over three years it has returned over 250%. In the past three months alone, shares climbed 46%. The market seems to be taking a far more optimistic view of Phoenix Financial’s prospects, compared to the more tempered gains earlier.

With shares rocketing higher on the back of earnings growth, is Phoenix Financial now undervalued, or are investors already pricing in all the future gains?

Price-to-Earnings of 12.4x: Is it justified?

Valuing Phoenix Financial by its price-to-earnings ratio, the company appears attractively priced versus its peers. With a price-to-earnings (P/E) multiple of 12.4x, the stock is trading below both the Israeli market average of 15.2x and the peer average of 14.7x. This reading suggests that investors are paying less for each unit of earnings compared to other similar companies.

The price-to-earnings ratio is a widely tracked valuation multiple. It is particularly important for firms like Phoenix Financial that generate substantial profits. It allows investors to compare the company's current valuation to its earnings power and offers insight into whether future growth potential is being fully recognized by the market.

With earnings growth outpacing the industry over the last year, a lower-than-average P/E may imply that the market is underestimating Phoenix Financial’s ability to sustain or accelerate profit gains. The company’s track record of growth makes its valuation particularly noteworthy at current levels.

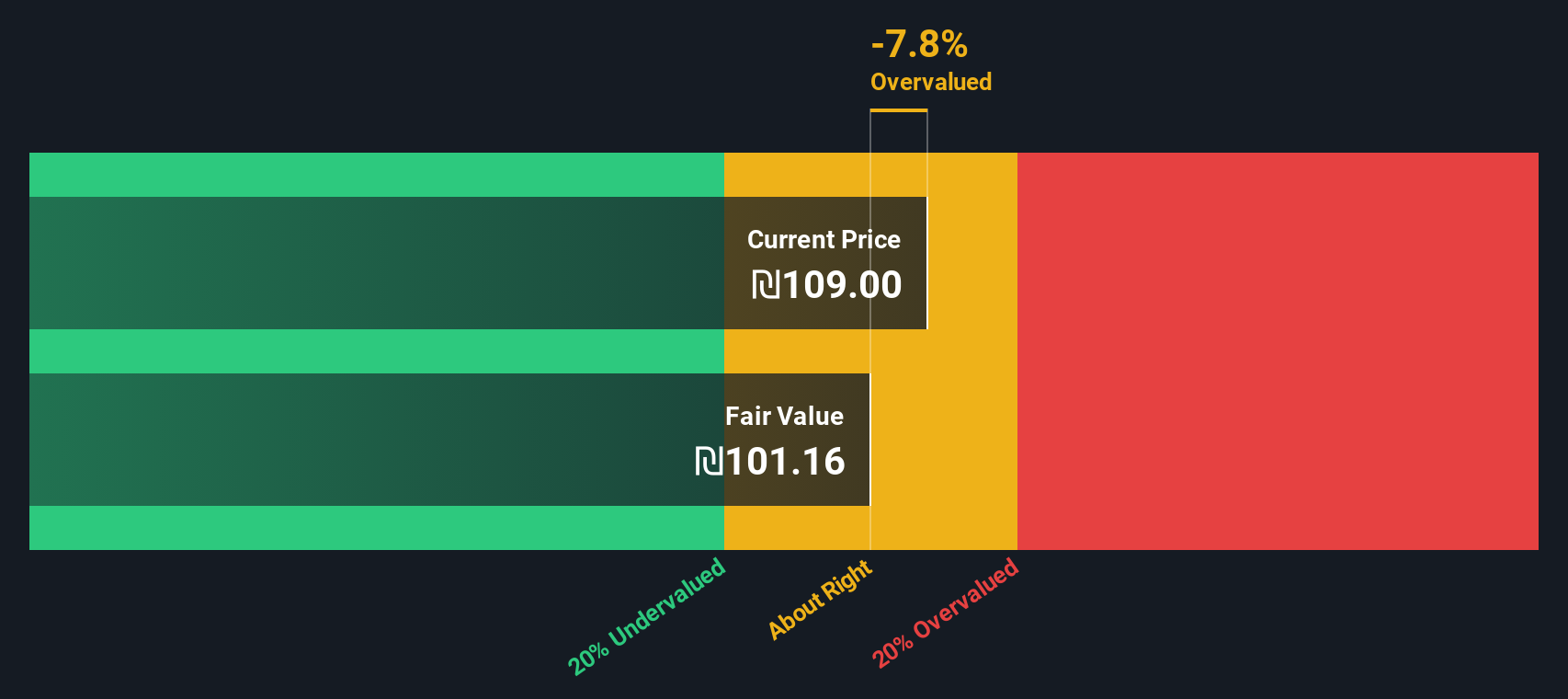

Result: Fair Value of ₪101.16 (OVERVALUED)

See our latest analysis for Phoenix Financial.However, rising valuations and unpredictable market conditions could challenge Phoenix Financial's growth run. This reminds investors that momentum alone does not guarantee future outperformance.

Find out about the key risks to this Phoenix Financial narrative.Another View: the SWS DCF Model

Looking at Phoenix Financial through the lens of our SWS DCF model, the outlook appears less optimistic. This approach suggests the shares may actually be overvalued, raising the question of which method provides a more accurate assessment.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Phoenix Financial Narrative

If you want to dig deeper or have your own perspective, you can quickly build your own view using the available data in just a few minutes. Do it your way

A great starting point for your Phoenix Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities slip through your fingers. Power up your portfolio by checking out these hand-picked lists of stocks backed by strong data-driven insights.

- Capture the upside in small-cap companies showing financial resilience by scanning our selection of penny stocks with strong financials.

- Tap into tomorrow’s medical breakthroughs with innovators at the frontier of patient care through our focused group of healthcare AI stocks.

- Boost your income with shares offering robust yields and benefit from stable long-term growth with our curated set of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TASE:PHOE

Fair value with acceptable track record.

Market Insights

Community Narratives