Should You Be Adding Harel Insurance Investments & Financial Services (TLV:HARL) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Harel Insurance Investments & Financial Services (TLV:HARL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Harel Insurance Investments & Financial Services

Harel Insurance Investments & Financial Services's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, Harel Insurance Investments & Financial Services has grown EPS by 27% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Harel Insurance Investments & Financial Services's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Harel Insurance Investments & Financial Services's EBIT margins have actually improved by 2.2 percentage points in the last year, to reach 8.3%, but, on the flip side, revenue was down 13%. That falls short of ideal.

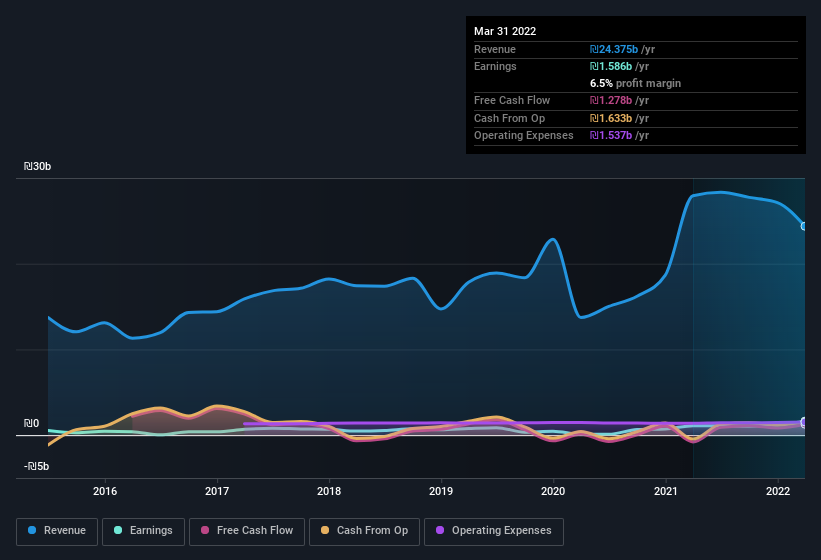

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Harel Insurance Investments & Financial Services's balance sheet strength, before getting too excited.

Are Harel Insurance Investments & Financial Services Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between ₪3.3b and ₪11b, like Harel Insurance Investments & Financial Services, the median CEO pay is around ₪3.9m.

The Harel Insurance Investments & Financial Services CEO received ₪3.5m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Harel Insurance Investments & Financial Services Worth Keeping An Eye On?

You can't deny that Harel Insurance Investments & Financial Services has grown its earnings per share at a very impressive rate. That's attractive. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. You still need to take note of risks, for example - Harel Insurance Investments & Financial Services has 1 warning sign we think you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Harel Insurance Investments & Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:HARL

Harel Insurance Investments & Financial Services

Offers insurance and financial services in Israel, Europe, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives