Shareholders Will Most Likely Find Clal Insurance Enterprises Holdings Ltd.'s (TLV:CLIS) CEO Compensation Acceptable

Key Insights

- Clal Insurance Enterprises Holdings will host its Annual General Meeting on 18th of December

- CEO Yoram Naveh's total compensation includes salary of ₪3.31m

- The overall pay is comparable to the industry average

- Clal Insurance Enterprises Holdings' total shareholder return over the past three years was 15% while its EPS was down 26% over the past three years

Under the guidance of CEO Yoram Naveh, Clal Insurance Enterprises Holdings Ltd. (TLV:CLIS) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18th of December. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Clal Insurance Enterprises Holdings

Comparing Clal Insurance Enterprises Holdings Ltd.'s CEO Compensation With The Industry

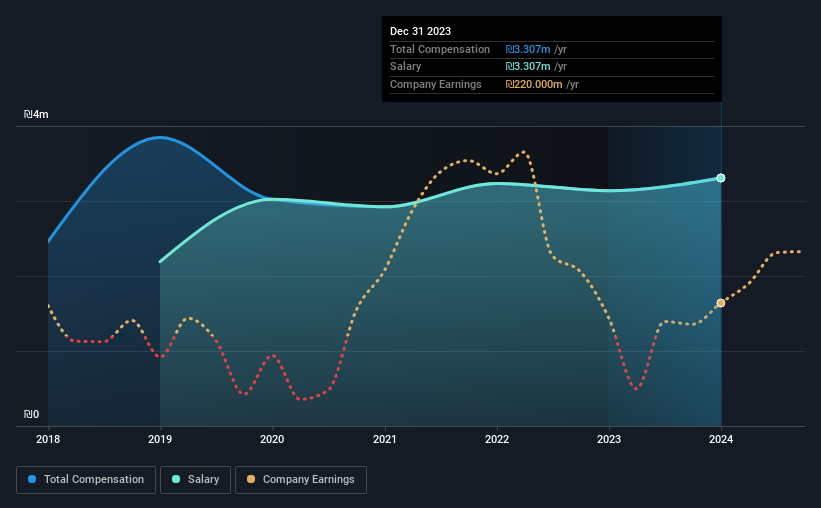

At the time of writing, our data shows that Clal Insurance Enterprises Holdings Ltd. has a market capitalization of ₪6.9b, and reported total annual CEO compensation of ₪3.3m for the year to December 2023. That's a modest increase of 5.4% on the prior year. Notably, the salary of ₪3.3m is the entirety of the CEO compensation.

For comparison, other companies in the Israel Insurance industry with market capitalizations ranging between ₪3.6b and ₪11b had a median total CEO compensation of ₪3.1m. So it looks like Clal Insurance Enterprises Holdings compensates Yoram Naveh in line with the median for the industry. What's more, Yoram Naveh holds ₪645k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₪3.3m | ₪3.1m | 100% |

| Other | - | - | - |

| Total Compensation | ₪3.3m | ₪3.1m | 100% |

On an industry level, roughly 86% of total compensation represents salary and 14% is other remuneration. On a company level, Clal Insurance Enterprises Holdings prefers to reward its CEO through a salary, opting not to pay Yoram Naveh through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Clal Insurance Enterprises Holdings Ltd.'s Growth

Over the last three years, Clal Insurance Enterprises Holdings Ltd. has shrunk its earnings per share by 26% per year. In the last year, its revenue is up 34%.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Clal Insurance Enterprises Holdings Ltd. Been A Good Investment?

Clal Insurance Enterprises Holdings Ltd. has generated a total shareholder return of 15% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Clal Insurance Enterprises Holdings rewards its CEO solely through a salary, ignoring non-salary benefits completely. Some shareholders will be pleased by the relatively good results, however, the results could still be improved. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Clal Insurance Enterprises Holdings.

Switching gears from Clal Insurance Enterprises Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:CLIS

Clal Insurance Enterprises Holdings

Operates in the fields of insurance, pensions, provident funds and finance, and credit insurance in Israel.

Low risk with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026