- Thailand

- /

- Marine and Shipping

- /

- SET:RCL

Discovering None's Top 3 Small Caps with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks continue to capture investor interest with the Russell 2000 Index showing a modest year-to-date gain of 10.73%. In this environment, identifying promising small-cap companies requires careful consideration of factors such as innovation potential, market positioning, and resilience in the face of economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Regional Container Lines (SET:RCL)

Simply Wall St Value Rating: ★★★★★★

Overview: Regional Container Lines Public Company Limited, along with its subsidiaries, operates in the feeder and vessel sector across Thailand, Singapore, Hong Kong, and China with a market cap of THB23.41 billion.

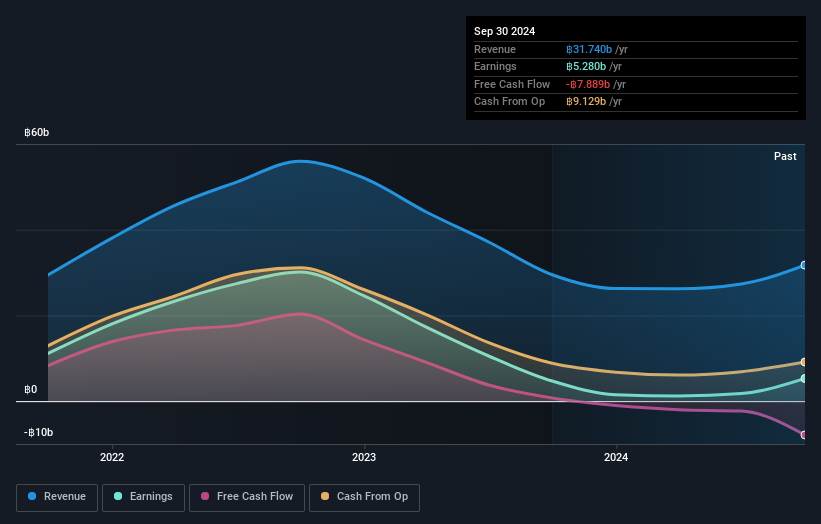

Operations: The primary revenue stream for Regional Container Lines comes from its feeder and vessel operations, generating THB31.74 billion. The company's financial performance is influenced by its ability to manage operational costs effectively.

Regional Container Lines, a nimble player in the shipping sector, has showcased impressive financial resilience. Over the past year, earnings surged by 12.6%, outpacing the industry's modest 0.8% growth. Their debt-to-equity ratio saw a significant reduction from 60.3% to 14% over five years, indicating stronger financial health. The company's price-to-earnings ratio stands attractively at 4.4x against the Thai market's average of 14.1x, suggesting potential undervaluation. Recent results highlight robust performance with Q3 revenue climbing to THB 11 billion from THB 6 billion last year and net income jumping to THB 4 billion from THB 585 million previously.

- Dive into the specifics of Regional Container Lines here with our thorough health report.

Evaluate Regional Container Lines' historical performance by accessing our past performance report.

Clal Insurance Enterprises Holdings (TASE:CLIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Clal Insurance Enterprises Holdings Ltd. is an Israeli company offering a range of insurance services, with a market capitalization of ₪6.78 billion.

Operations: Clal Insurance generates significant revenue from its life insurance segment, totaling ₪17.10 billion, followed by credit cards at ₪2.77 billion and health insurance at ₪2.07 billion. The company also earns from general insurance, including automobile property and compulsory vehicle insurance, contributing to its diversified income streams.

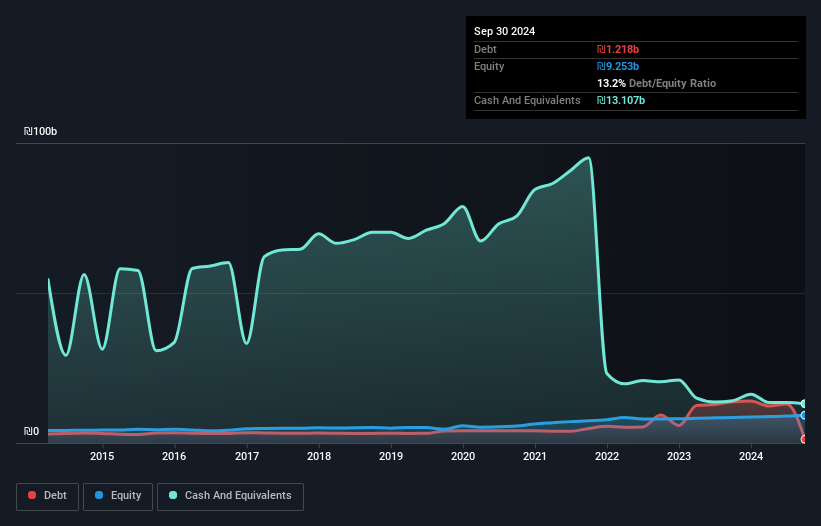

Clal Insurance Enterprises Holdings has been making waves with impressive earnings growth of 621.8% over the past year, outpacing its industry peers. The company's debt management is commendable, reducing its debt to equity ratio from 88% to a mere 13.2% in five years, showcasing financial prudence. Despite having high-quality past earnings and more cash than total debt, interest coverage remains a concern at only 2.3 times EBIT versus the ideal of at least three times. Recent quarterly results reveal revenue of ILS 8 billion and net income of ILS 128 million, hinting at robust operational performance amidst challenges.

Intermestic (TSE:262A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Intermestic Inc. operates as a retailer of eyeglasses and sunglasses through both physical stores and an online platform in Japan, with a market capitalization of ¥55.43 billion.

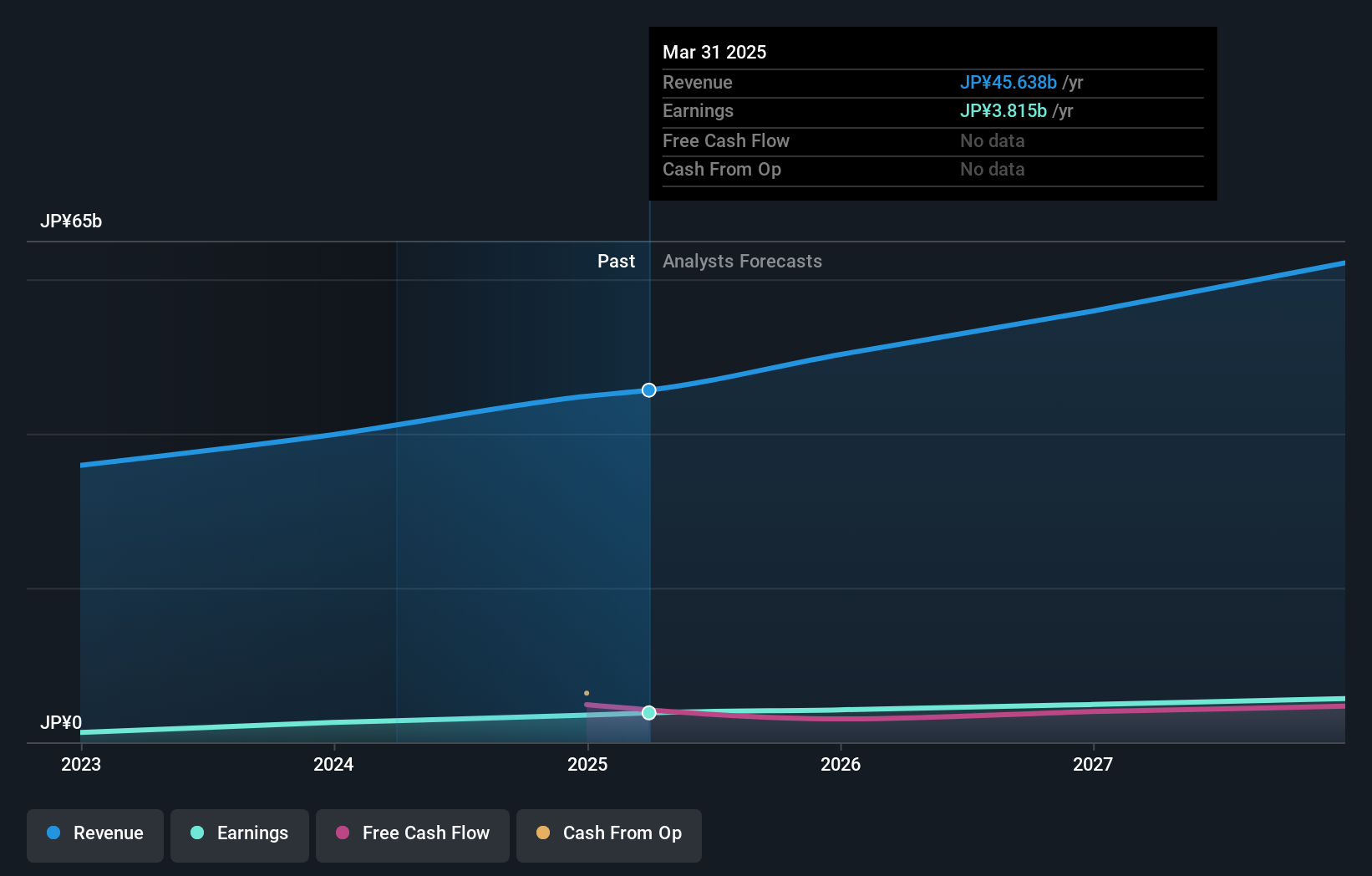

Operations: Intermestic Inc. generates revenue primarily from its Domestic Business segment, contributing ¥38.17 billion, while the Overseas Segment adds ¥2.09 billion.

Intermestic, a smaller player in the market, recently completed an IPO raising ¥17.48 billion, offering shares at ¥1,630 each with a discount of ¥97.8 per share. The company expects net sales of JPY 43,489 million and operating profit of JPY 4,206 million for the fiscal year ending December 31, 2024. Earnings have surged by 102%, outpacing the Specialty Retail industry’s growth rate of 5.8%. With interest payments well-covered by EBIT at a robust ratio of 112x and a satisfactory net debt to equity ratio of just under 10%, Intermestic appears financially sound despite recent share price volatility.

- Click here and access our complete health analysis report to understand the dynamics of Intermestic.

Where To Now?

- Investigate our full lineup of 4636 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:RCL

Regional Container Lines

Engages in the feeder and vessel operations in Thailand, Singapore, Hong Kong, and the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives