- Turkey

- /

- Industrials

- /

- IBSE:IHLAS

Middle Eastern Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

Most Gulf markets have recently experienced gains, buoyed by hopes of U.S. interest rate cuts and a ceasefire agreement in Gaza that could ease regional tensions. In this context, the concept of penny stocks—often seen as smaller or newer companies—remains relevant for investors seeking opportunities beyond well-known names. While the term may seem outdated, these stocks can offer potential value and growth when selected with care, particularly those with strong financials and promising prospects.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.84 | SAR2.18B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.78 | SAR1.51B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.756 | ₪338.68M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.98 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.28 | AED13.86B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.846 | AED514.58M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.874 | ₪225.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC operates in the United Arab Emirates, focusing on providing and investing in education services, with a market capitalization of AED4.25 billion.

Operations: The company's revenue primarily comes from school operations, which generated AED1.10 billion.

Market Cap: AED4.25B

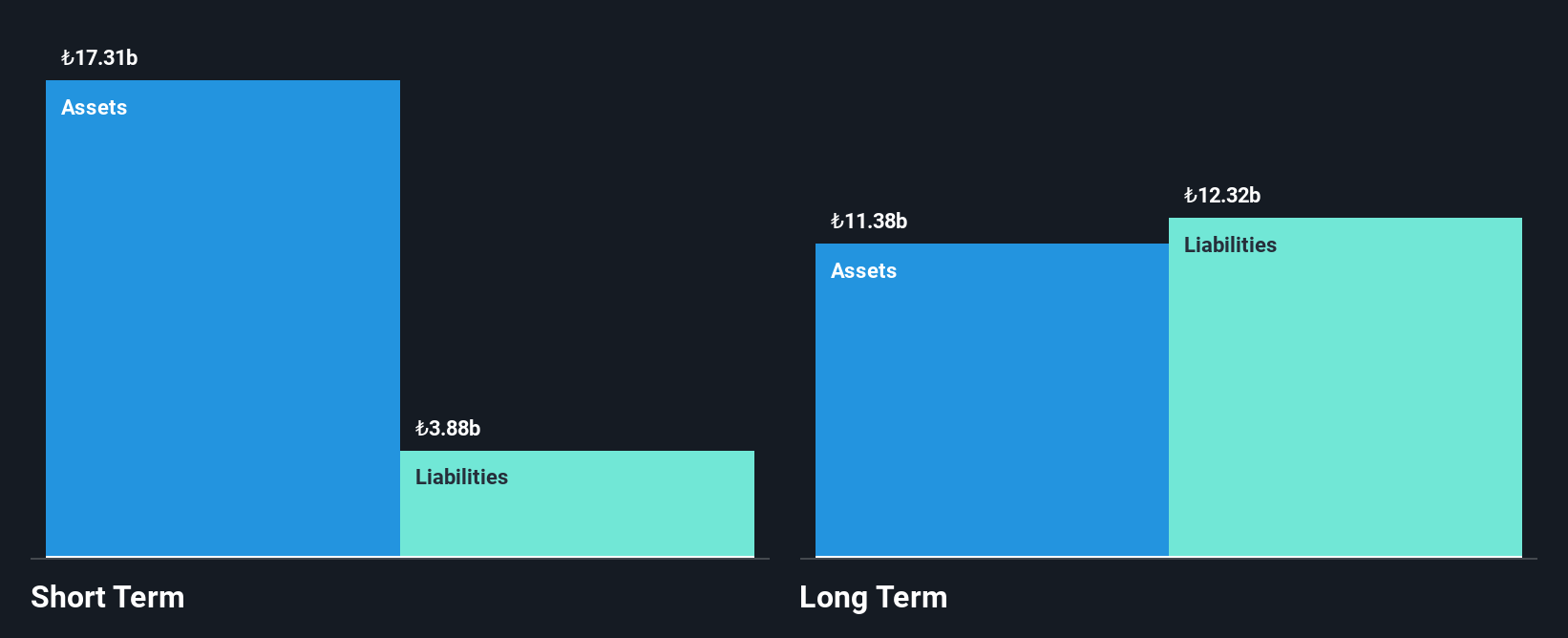

Taaleem Holdings PJSC, with a market cap of AED4.25 billion, recently reported an increase in sales to AED1.14 billion for fiscal 2025, up from AED946.88 million the previous year. Despite a slight decrease in net profit margins from 15.3% to 14%, the company maintains high-quality earnings and has not diluted shareholders over the past year. Its seasoned management and board teams contribute to stability, while its debt remains well-covered by operating cash flow and EBIT. Although short-term assets exceed short-term liabilities, long-term liabilities are not fully covered by current assets.

- Jump into the full analysis health report here for a deeper understanding of Taaleem Holdings PJSC.

- Understand Taaleem Holdings PJSC's earnings outlook by examining our growth report.

Ihlas Holding (IBSE:IHLAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Holding A.S. operates in construction and real estate, media, manufacturing and trading, as well as healthcare and education sectors in Turkey and internationally, with a market cap of TRY5.37 billion.

Operations: The company's revenue is primarily derived from its marketing segment at TRY4.78 billion, followed by media at TRY2.29 billion, and construction at TRY855.60 million.

Market Cap: TRY5.37B

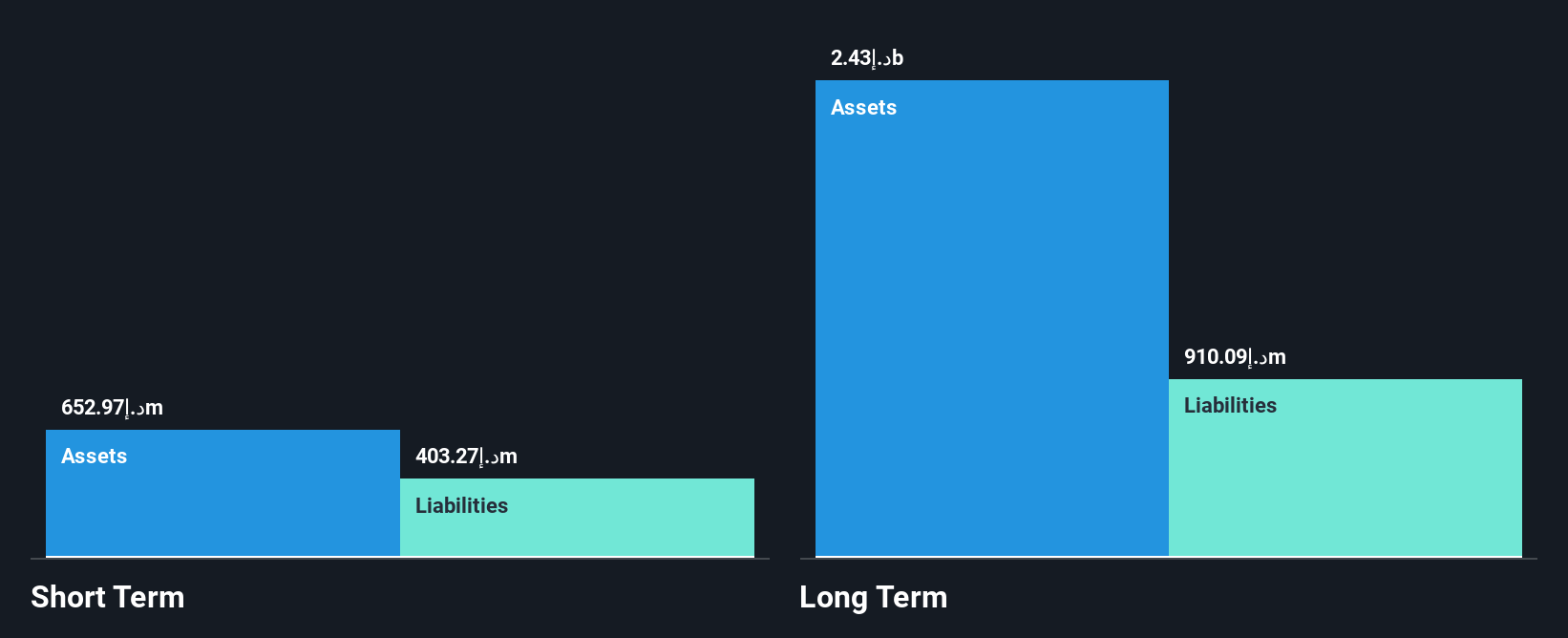

Ihlas Holding A.S., with a market cap of TRY5.37 billion, operates across diverse sectors but remains unprofitable despite reducing losses by 1.5% annually over five years. The company reported sales of TRY2.74 billion for Q2 2025, an increase from the previous year, yet net losses widened to TRY639.72 million. Its debt management has improved significantly, with a net debt to equity ratio at a satisfactory 2.6%. While short-term assets cover liabilities comfortably, Ihlas faces financial pressure with less than one year of cash runway and high share price volatility compared to other Turkish stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Ihlas Holding.

- Review our historical performance report to gain insights into Ihlas Holding's track record.

Pulsenmore (TASE:PULS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulsenmore Ltd. provides self-scan ultrasound devices for remote clinical diagnosis and screening, with a market cap of ₪239.98 million.

Operations: The company's revenue comes from the X-Ray Equipment segment, totaling ₪9.31 million.

Market Cap: ₪239.98M

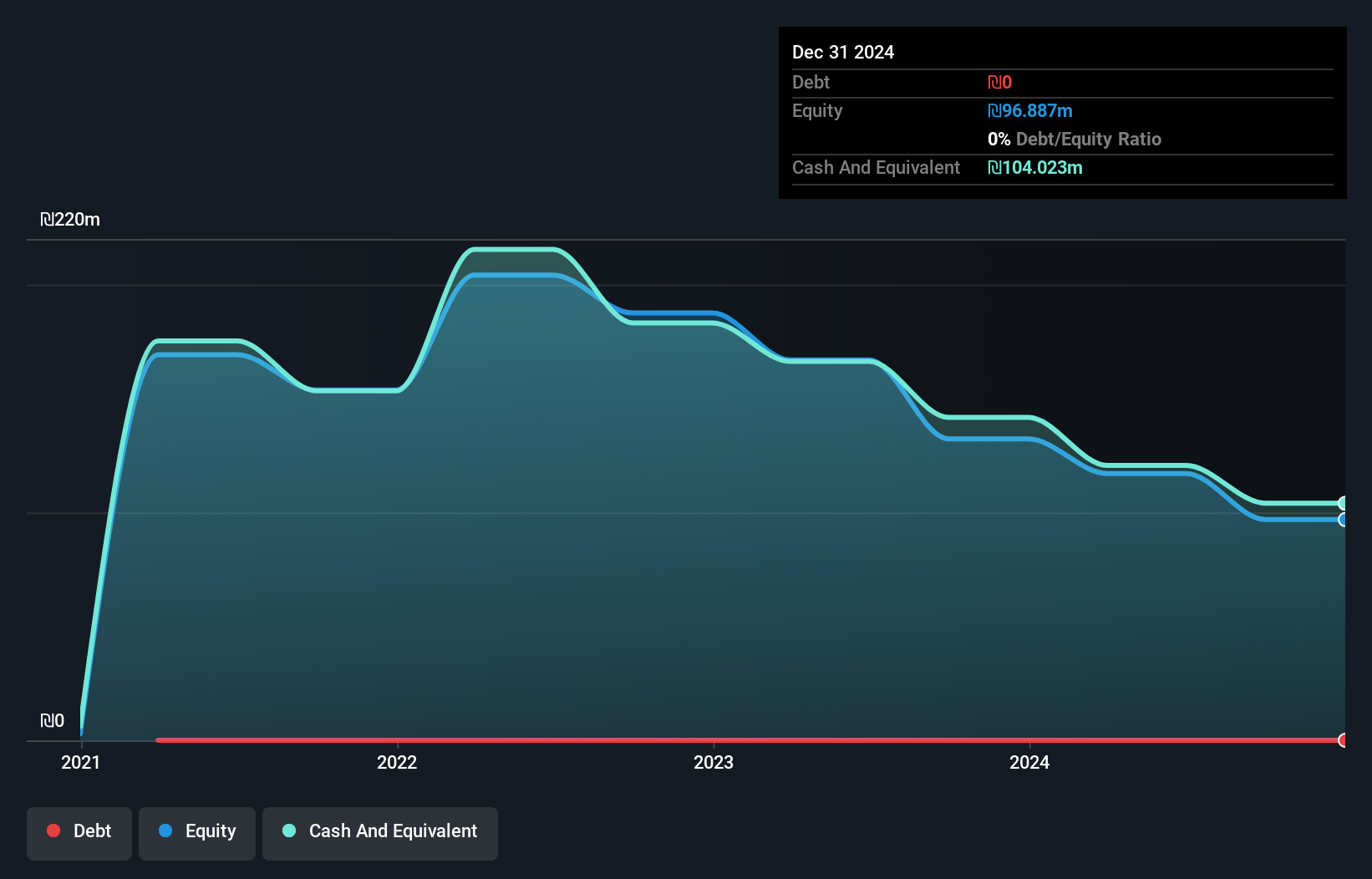

Pulsenmore Ltd., with a market cap of ₪239.98 million, is currently pre-revenue with sales of ₪4 million for the first half of 2025, down from the previous year. Despite being debt-free and having short-term assets that exceed liabilities, Pulsenmore remains unprofitable, with losses increasing annually by 24.4% over five years. The company has sufficient cash runway for more than a year if free cash flow remains stable but faces high share price volatility and negative return on equity at -59.05%. Management and board members have experienced tenures, providing some operational stability amidst financial challenges.

- Get an in-depth perspective on Pulsenmore's performance by reading our balance sheet health report here.

- Explore historical data to track Pulsenmore's performance over time in our past results report.

Key Takeaways

- Dive into all 78 of the Middle Eastern Penny Stocks we have identified here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHLAS

Ihlas Holding

Engages in the construction and real estate, media, manufacturing and trading, and healthcare and education businesses in Turkey and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives