- Israel

- /

- Oil and Gas

- /

- TASE:ORL

Middle Eastern Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have shown mixed results recently, influenced by global trade tensions and fluctuating oil prices. Despite these challenges, the region continues to offer intriguing investment opportunities, particularly in the realm of penny stocks. While traditionally seen as risky ventures due to their association with smaller or less-established companies, penny stocks can still be attractive investments when they demonstrate strong financial health and potential for growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.78 | SAR1.51B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.596 | ₪327.67M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.40 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.98 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.29 | AED14.03B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.839 | AED510.32M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.874 | ₪225.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gulf Pharmaceutical Industries P.S.C., along with its subsidiaries, produces and distributes a range of pharmaceutical, cosmetic, and medical products in the United Arab Emirates, other GCC countries, and internationally, with a market cap of AED1.47 billion.

Operations: The company's revenue is primarily derived from its manufacturing segment, which generated AED640.8 million.

Market Cap: AED1.47B

Gulf Pharmaceutical Industries P.S.C. has recently demonstrated improved financial health, with a net income of AED 157.9 million for the first half of 2025, compared to a net loss the previous year. Its debt levels are satisfactory and well-covered by operating cash flow, while short-term assets exceed both short and long-term liabilities. The company’s profitability has grown significantly over five years, although its return on equity remains low at 4.9%. Recent additions to major indices like the S&P Pan Arab Composite highlight its growing market presence amidst reduced volatility and stable management tenure.

- Unlock comprehensive insights into our analysis of Gulf Pharmaceutical Industries P.S.C stock in this financial health report.

- Explore Gulf Pharmaceutical Industries P.S.C's analyst forecasts in our growth report.

Tukas Gida Sanayi ve Ticaret (IBSE:TUKAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tukas Gida Sanayi ve Ticaret A.S., along with its subsidiaries, manufactures and sells food products both in Turkey and internationally, with a market cap of TRY12.96 billion.

Operations: The company generates revenue primarily from its food processing segment, which amounted to TRY7.07 billion.

Market Cap: TRY12.96B

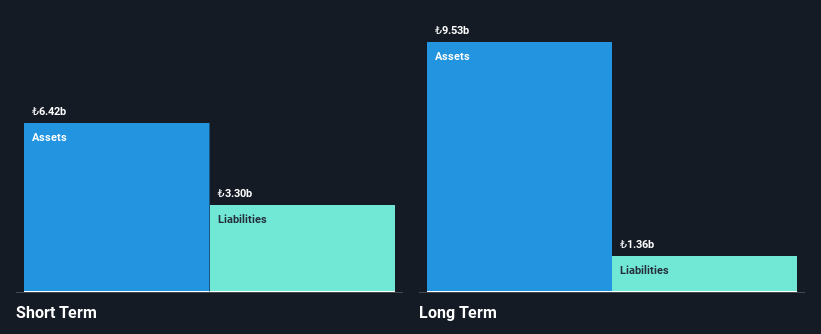

Tukas Gida Sanayi ve Ticaret A.S. has demonstrated growth in revenue, with sales reaching TRY 3.83 billion for the first half of 2025, although it faced a net loss in the recent quarter due to reduced profit margins and negative earnings growth over the past year. Despite this, its debt-to-equity ratio has improved significantly over five years to a satisfactory level of 28.8%. The company's short-term assets comfortably cover both short and long-term liabilities, yet its operating cash flow remains negative. While volatility is high, Tukas's seasoned board offers stability amidst these challenges.

- Navigate through the intricacies of Tukas Gida Sanayi ve Ticaret with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Tukas Gida Sanayi ve Ticaret's track record.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oil Refineries Ltd., with a market cap of ₪2.91 billion, produces and sells fuel products, intermediate materials, and aromatic products both in Israel and internationally.

Operations: The company's revenue is primarily derived from its refining operations, which generated $5.81 billion, and its polymers segment, which contributed $766 million.

Market Cap: ₪2.91B

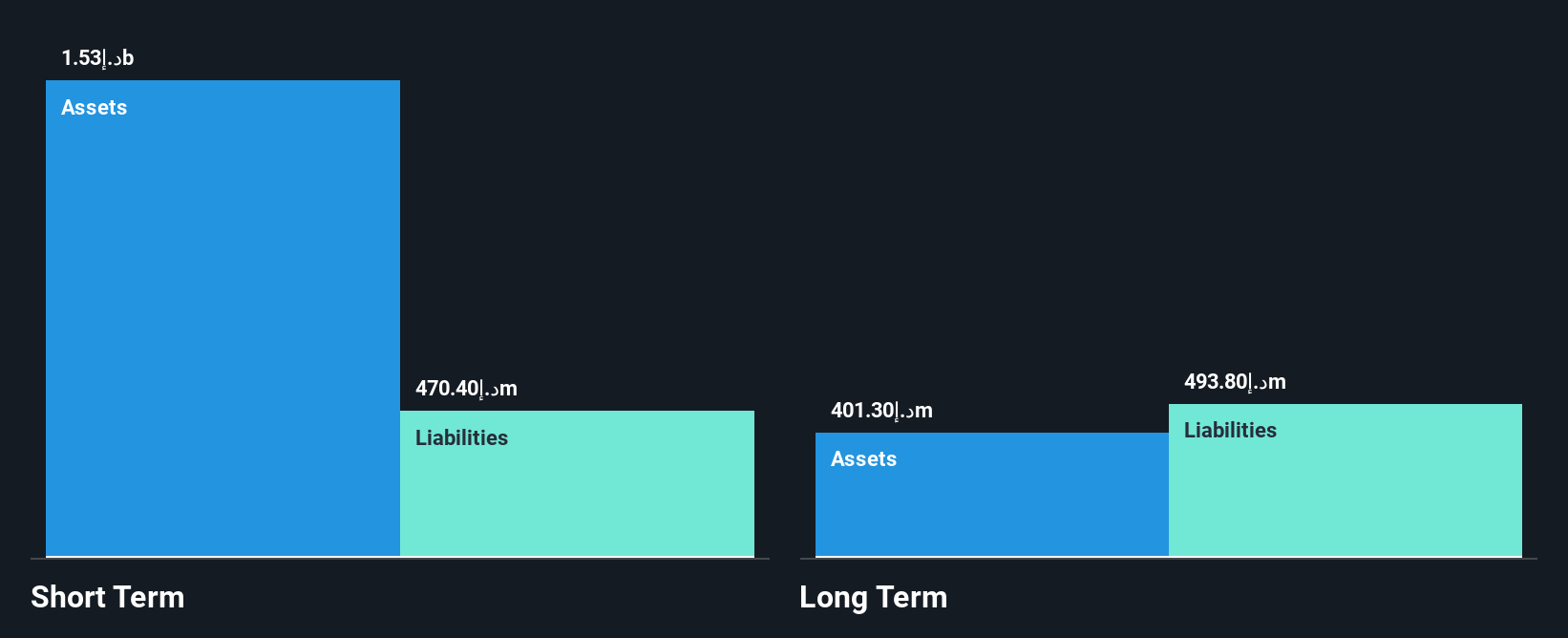

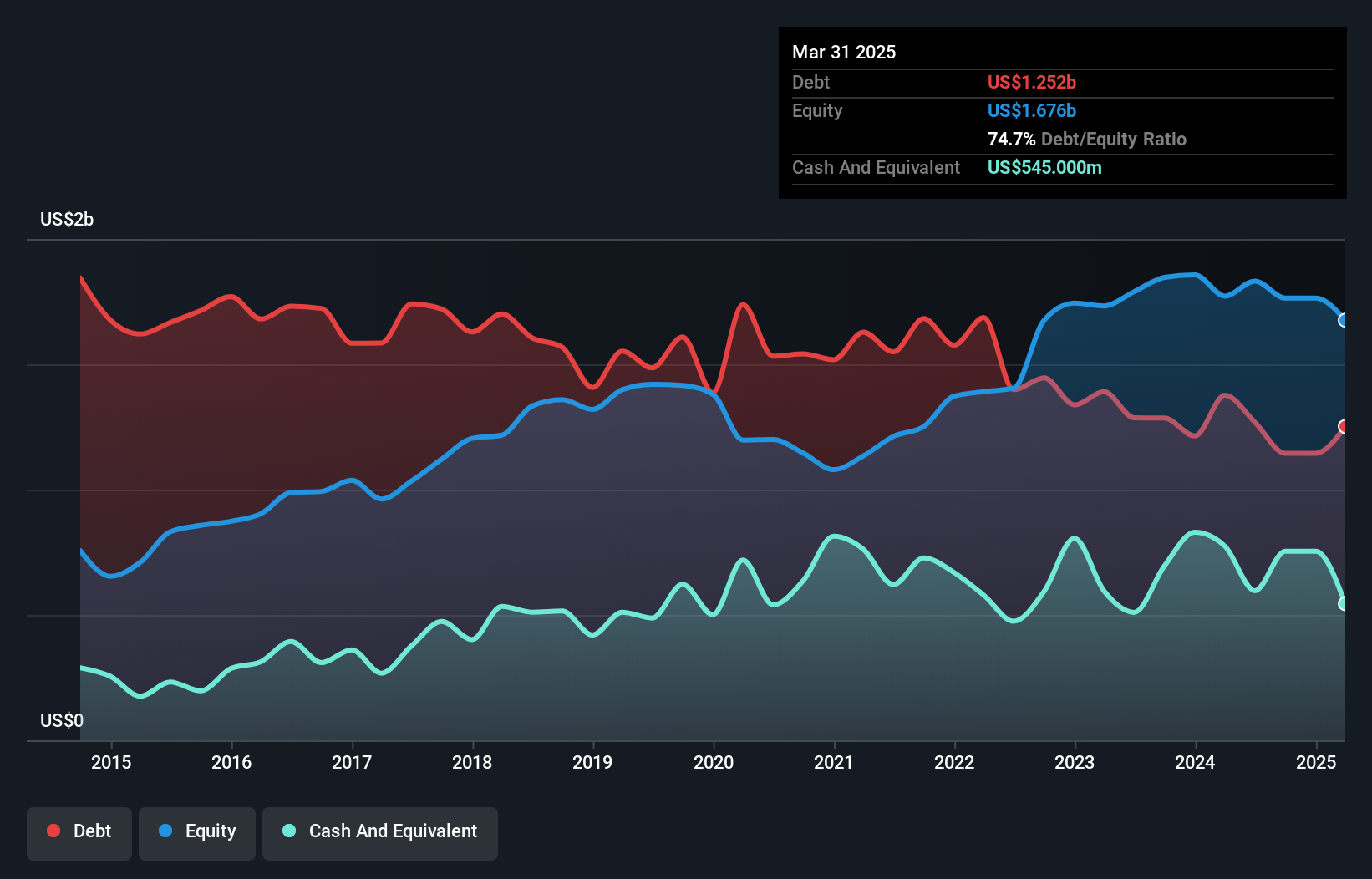

Oil Refineries Ltd. faces challenges as it remains unprofitable, with a recent net loss of US$37 million in Q2 2025 and declining sales compared to the previous year. Despite this, its management and board are experienced, providing some stability. The company has improved its debt-to-equity ratio from 127.7% to 83.7% over five years, although net debt levels remain high at 50%. Short-term assets exceed liabilities, indicating a strong liquidity position. However, interest payments are not well covered by earnings, highlighting ongoing financial pressures despite reduced losses over the past five years at a rate of 25.8% annually.

- Dive into the specifics of Oil Refineries here with our thorough balance sheet health report.

- Gain insights into Oil Refineries' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Click through to start exploring the rest of the 73 Middle Eastern Penny Stocks now.

- Want To Explore Some Alternatives? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ORL

Oil Refineries

Produces and sells fuel products, intermediate materials, and aromatic products in Israel and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives