- Israel

- /

- Oil and Gas

- /

- TASE:ILDR

Israel Land Development - Urban Renewal Ltd (TLV:ILDR) Looks Just Right With A 30% Price Jump

Israel Land Development - Urban Renewal Ltd (TLV:ILDR) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 8.8% isn't as impressive.

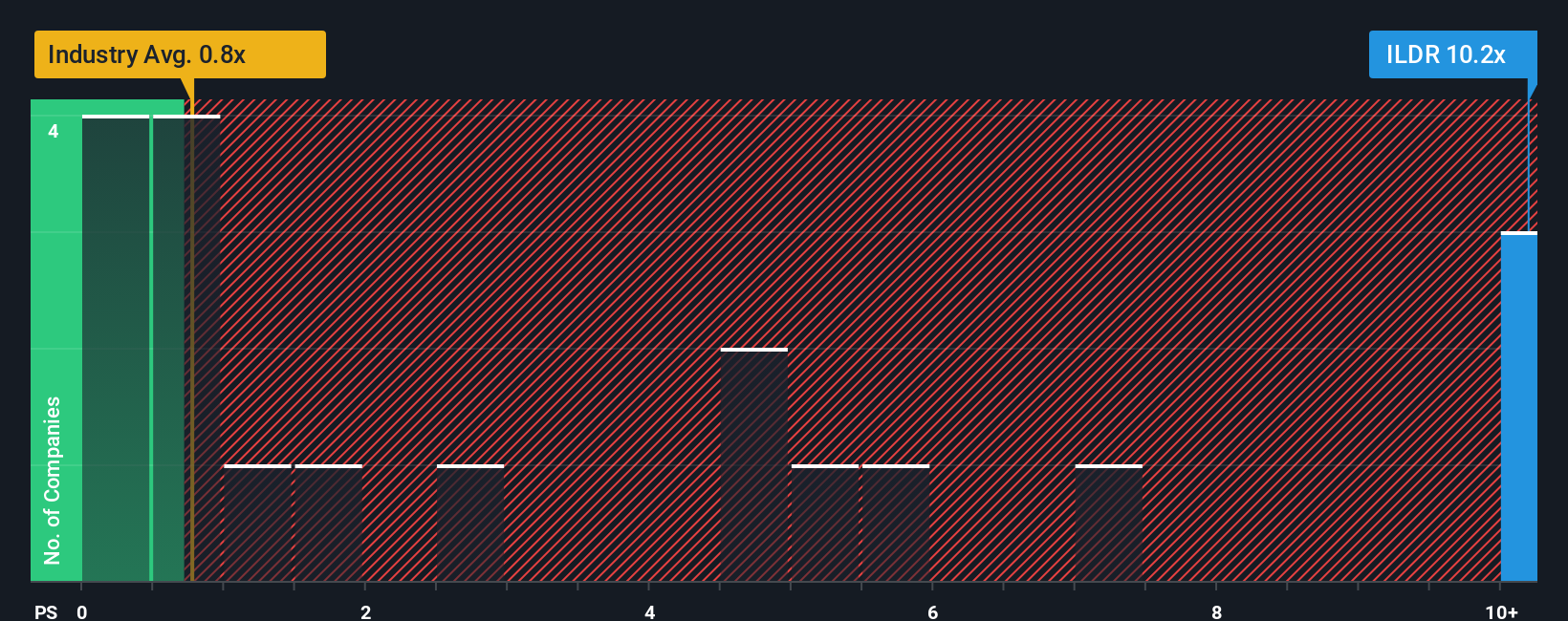

Following the firm bounce in price, when almost half of the companies in Israel's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Israel Land Development - Urban Renewal as a stock not worth researching with its 10.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Israel Land Development - Urban Renewal

What Does Israel Land Development - Urban Renewal's P/S Mean For Shareholders?

Israel Land Development - Urban Renewal certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Israel Land Development - Urban Renewal will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Israel Land Development - Urban Renewal?

Israel Land Development - Urban Renewal's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. Pleasingly, revenue has also lifted 208% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to shrink 4.2% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we can see why Israel Land Development - Urban Renewal is trading at a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Bottom Line On Israel Land Development - Urban Renewal's P/S

Israel Land Development - Urban Renewal's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Israel Land Development - Urban Renewal revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

Before you take the next step, you should know about the 4 warning signs for Israel Land Development - Urban Renewal (3 are a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Israel Land Development - Urban Renewal, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ILDR

Israel Land Development - Urban Renewal

Engages in urban renewal activities.

Slight risk with weak fundamentals.

Market Insights

Community Narratives