Exploring Undiscovered Gems In The Middle East This August 2025

Reviewed by Simply Wall St

As the Gulf stock markets navigate mixed performances amid cautious trading and fluctuating oil prices, investors are keenly focused on potential shifts in U.S. monetary policy that could impact regional indices. In this dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals and resilience to broader economic uncertainties, making them stand out as potential undiscovered gems in the Middle East's vibrant market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

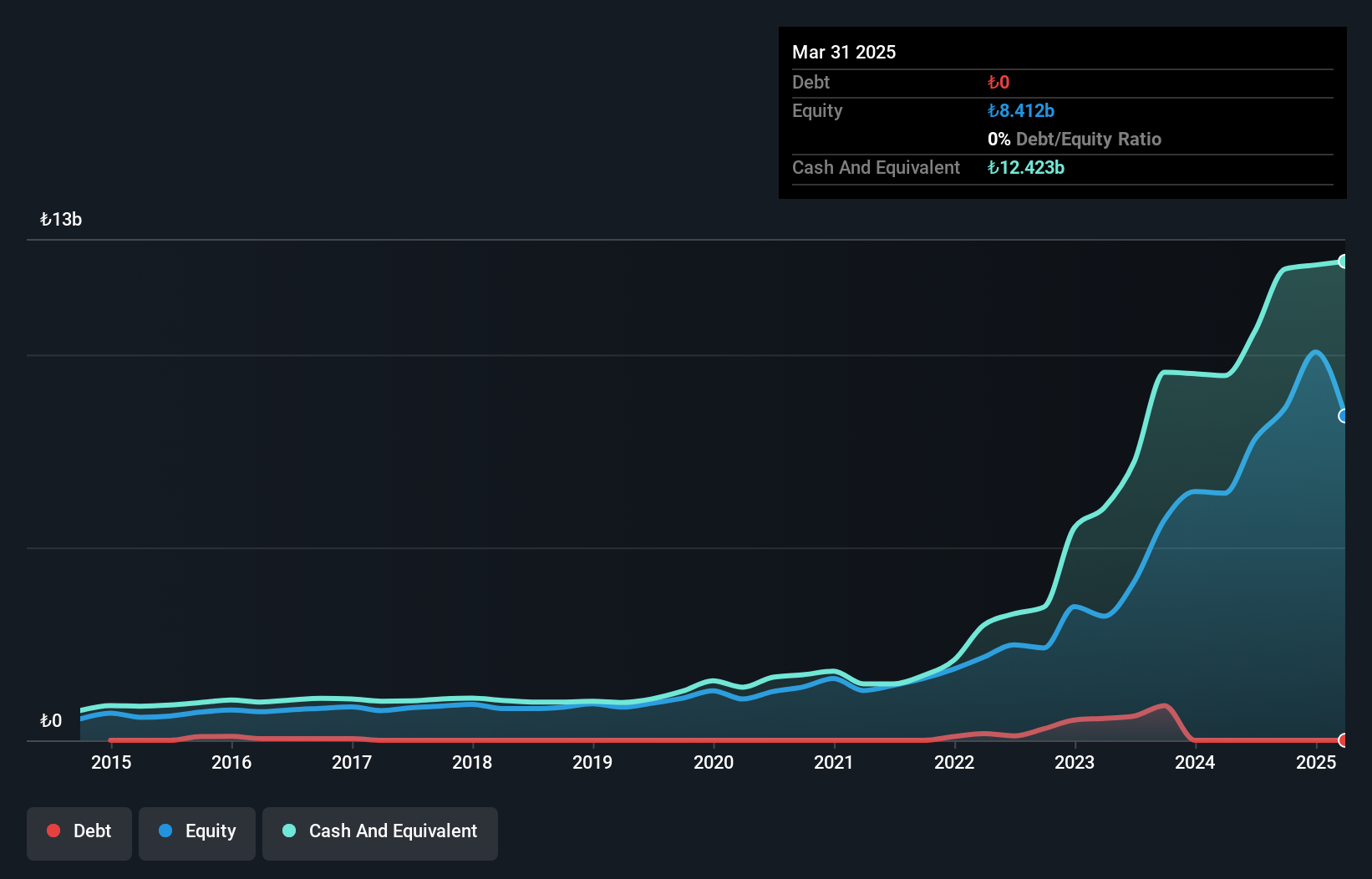

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey offering individual and group insurance, reinsurance services, and retirement plans with a market cap of TRY36.46 billion.

Operations: Anadolu Hayat Emeklilik generates revenue primarily from its life insurance segment, contributing TRY23.42 billion, and its retirement services, which add TRY6.85 billion. The non-life segment provides a smaller portion of revenue at TRY4.71 million.

Anadolu Hayat Emeklilik, a financial player in the Middle East, showcases notable growth with earnings increasing at an impressive 47.6% annually over the past five years. This debt-free company reported a net income of TRY 1,416.78 million for Q2 2025, up from TRY 1,221.76 million the previous year. Despite not outpacing industry growth last year (22.7% vs. industry's 40.7%), it maintains high-quality earnings and offers good value with a price-to-earnings ratio of just 7.9x compared to the market's 22.7x—suggesting potential for those seeking undervalued opportunities in this region's insurance sector.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

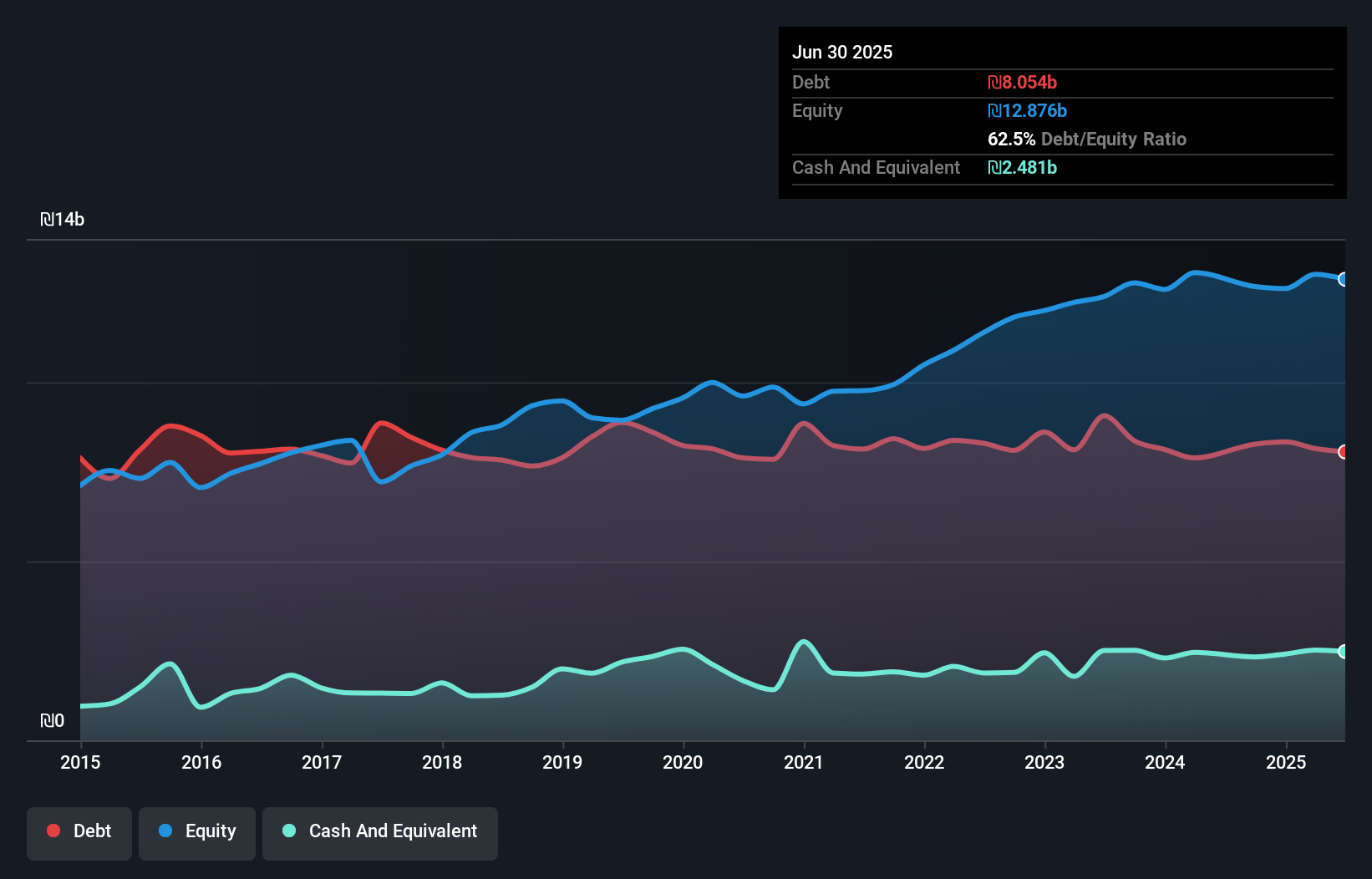

Overview: Equital Ltd. operates through its subsidiaries in the real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market cap of ₪5.32 billion.

Operations: Equital's revenue streams are primarily derived from its oil and gas operations in Israel and the USA, contributing ₪1.77 billion and ₪707.49 million respectively, along with property rental and management in Israel at ₪947.02 million. The construction of buildings for sale in Israel adds another ₪141.63 million to its revenue mix.

Equital stands out in the Middle East with its earnings growth of 5.4% over the past year, surpassing the Oil and Gas industry average of -1%. The company's debt to equity ratio has improved from 81.5% to 62.6% over five years, yet its net debt to equity remains high at 43.2%. Despite this, Equital's interest payments are well covered by EBIT at a multiple of 8.4x, indicating strong financial management. Recent earnings results showed revenue rising from ILS 836.97 million to ILS 930.68 million year-over-year, although net income decreased from ILS 196.54 million to ILS 129.41 million, reflecting some challenges ahead.

- Take a closer look at Equital's potential here in our health report.

Gain insights into Equital's historical performance by reviewing our past performance report.

Formula Systems (1985) (TASE:FORTY)

Simply Wall St Value Rating: ★★★★★★

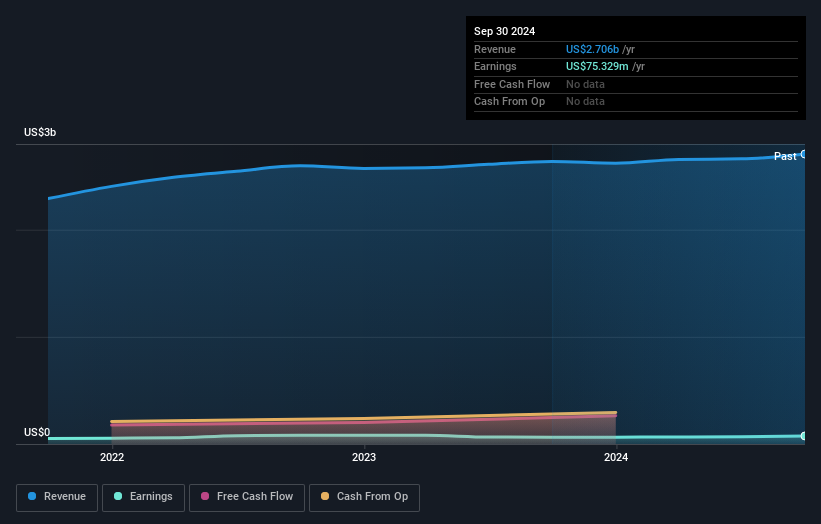

Overview: Formula Systems (1985) Ltd. operates through its subsidiaries to offer a range of IT services including software solutions, professional services, and computer infrastructure with a market cap of ₪6.60 billion.

Operations: Formula Systems (1985) Ltd. generates revenue through its subsidiaries by providing a mix of proprietary and non-proprietary software solutions, IT professional services, and computer infrastructure integration. The company's financial performance is reflected in its market capitalization of approximately ₪6.60 billion.

Formula Systems, a notable player in the IT sector, recently reported sales of $743 million for Q2 2025, up from $668 million the previous year. Despite this increase in revenue, net income fell to $15 million from $19 million. The company’s basic earnings per share dropped to $0.98 compared to last year's $1.23. With a net debt to equity ratio of 6.5%, its financial leverage is satisfactory and interest payments are well covered at 15 times EBIT. Trading significantly below estimated fair value by 43%, Formula Systems still offers potential value despite recent profit pressures and volatile share prices.

- Delve into the full analysis health report here for a deeper understanding of Formula Systems (1985).

Evaluate Formula Systems (1985)'s historical performance by accessing our past performance report.

Where To Now?

- Unlock our comprehensive list of 212 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FORTY

Formula Systems (1985)

Through its subsidiaries, provides proprietary and non-proprietary software solutions and information technologies (IT) professional services in Israel, the United States, Europe, Africa, Japan, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)