As global markets navigate the early days of President Trump's second term, optimism around potential trade deals and AI investments has driven major indices like the S&P 500 to new highs, although large-cap stocks have generally outperformed their smaller-cap counterparts. With manufacturing activity rebounding and consumer sentiment showing signs of dampening, investors are keenly observing how these dynamics might influence small-cap companies. In this environment, identifying promising stocks often involves looking for those with strong fundamentals and growth potential that can capitalize on emerging trends or navigate economic shifts effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 10.32% | 5.63% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Isracard (TASE:ISCD)

Simply Wall St Value Rating: ★★★★★☆

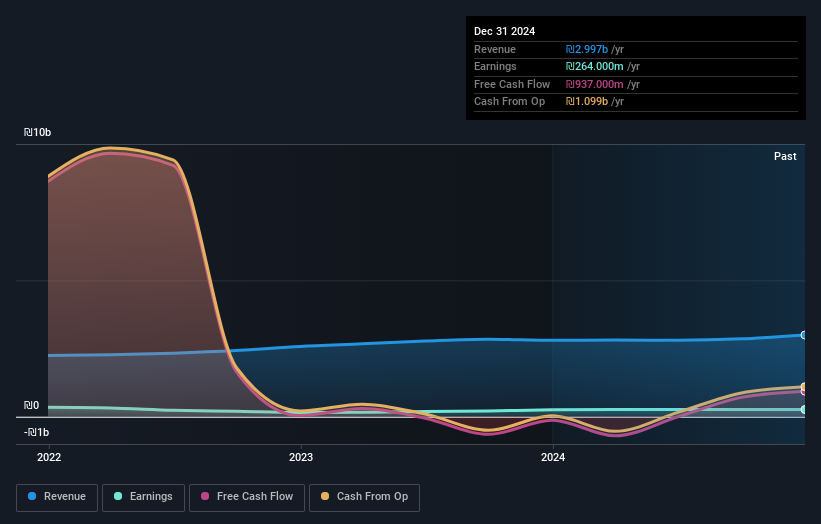

Overview: Isracard Ltd. operates as a credit card company in Israel with a market cap of ₪3.33 billion.

Operations: The company generates revenue primarily from private customers, contributing ₪2.36 billion, and business customers, adding ₪787 million.

Isracard, a notable player in the financial sector, has seen its earnings grow by 22% over the past year, outpacing the Consumer Finance industry’s 12.8%. The company's debt to equity ratio impressively decreased from 264% to 69.5% over five years, demonstrating effective debt management. With a price-to-earnings ratio of 12.7x below the IL market average of 14.5x, Isracard appears attractively valued. Recent developments include a proposed reverse merger with Bank of Jerusalem valuing Isracard between ILS 3.8 billion and ILS 4.2 billion, offering shareholders an improved share swap deal compared to earlier bids from competitors like Menora Mivtachim and Delek Group.

- Click here to discover the nuances of Isracard with our detailed analytical health report.

Understand Isracard's track record by examining our Past report.

Bank of Iwate (TSE:8345)

Simply Wall St Value Rating: ★★★★☆☆

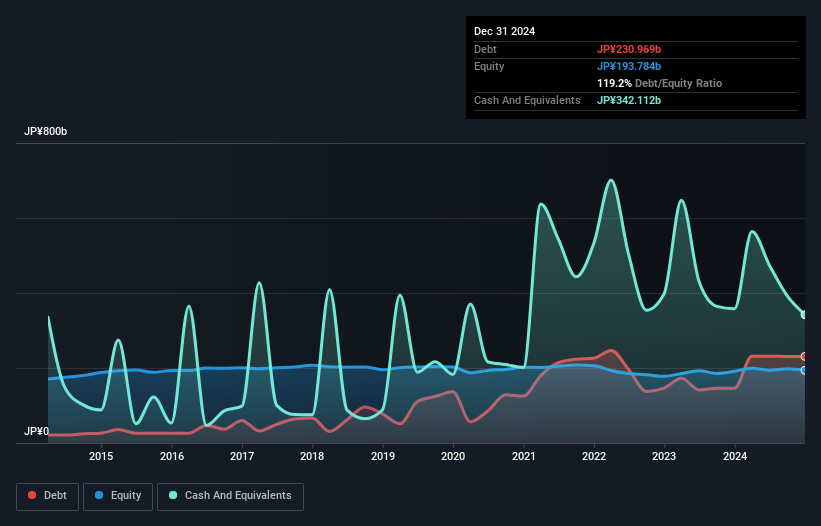

Overview: The Bank of Iwate, Ltd. provides a range of financial products and services in Japan, with a market cap of ¥52.35 billion.

Operations: The Bank of Iwate generates revenue primarily through its financial products and services in Japan. Operating within the financial sector, it focuses on optimizing its cost structure to enhance profitability. The company's market capitalization stands at ¥52.35 billion, reflecting its position in the Japanese banking industry.

Boasting total assets of ¥3,812.4 billion and equity of ¥193.8 billion, Iwate Bank stands out with its robust balance sheet. Its deposit base is strong at ¥3,363.6 billion, while loans total ¥2,173.5 billion with a net interest margin of 0.8%. However, the bank faces challenges with a high bad loan ratio at 2.6%, indicating potential risk areas despite earnings surging by 69% last year—far outpacing the industry average of 22%. With customer deposits making up 93% of its liabilities and trading below estimated fair value by about 29%, it presents an intriguing opportunity for investors seeking undervalued financial stocks in Japan's banking sector.

- Dive into the specifics of Bank of Iwate here with our thorough health report.

Assess Bank of Iwate's past performance with our detailed historical performance reports.

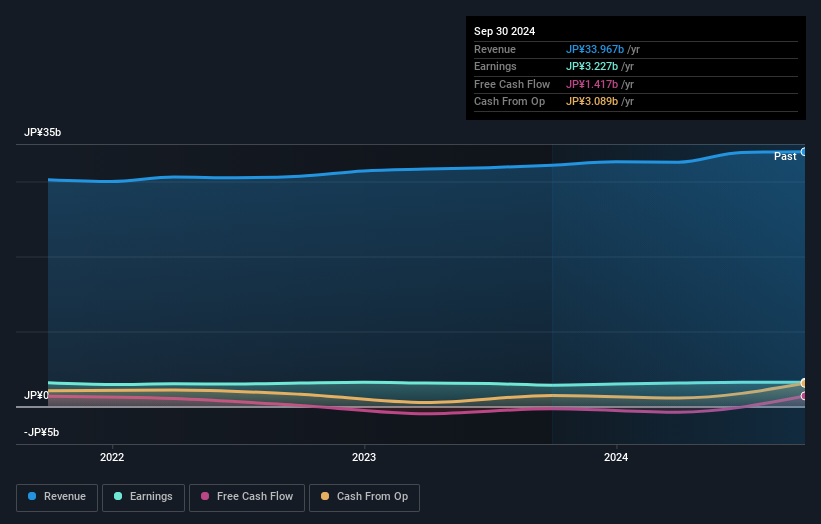

NAGAWA (TSE:9663)

Simply Wall St Value Rating: ★★★★★★

Overview: NAGAWA Co., Ltd. is engaged in planning, designing, manufacturing, and selling system and modular buildings as well as unit houses under the Super House brand in Japan, with a market capitalization of ¥103.06 billion.

Operations: The primary revenue stream for NAGAWA comes from its Unit House Business, generating ¥28.21 billion, followed by the Module System Construction Business at ¥4.73 billion and the Construction Machinery Rental Business at ¥1.02 billion. The company focuses on these segments to drive its financial performance.

Nagawa, a nimble player in its sector, showcases impressive financial health with no debt over the past five years and high-quality earnings. Its recent performance is notable, with earnings growth of 13.6% outpacing the Consumer Durables industry average of 0.6%. Trading at 40% below its estimated fair value suggests potential for investors seeking undervalued opportunities. The company is profitable, eliminating concerns about cash runway issues. Despite these strengths, careful consideration should be given to its ability to sustain this momentum in a competitive market environment where flexibility and strategic execution are key drivers for future success.

- Unlock comprehensive insights into our analysis of NAGAWA stock in this health report.

Evaluate NAGAWA's historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 4671 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bank of Iwate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8345

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion