- Israel

- /

- Capital Markets

- /

- TASE:FEAT

3 Middle Eastern Penny Stocks With Market Caps Up To US$60M

Reviewed by Simply Wall St

As excitement over a potential U.S. interest rate cut fades, most Gulf markets have eased, reflecting broader global declines. For investors seeking opportunities beyond the established giants, penny stocks—typically smaller or newer companies—remain an intriguing option despite their somewhat outdated label. These stocks can still offer surprising value and stability when backed by strong financial health, and in this article, we explore three Middle Eastern penny stocks that might hold long-term potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.89 | SAR2.2B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.74 | SAR1.5B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.57 | AED3.14B | ✅ 2 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY3.25 | TRY3.5B | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.74 | AED776.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.91 | AED12.37B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.855 | AED3.66B | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.907 | AED551.69M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.889 | ₪214.77M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

National Investor Pr. J.S.C (ADX:TNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The National Investor Pr. J.S.C. operates in the United Arab Emirates, offering private equity, real estate investment and consultancy, economic feasibility studies, commercial agencies, and hospitality services with a market capitalization of AED108.10 million.

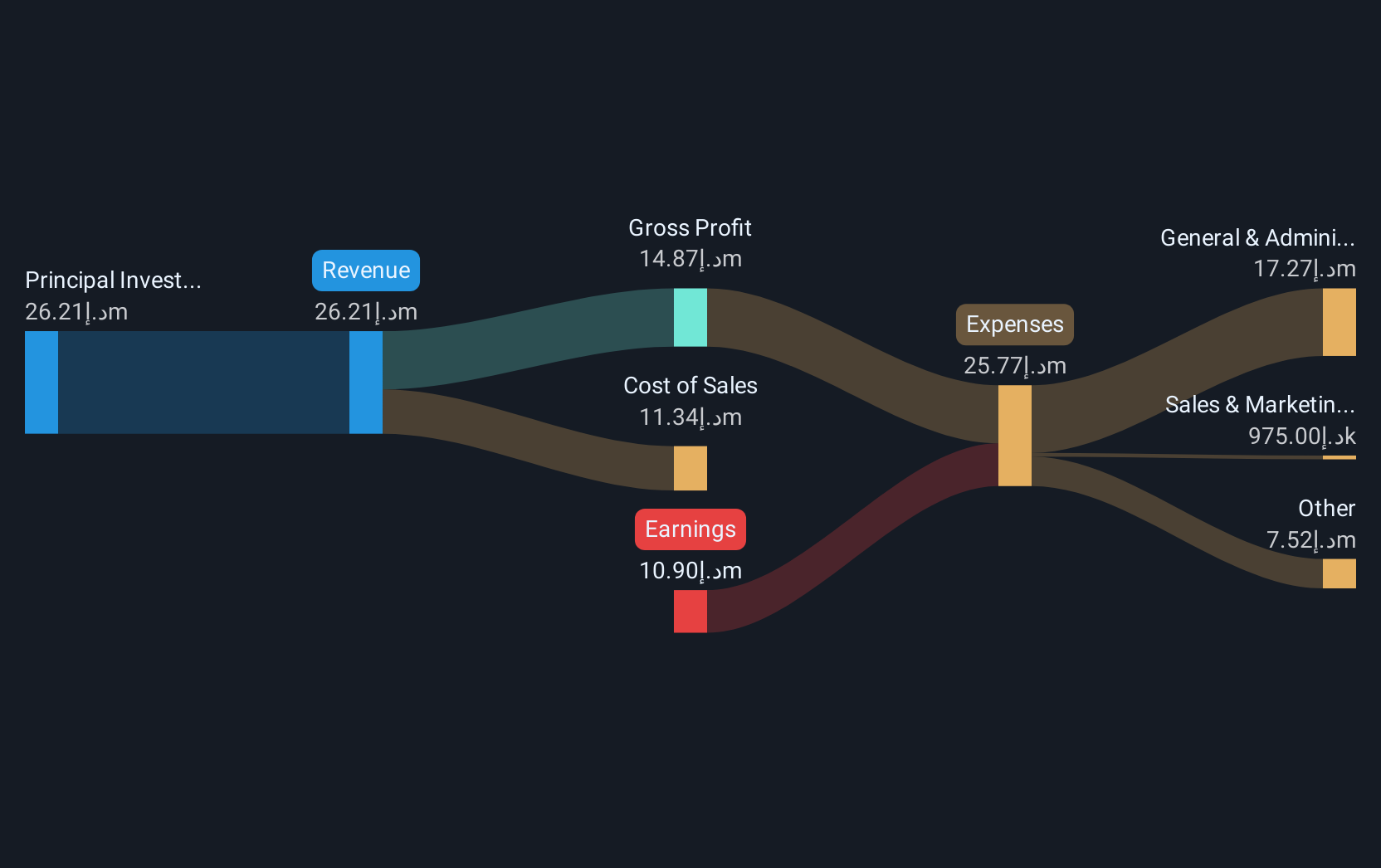

Operations: The company generates revenue primarily from its Principal Investments segment, amounting to AED31.79 million.

Market Cap: AED108.1M

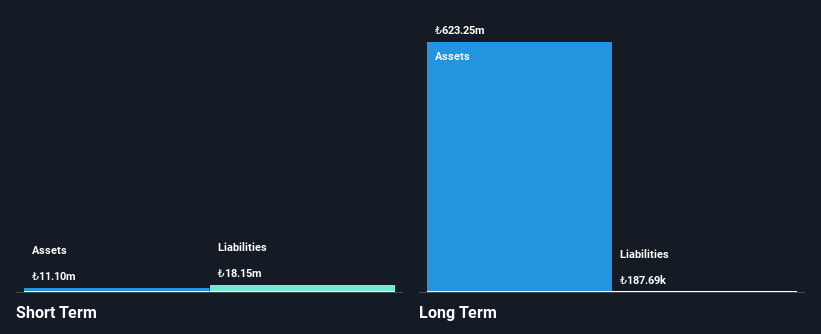

National Investor Pr. J.S.C., operating in the UAE, has shown significant revenue growth, reporting AED20.23 million for the first half of 2025, doubling from AED10.25 million a year prior. Despite being unprofitable historically, it achieved a net income of AED2.03 million this period compared to a loss last year. The company benefits from an experienced board with an average tenure of 6.3 years and maintains more cash than its total debt, ensuring financial stability with short-term assets covering both short and long-term liabilities comfortably while enjoying over three years of cash runway due to positive free cash flow growth.

- Click here to discover the nuances of National Investor Pr. J.S.C with our detailed analytical financial health report.

- Gain insights into National Investor Pr. J.S.C's historical outcomes by reviewing our past performance report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally, with a market cap of TRY2.42 billion.

Operations: The company generates revenue of TRY369.27 million from its operations in Turkey.

Market Cap: TRY2.42B

Escort Teknoloji Yatirim A.S., with a market cap of TRY2.42 billion, remains unprofitable but has successfully reduced its losses by 23.9% annually over the past five years. The company operates without debt, eliminating concerns about interest payments and showcasing financial prudence. However, its short-term assets of TRY26.3 million fall short of covering its short-term liabilities amounting to TRY60.2 million, indicating potential liquidity challenges. Despite these hurdles, the absence of shareholder dilution in the past year is a positive sign for investors considering this penny stock's potential in technology markets across Turkey and internationally.

- Get an in-depth perspective on Escort Teknoloji Yatirim's performance by reading our balance sheet health report here.

- Learn about Escort Teknoloji Yatirim's historical performance here.

Feat Fund Investments - Limited Partnership (TASE:FEAT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Feat Fund Investments - Limited Partnership focuses on investments in the food, environment, agriculture, and technology sectors with a market cap of ₪6.69 million.

Operations: Feat Fund Investments - Limited Partnership has not reported any specific revenue segments.

Market Cap: ₪6.69M

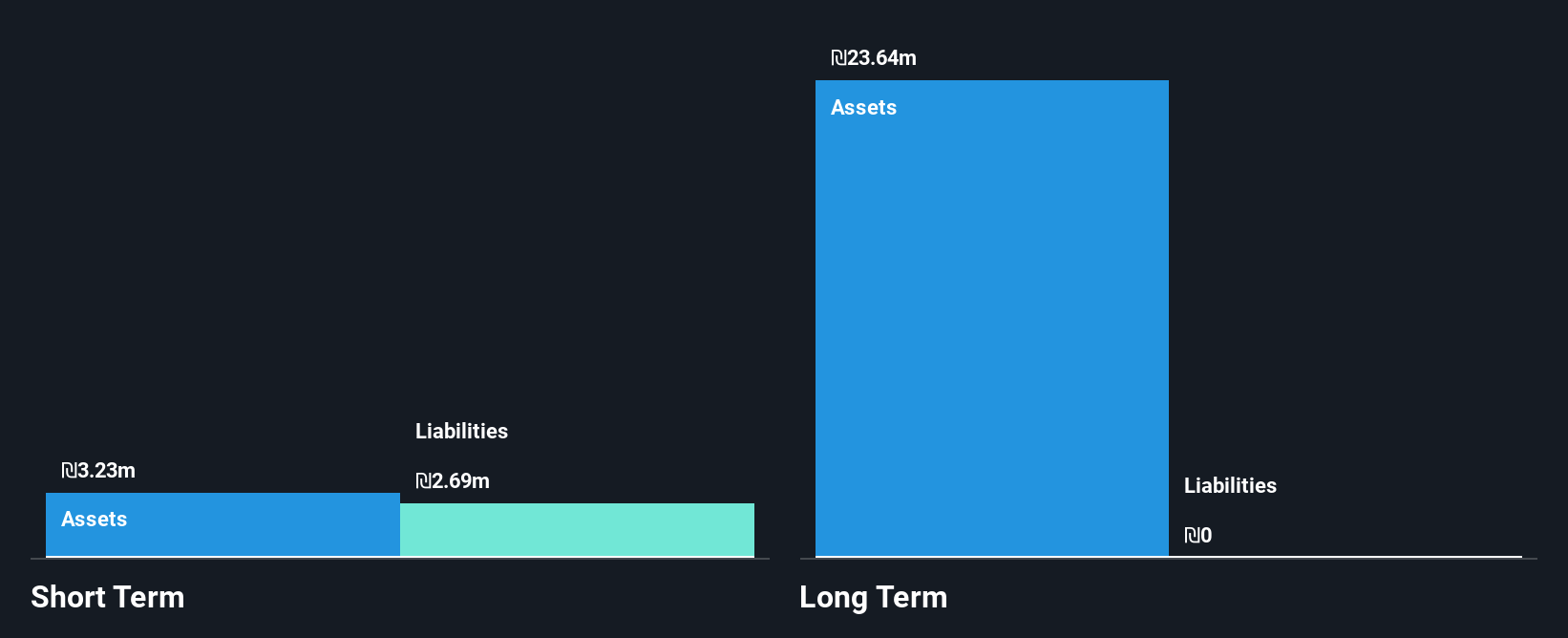

Feat Fund Investments - Limited Partnership, with a market cap of ₪6.69 million, operates in the food, environment, agriculture, and technology sectors but remains pre-revenue with less than US$1 million in earnings. The company is debt-free and has no long-term liabilities, providing financial stability despite its unprofitability and recent net loss of ₪2.37 million for the half year ended June 30, 2025. Short-term assets of ₪3.2 million exceed short-term liabilities of ₪2.7 million, ensuring liquidity for over a year based on current cash flow levels without significant shareholder dilution recently observed.

- Click here and access our complete financial health analysis report to understand the dynamics of Feat Fund Investments - Limited Partnership.

- Explore historical data to track Feat Fund Investments - Limited Partnership's performance over time in our past results report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 80 companies within our Middle Eastern Penny Stocks screener.

- Contemplating Other Strategies? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FEAT

Feat Fund Investments - Limited Partnership

Invests in food, environment, agriculture, and technology industries.

Flawless balance sheet with low risk.

Market Insights

Community Narratives