- Japan

- /

- Professional Services

- /

- TSE:6028

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new highs, driven by robust economic data and geopolitical developments, investors are increasingly looking for stable income sources amidst the fluctuating landscape. In this context, dividend stocks stand out as a compelling option due to their potential to provide consistent returns and hedge against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

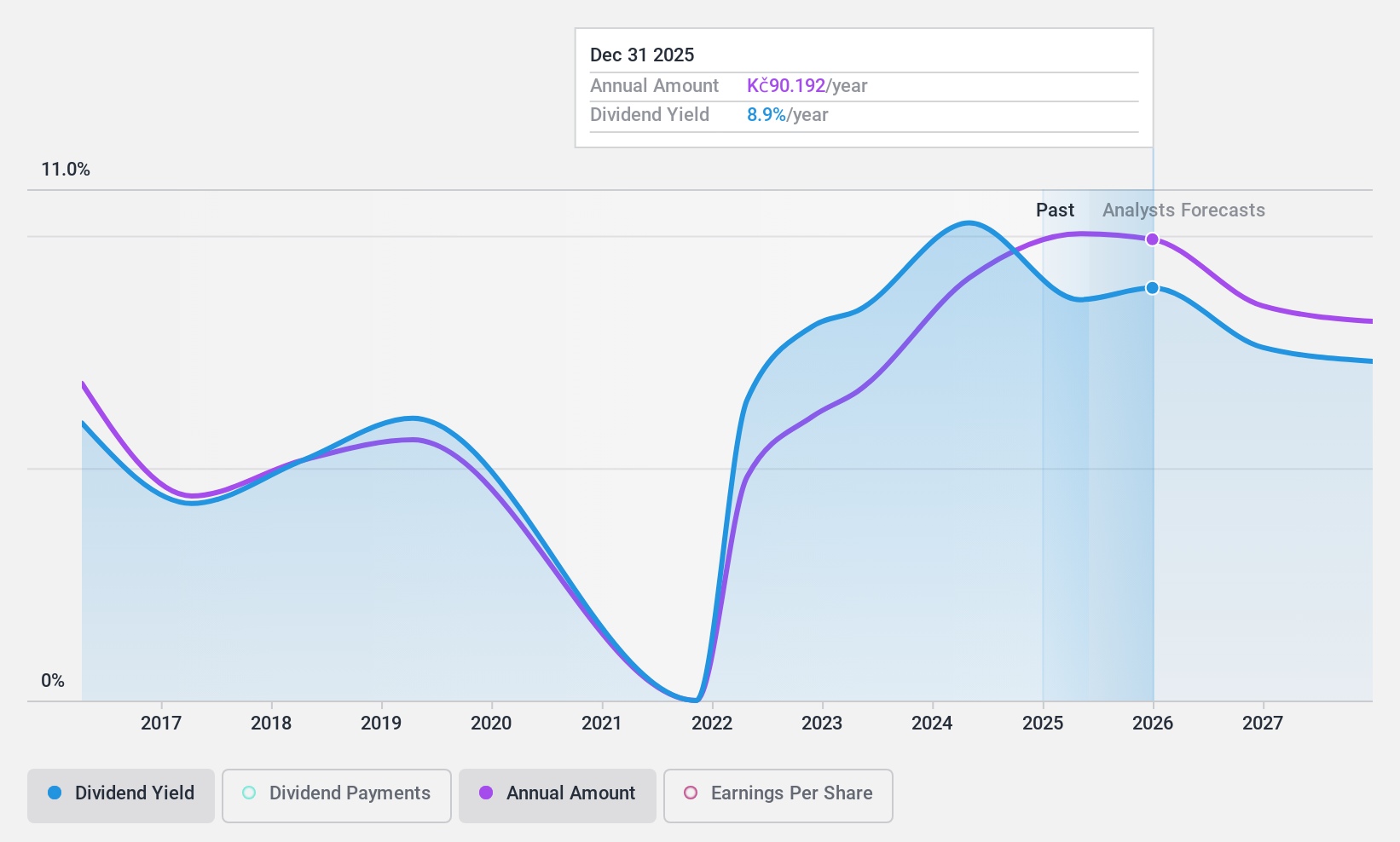

Komercní banka (SEP:KOMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Komercní banka, a.s., along with its subsidiaries, offers a range of retail, corporate, and investment banking services mainly in the Czech Republic and Central and Eastern Europe, with a market cap of CZK153.92 billion.

Operations: Komercní banka's revenue segments include retail banking, corporate banking, and investment banking services across the Czech Republic and Central and Eastern Europe.

Dividend Yield: 9.9%

Komercní banka's dividend yield is attractive, ranking in the top 25% of the Czech market. However, its dividends have been volatile and are not currently well covered by earnings, with a high payout ratio of 98.8%. Despite a history of unreliable payments over the past decade, future forecasts suggest improved coverage in three years with a 70% payout ratio. The bank trades at 32.1% below estimated fair value but has a low allowance for bad loans at 79%.

- Delve into the full analysis dividend report here for a deeper understanding of Komercní banka.

- The analysis detailed in our Komercní banka valuation report hints at an deflated share price compared to its estimated value.

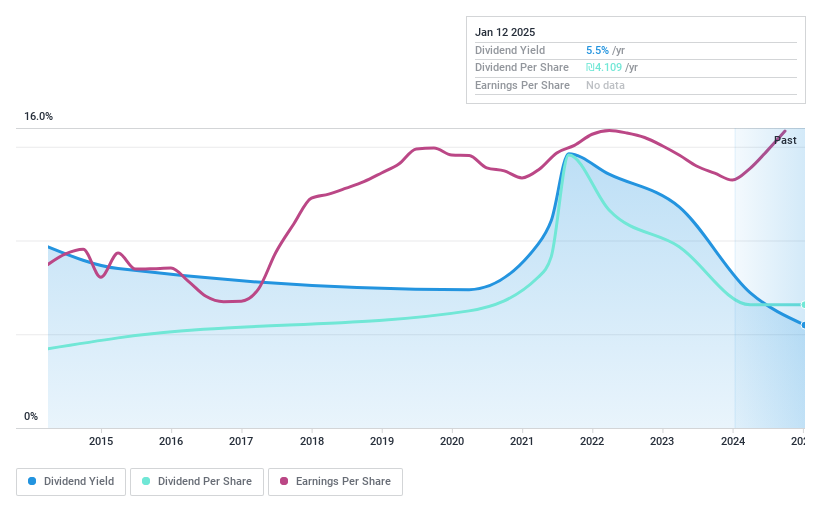

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atreyu Capital Markets Ltd provides investment management services both in Israel and internationally, with a market cap of ₪1.02 billion.

Operations: Atreyu Capital Markets Ltd generates revenue through its investment management services provided both domestically and abroad.

Dividend Yield: 5.9%

Atreyu Capital Markets offers a dividend yield of 5.9%, placing it among the top 25% in the IL market. Despite recent earnings growth, its dividends have been unreliable and volatile over the past decade, with coverage issues due to a high cash payout ratio of 104.5%. The company's dividends are not well supported by free cash flows, although it trades at a significant discount to estimated fair value. Recent earnings showed increased revenue and net income year-over-year.

- Dive into the specifics of Atreyu Capital Markets here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Atreyu Capital Markets is trading behind its estimated value.

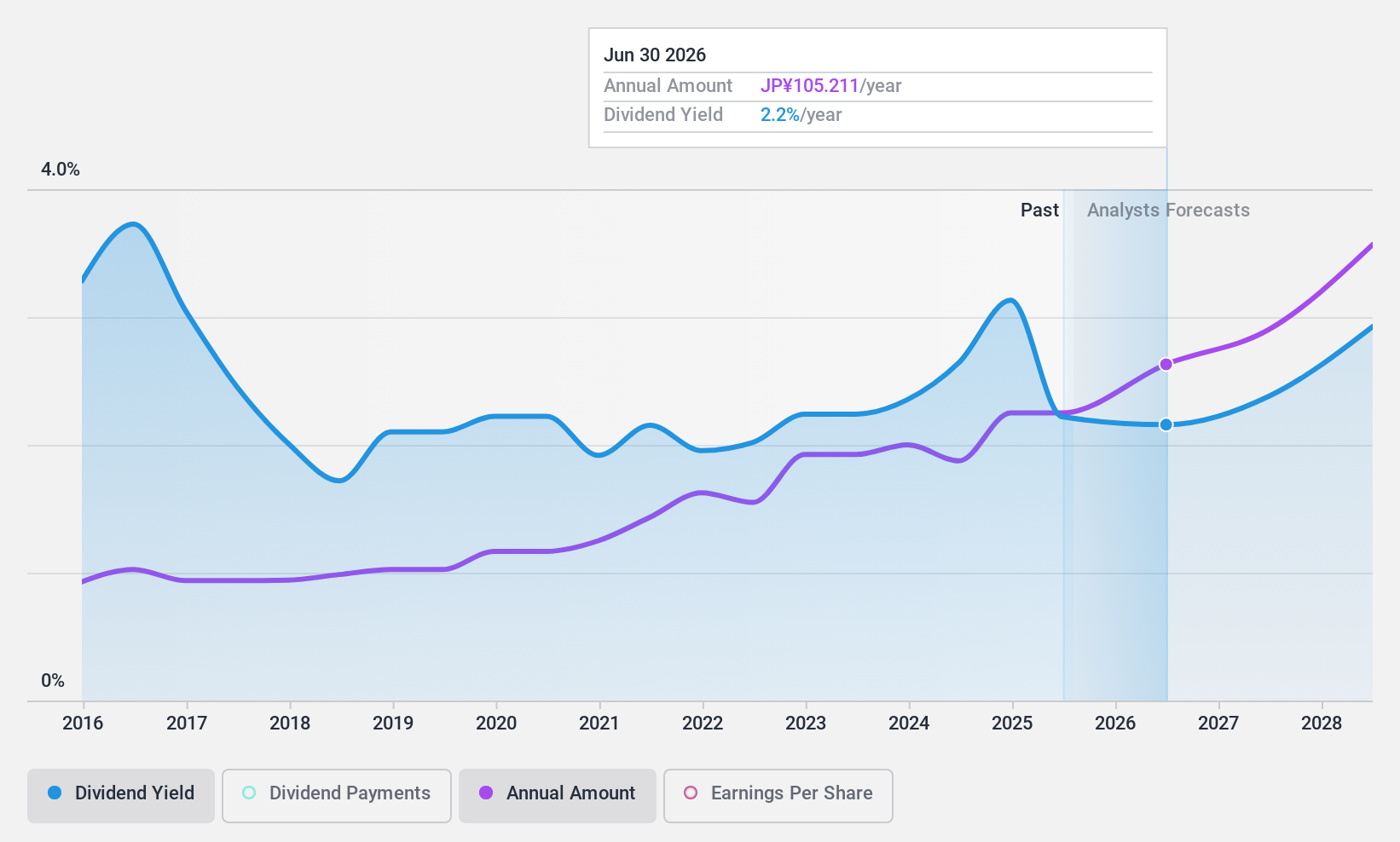

TechnoPro Holdings (TSE:6028)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TechnoPro Holdings, Inc. operates as a temporary staffing and contract work company in Japan and internationally, with a market cap of ¥290.53 billion.

Operations: TechnoPro Holdings, Inc.'s revenue segments include ¥17.32 billion from R&D Outsourcing Business, ¥23.86 billion from Construction Management Outsourcing, ¥25.62 million from Overseas Businesses, and ¥4.85 million from Domestic Other Business.

Dividend Yield: 3.2%

TechnoPro Holdings' dividend yield of 3.23% is below the top quartile in Japan, and its dividend history has been volatile over the past decade. However, dividends are well-covered by earnings (55.1% payout ratio) and cash flows (38.6% cash payout ratio). The company trades at a significant discount to its estimated fair value and has completed a share buyback worth ¥4.99 billion, which may signal management's confidence in future performance despite past dividend instability.

- Unlock comprehensive insights into our analysis of TechnoPro Holdings stock in this dividend report.

- Upon reviewing our latest valuation report, TechnoPro Holdings' share price might be too pessimistic.

Turning Ideas Into Actions

- Explore the 1968 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnoPro Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6028

TechnoPro Holdings

Through its subsidiaries, operates as a temporary staffing and contract work company in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.