- Saudi Arabia

- /

- Food

- /

- SASE:9559

Undiscovered Gems In Middle East To Watch This April 2025

Reviewed by Simply Wall St

As Gulf bourses remain largely unchanged amid the ongoing uncertainty of U.S.-China trade talks, investors in the Middle East are treading cautiously while awaiting further corporate earnings reports. In this environment, identifying promising stocks often involves looking for companies with solid fundamentals and growth potential that can weather global economic fluctuations and capitalize on regional opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Balady Poultry (SASE:9559)

Simply Wall St Value Rating: ★★★★★☆

Overview: Balady Poultry Company focuses on the production of poultry products in the Kingdom of Saudi Arabia, with a market capitalization of SAR1.85 billion.

Operations: Balady Poultry generates revenue primarily from its food processing segment, amounting to SAR895.05 million. The company's market capitalization stands at SAR1.85 billion.

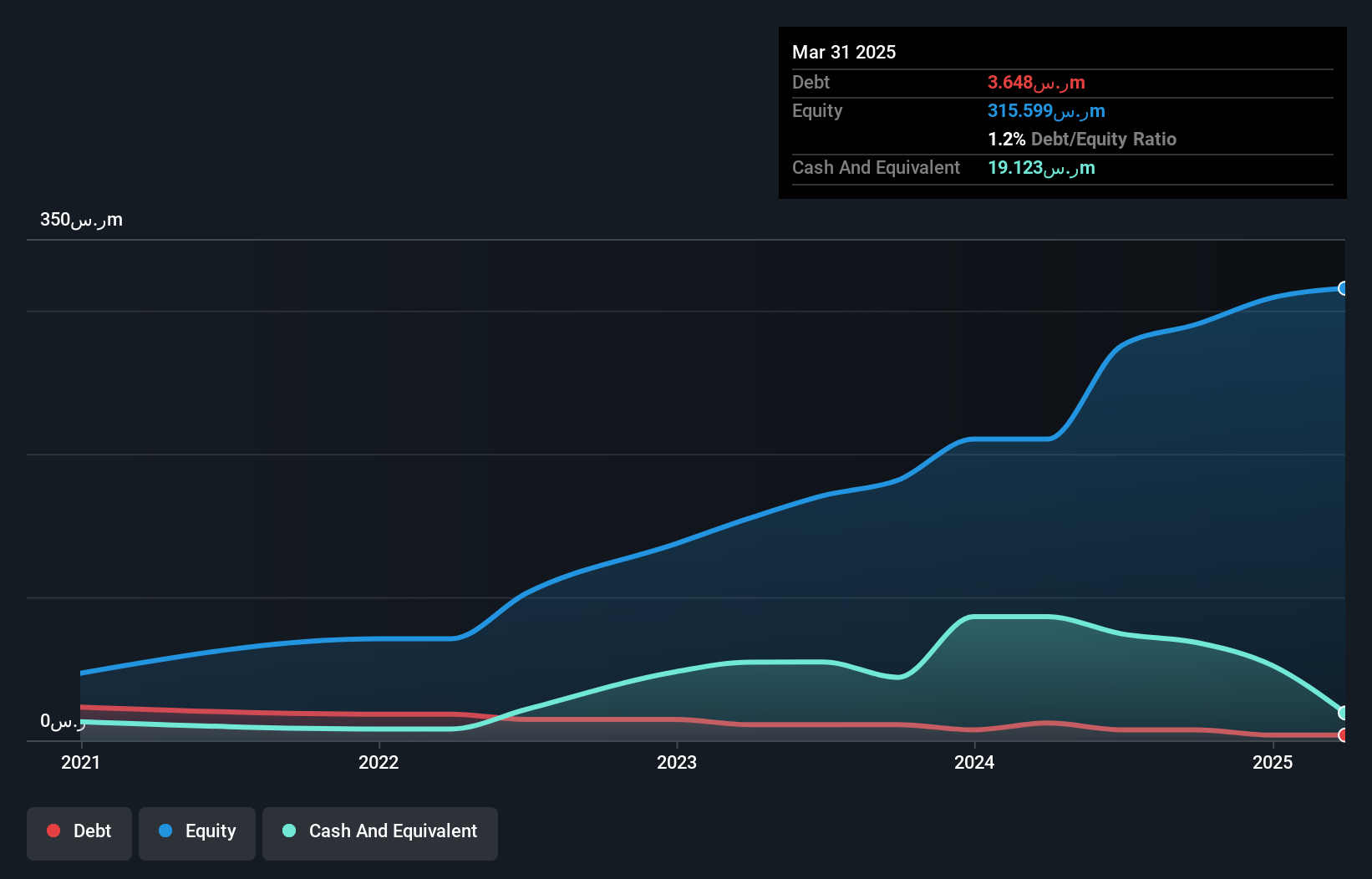

Balady Poultry, a small player in the Middle East market, showcases impressive figures with earnings growth of 64% over the past year, significantly outperforming the Food industry's 14.8%. Trading at 24% below its estimated fair value, it presents an attractive opportunity for potential investors. The company's financial health is robust; interest payments are well-covered by EBIT at a whopping 828 times coverage. Despite high volatility in share price recently, Balady's profitability and strong cash position relative to debt suggest resilience and potential for continued growth within its sector.

- Get an in-depth perspective on Balady Poultry's performance by reading our health report here.

Gain insights into Balady Poultry's past trends and performance with our Past report.

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market capitalization of ₪3.87 billion.

Operations: Rami Levi generates revenue primarily from its retail chains, contributing ₪6.55 billion, and Good Pharm Wholesale, adding ₪439.85 million.

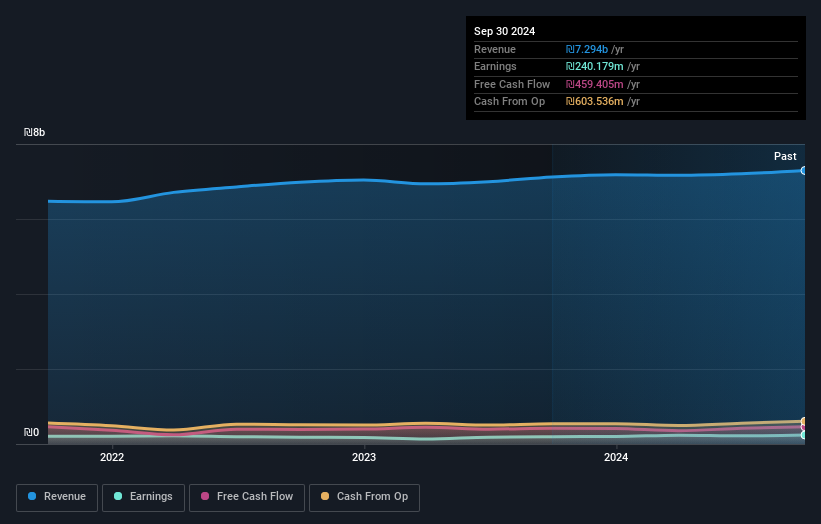

Trading at a notable discount to its estimated fair value, Rami Levi Chain Stores Hashikma Marketing 2006 stands out with high-quality earnings and a robust financial position. The company's debt to equity ratio has impressively decreased from 6% to 2.2% over five years, while its net income rose to ILS 241.17 million in the latest fiscal year from ILS 199.36 million previously. Although recent earnings growth of 21% lagged behind the industry average of 51%, RMLI's interest payments are comfortably covered by EBIT at an impressive multiple of 8.5 times, reflecting strong operational efficiency and financial health.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market cap of ₪920.80 million.

Operations: The company generates revenue primarily from operating payment systems for international debit cards. It has a market cap of ₪920.80 million, reflecting its significant presence in the financial services sector in Israel.

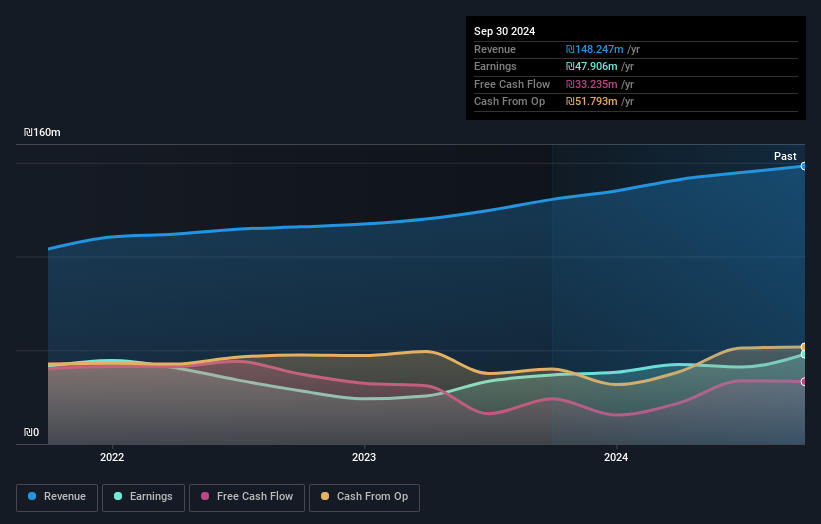

Automatic Bank Services, a nimble player in the financial sector, has demonstrated significant growth with earnings rising by 33% over the past year, outpacing the industry's 19.5%. The company boasts high-quality earnings and operates debt-free for five years, ensuring no concerns about interest coverage. Its levered free cash flow reached ILS 40.95 million as of April 2025. Recent announcements highlight a robust net income increase to ILS 50.91 million from ILS 38.22 million last year and a dividend of ILS 0.75 per share announced in March, reflecting solid shareholder returns amidst its promising trajectory in the market.

- Delve into the full analysis health report here for a deeper understanding of Automatic Bank Services.

Explore historical data to track Automatic Bank Services' performance over time in our Past section.

Where To Now?

- Dive into all 248 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Balady Poultry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Balady Poultry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9559

Balady Poultry

Engages in the production of poultry products in the Kingdom of Saudi Arabia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives