Assessing Delta Galil After Solid Five-Year Gain and This Month’s 3% Rally

Reviewed by Bailey Pemberton

Trying to figure out what to do with Delta Galil Industries stock? You are not alone. Investors have been watching recent price movements and asking themselves the same question, especially with the stock posting a solid 8.3% gain over the past year and an impressive 205.3% jump across five years. Yet, the run-up has not been in a straight line. Year-to-date, the share price is down 14%, even with a 3.4% rally in the last month and 1.4% gain over the past week. These ups and downs reflect shifting investor sentiment as the market weighs both growth potential and changing risks in the global textile and apparel space.

What stands out about Delta Galil Industries is how the numbers tell a mixed story, at least at first glance. On a basic valuation scorecard, the company checks the box for being undervalued in 2 out of 6 measures, for a total score of 2. Is that enough to make the stock a bargain or just mediocre? To get a clearer picture, it is worth diving into the individual valuation methods investors use. But as you will see, there may be a more insightful way to assess the stock's worth than just tallying up these checks.

Delta Galil Industries scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Delta Galil Industries Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method investors use to estimate a company's fair value. It works by projecting the future cash flows that the company is expected to generate and then discounting them back to today’s dollars, adjusting for the time value of money. This approach gives a data-driven estimate of what the business could be worth based on its ability to keep generating cash.

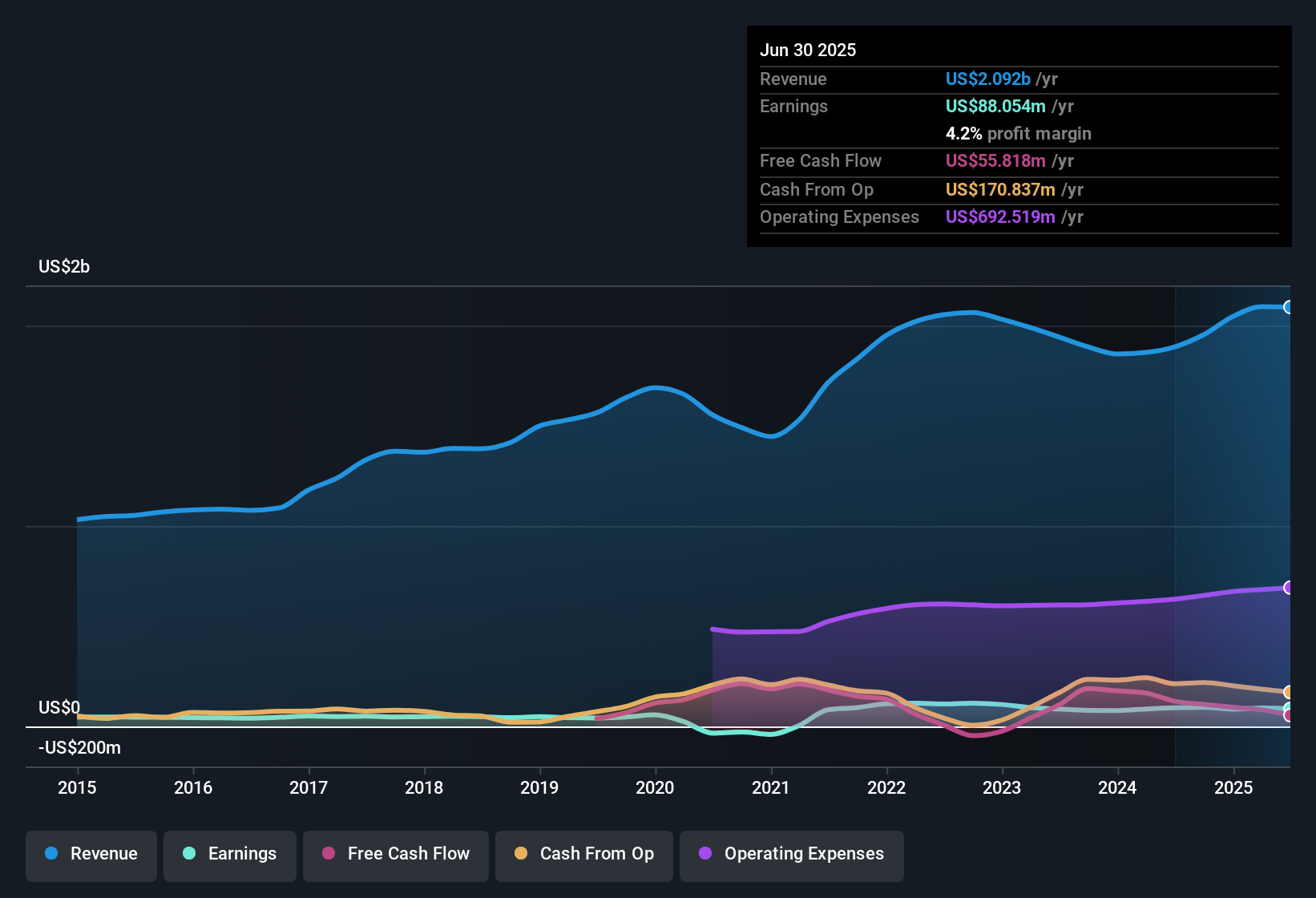

For Delta Galil Industries, the DCF model uses the latest trailing twelve months Free Cash Flow (FCF) figure of $78.0 million. Projections suggest a modest growth rate, with analysts estimating FCF to remain fairly stable over the next few years. While direct estimates are typically available for up to five years, Simply Wall St extrapolates further out and projects FCF to reach $93.9 million by 2035. All of these cash flow figures are in US dollars, regardless of the listing currency.

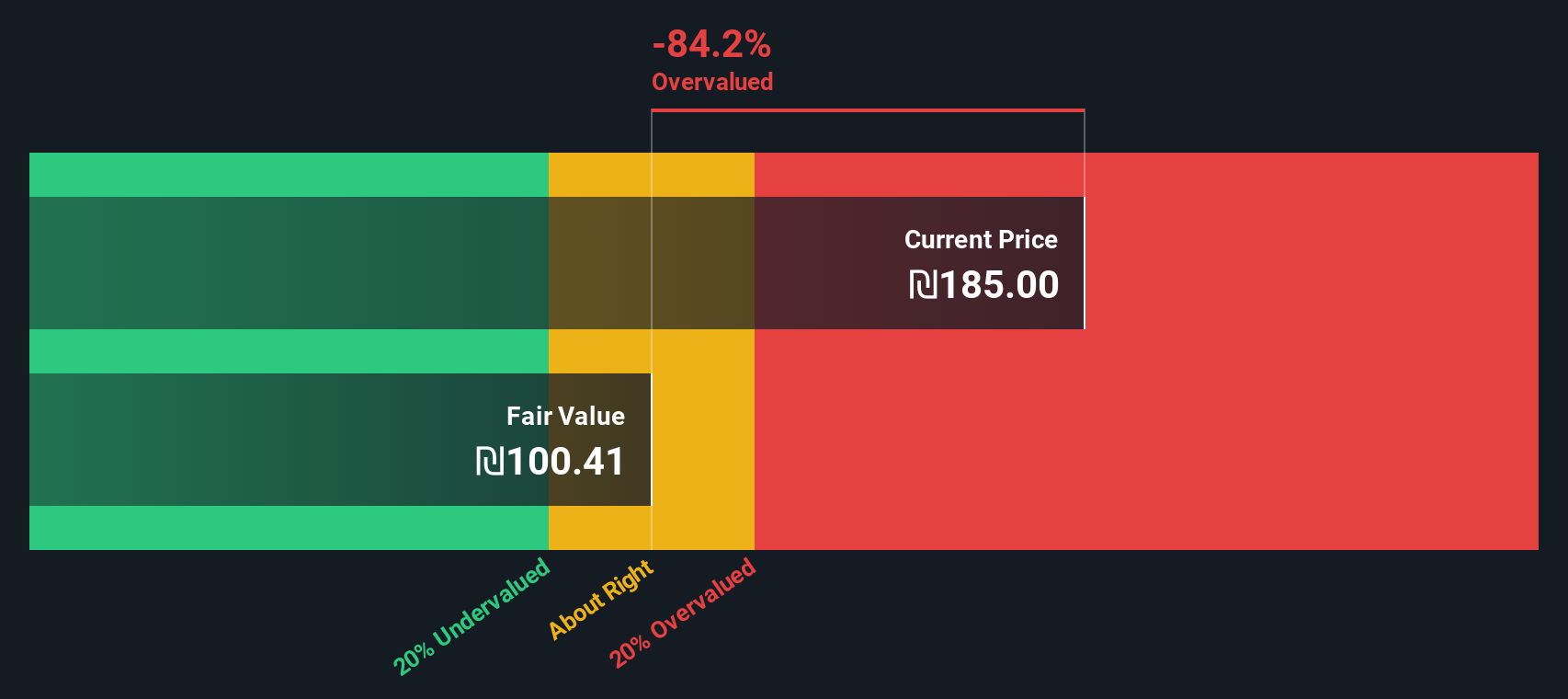

Bringing all future cash flows back to present value, the DCF analysis calculates Delta Galil Industries’ intrinsic value at $98.81 per share. Since this is 76.6% below the recent share price, the DCF result signals the stock is significantly overvalued at its current level.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delta Galil Industries may be overvalued by 76.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Delta Galil Industries Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored tool for valuing profitable companies, as it directly links a company's share price to its bottom-line earnings. This provides investors with a snapshot of how much the market is willing to pay for each dollar of profit, making it especially useful for businesses like Delta Galil Industries that report consistent profit.

However, it is important to remember that a "normal" or "fair" PE ratio is not set in stone. Investors typically award higher ratios to companies with stronger growth prospects and lower risk profiles. Conversely, firms facing challenges, slower growth, or industry headwinds will usually trade at lower PE multiples. This means valuation comparisons should always factor in those underlying business characteristics.

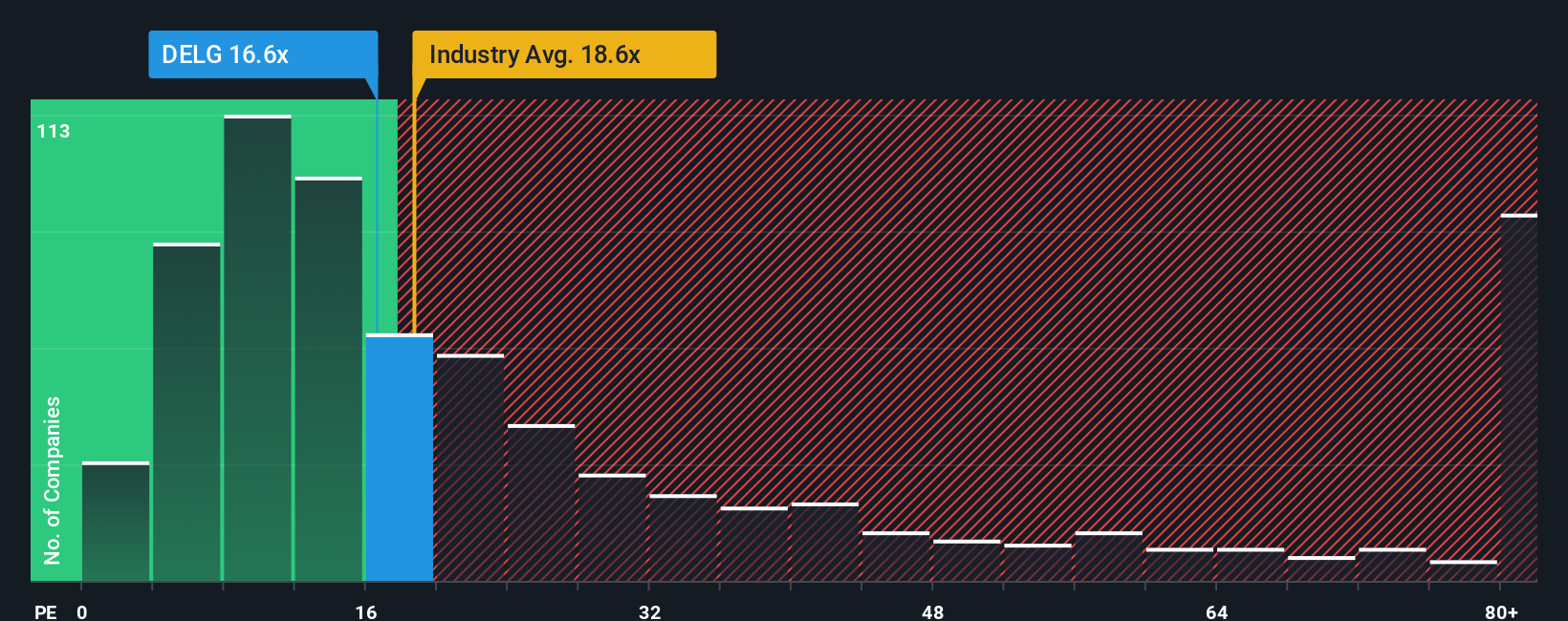

Currently, Delta Galil Industries has a PE ratio of 15.7x. This is below both the average for its luxury industry peers at 18.7x, and noticeably lower than the wider peer group, which averages 38.4x. While this seems to suggest the stock may be cheap on this basis, context matters.

That is where Simply Wall St’s “Fair Ratio” comes in. Rather than relying on basic industry or peer benchmarks, the Fair Ratio calculates what would be a reasonable PE multiple for Delta Galil Industries, factoring in its own unique mix of growth forecasts, risk profile, margins, market cap, and more. Because this approach accounts for the company’s individual qualities rather than broad averages, it gives a truer sense of value.

In this case, the Fair Ratio closely matches Delta Galil Industries’ current PE ratio, with the two ratios landing within 0.10 of each other. The stock’s valuation, based on earnings, appears to be about where it should be given the company’s underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delta Galil Industries Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company, connecting your perspective on its future with a unique financial forecast. This ties together your views on fair value, future revenue, earnings, and profit margins. Narratives let you map out this story using real numbers, linking company developments to financial outcomes and ultimately showing what you think the stock is truly worth.

Available as an easy-to-use tool on Simply Wall St’s Community page, trusted by millions of investors, Narratives offer a dynamic approach to decision making. By comparing your Fair Value to the current Price, you can clearly see if you believe Delta Galil Industries is a buy, sell, or hold. Plus, Narratives stay relevant as they automatically update when important news or earnings are released, offering a fresh perspective as conditions change.

For example, while one investor’s Narrative might forecast rapid growth and assign a high fair value, another may expect slower progress and a much lower fair value, allowing both viewpoints to coexist and evolve as new information emerges.

Do you think there's more to the story for Delta Galil Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DELG

Delta Galil Industries

Engages in the design, development, production, marketing, and sale of intimate and activewear products in Israel, the United States, Europe, Germany, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success