- Israel

- /

- Construction

- /

- TASE:ORON

We Think Shareholders Are Less Likely To Approve A Pay Rise For Oron Group Investments & Holdings Ltd's (TLV:ORON) CEO For Now

Key Insights

- Oron Group Investments & Holdings will host its Annual General Meeting on 20th of December

- CEO Yoel Azaria's total compensation includes salary of ₪1.03m

- The total compensation is similar to the average for the industry

- Oron Group Investments & Holdings' EPS declined by 1.7% over the past three years while total shareholder loss over the past three years was 15%

In the past three years, shareholders of Oron Group Investments & Holdings Ltd (TLV:ORON) have seen a loss on their investment. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 20th of December and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

Check out our latest analysis for Oron Group Investments & Holdings

How Does Total Compensation For Yoel Azaria Compare With Other Companies In The Industry?

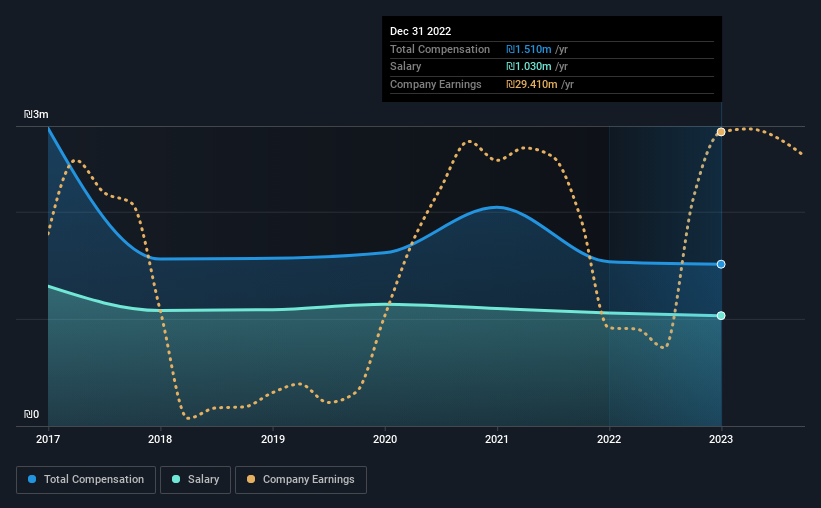

According to our data, Oron Group Investments & Holdings Ltd has a market capitalization of ₪335m, and paid its CEO total annual compensation worth ₪1.5m over the year to December 2022. That is, the compensation was roughly the same as last year. In particular, the salary of ₪1.03m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Israel Construction industry with market capitalizations below ₪740m, reported a median total CEO compensation of ₪1.8m. So it looks like Oron Group Investments & Holdings compensates Yoel Azaria in line with the median for the industry. What's more, Yoel Azaria holds ₪127m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₪1.0m | ₪1.1m | 68% |

| Other | ₪480k | ₪480k | 32% |

| Total Compensation | ₪1.5m | ₪1.5m | 100% |

On an industry level, roughly 63% of total compensation represents salary and 37% is other remuneration. Our data reveals that Oron Group Investments & Holdings allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Oron Group Investments & Holdings Ltd's Growth Numbers

Over the last three years, Oron Group Investments & Holdings Ltd has shrunk its earnings per share by 1.7% per year. Its revenue is up 41% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Oron Group Investments & Holdings Ltd Been A Good Investment?

With a three year total loss of 15% for the shareholders, Oron Group Investments & Holdings Ltd would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Oron Group Investments & Holdings you should be aware of, and 1 of them is potentially serious.

Switching gears from Oron Group Investments & Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ORON

Oron Group Investments & Holdings

Engages in the civil engineering, infrastructure, and construction businesses in Israel.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives