- Israel

- /

- Construction

- /

- TASE:LUZN

Investors Who Bought Amos Luzon Development and Energy Group (TLV:LUZN) Shares Five Years Ago Are Now Up 618%

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. For example, the Amos Luzon Development and Energy Group Ltd (TLV:LUZN) share price is up a whopping 618% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. On top of that, the share price is up 120% in about a quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Amos Luzon Development and Energy Group

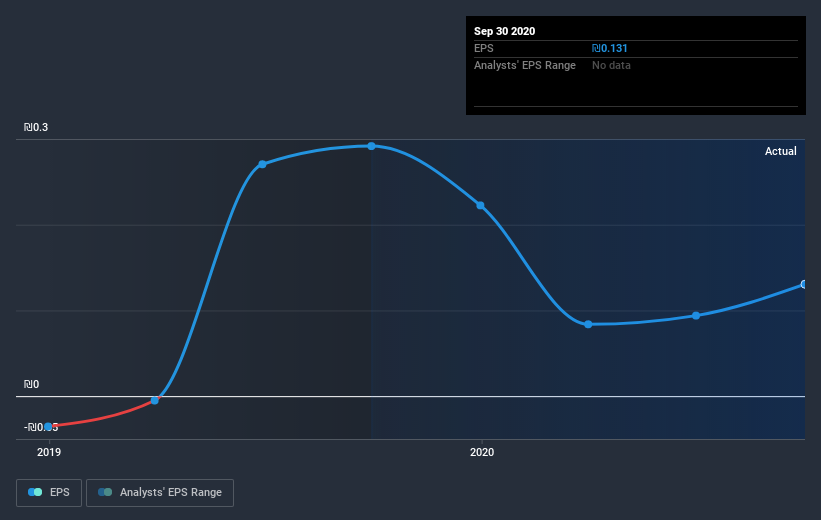

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Amos Luzon Development and Energy Group moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's nice to see that Amos Luzon Development and Energy Group shareholders have received a total shareholder return of 324% over the last year. That's better than the annualised return of 48% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Amos Luzon Development and Energy Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Amos Luzon Development and Energy Group (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Amos Luzon Development and Energy Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:LUZN

Amos Luzon Development and Energy Group

Engages in the real estate development and construction business in Israel and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives