The Trends At Hamat Group (TLV:HAMAT) That You Should Know About

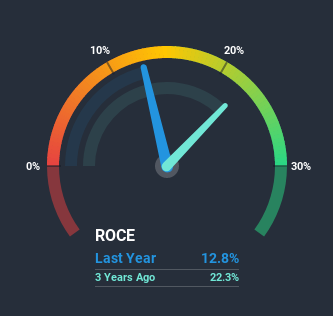

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at Hamat Group (TLV:HAMAT) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Hamat Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = ₪62m ÷ (₪920m - ₪438m) (Based on the trailing twelve months to September 2020).

Thus, Hamat Group has an ROCE of 13%. That's a pretty standard return and it's in line with the industry average of 13%.

See our latest analysis for Hamat Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Hamat Group's past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

On the surface, the trend of ROCE at Hamat Group doesn't inspire confidence. Over the last five years, returns on capital have decreased to 13% from 30% five years ago. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a side note, Hamat Group's current liabilities are still rather high at 48% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.The Key Takeaway

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Hamat Group. These trends are starting to be recognized by investors since the stock has delivered a 34% gain to shareholders who've held over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

Hamat Group does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those is significant...

While Hamat Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you decide to trade Hamat Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hamat Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:HAMAT

Hamat Group

Engages in the production, development, import, marketing, distribution, and sale of home design and construction finishing products for bathrooms, toilets, and kitchens in Israel and internationally.

Moderate risk with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026