- Israel

- /

- Aerospace & Defense

- /

- TASE:FBRT

Taaleem Holdings PJSC And 2 Other Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

As the Middle East market navigates the complexities of U.S. trade policies, with Saudi Arabia's bourse experiencing gains and Qatar remaining steady, investors are keenly observing how these dynamics influence regional equities. In this environment, identifying promising stocks involves looking for companies that can capitalize on local economic trends and demonstrate resilience amid global uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 25.31% | 6.39% | 13.45% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Meditera Tibbi Malzeme Sanayi ve Ticaret Anonim Sirketi | 2.10% | 33.53% | -19.97% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.68% | 12.49% | 49.63% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Aura Investments | 180.44% | 9.48% | 43.42% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC is engaged in providing and investing in education services within the United Arab Emirates, with a market capitalization of AED3.59 billion.

Operations: Taaleem Holdings PJSC generates revenue primarily from school operations, amounting to AED1.05 billion. The company’s financial performance is influenced by its operational costs and revenue streams within the education sector in the UAE.

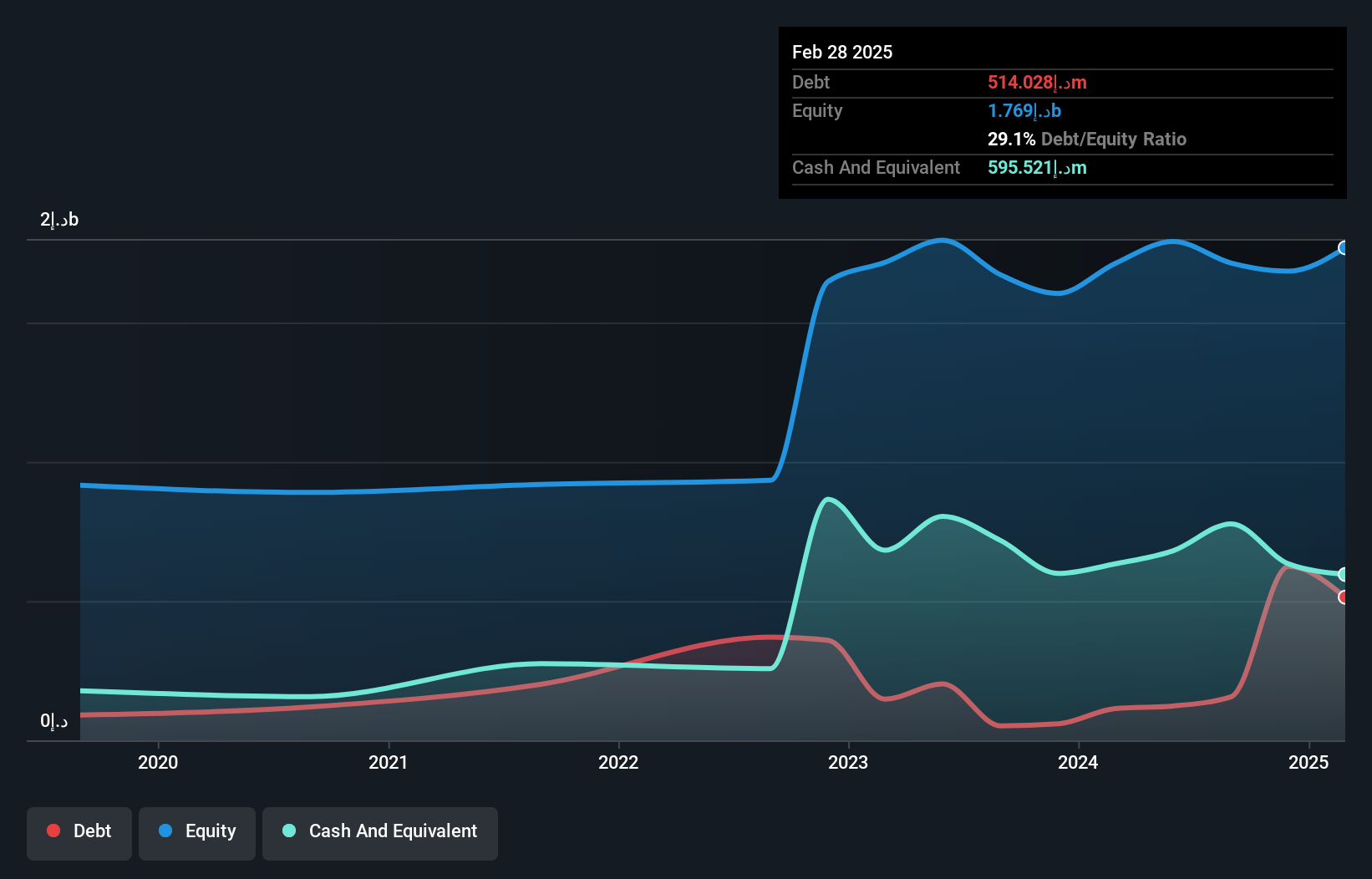

Taaleem Holdings PJSC, a dynamic player in the education sector, has shown robust earnings growth of 16.9% over the past year, outpacing the industry average of 8.3%. Despite an increased debt-to-equity ratio from 19.9% to 29.1% over five years, its financial health remains strong with cash exceeding total debt and EBIT covering interest payments by nearly fifty times. Recent earnings reports reveal a net income of AED 160 million for six months ending February 2025, up from AED 139 million previously. Trading slightly below fair value estimates and expanding into premium segments suggests potential growth amid challenges like margin pressures and negative free cash flow trends.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY44.50 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue primarily from its Motor Vehicles, Disease/Health, and Motor Vehicles Liability insurance segments, with respective revenues of TRY13.67 billion, TRY8.49 billion, and TRY8.69 billion. The company's financial performance is influenced by these key segments in the non-life insurance market in Turkey.

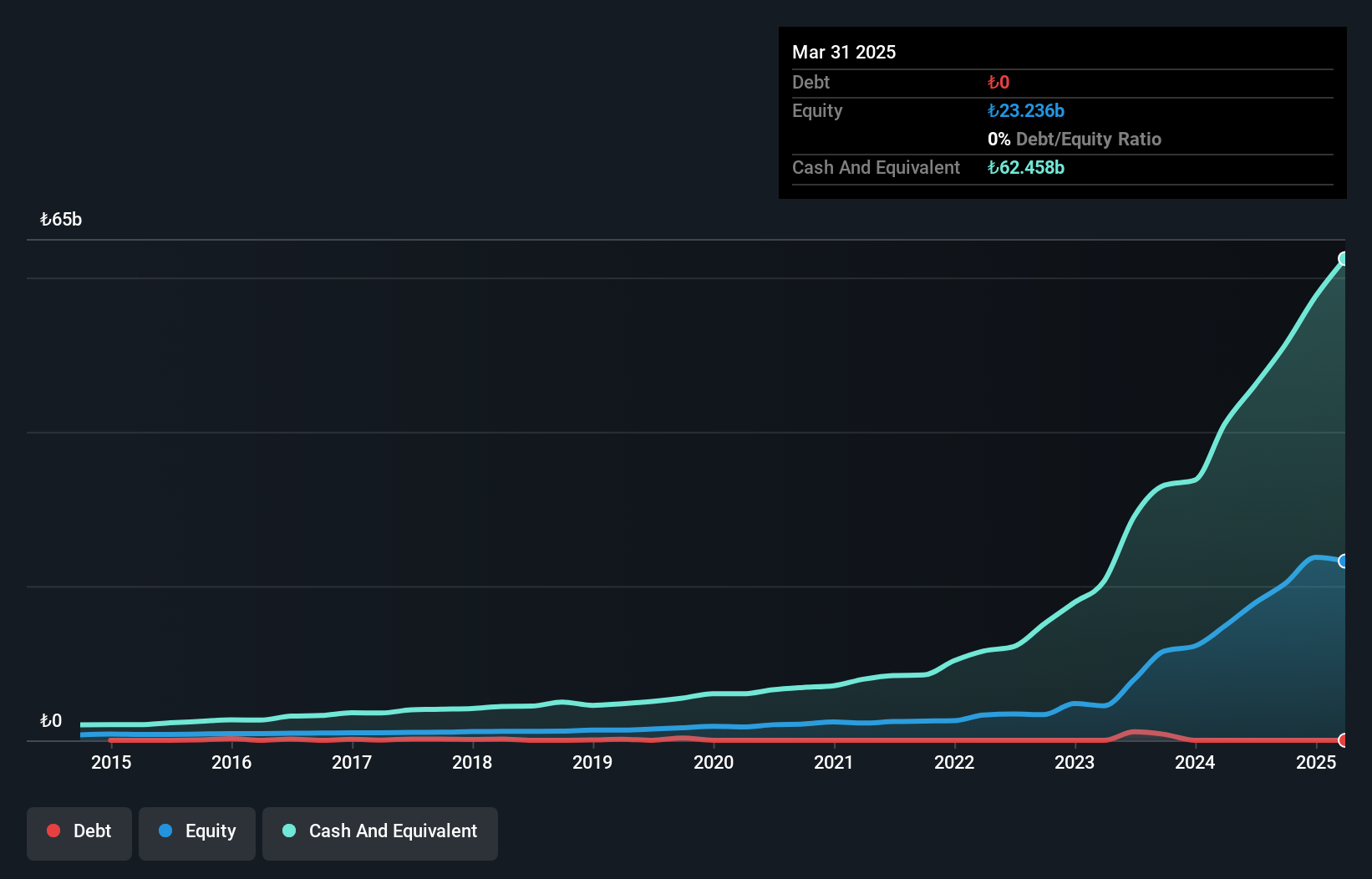

Anadolu Sigorta, a nimble player in the insurance sector, has demonstrated impressive financial health with no debt on its books. Its earnings have surged by 67% annually over five years, showcasing robust growth despite trailing the industry's 93% pace last year. The company reported a significant net income increase to TRY 11.54 billion from TRY 6.38 billion previously, reflecting solid profitability and high-quality earnings. With a P/E ratio of just 3.9x compared to the market's 17.5x, it presents an attractive valuation for investors seeking value in emerging markets like Turkey's insurance industry.

FMS Enterprises Migun (TASE:FBRT)

Simply Wall St Value Rating: ★★★★★★

Overview: FMS Enterprises Migun Ltd specializes in the manufacturing and sale of ballistic protection raw materials and products globally, with a market capitalization of ₪1.57 billion.

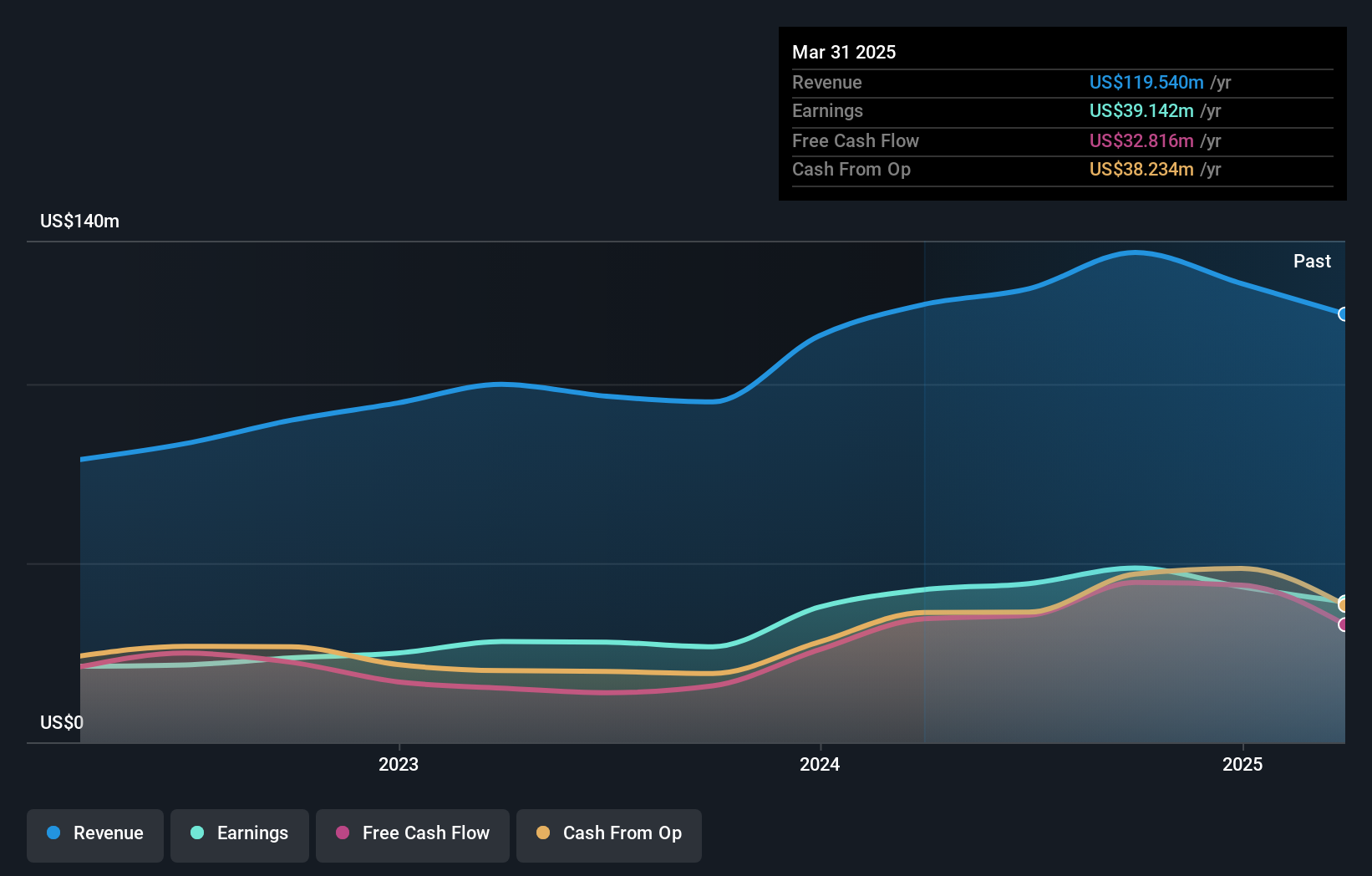

Operations: FMS Enterprises Migun Ltd generates revenue primarily from its Aerospace & Defense segment, which brought in $128.07 million. The company's financial performance is characterized by a focus on this key revenue stream.

FMS Enterprises Migun, a nimble player in the aerospace and defense sector, has shown solid performance with its earnings growing 17% annually over the past five years. The company reported sales of US$128.07 million for 2024, up from US$113.42 million the previous year, while net income rose to US$43.38 million from US$37.71 million. Basic earnings per share increased to US$4.7 compared to last year's US$4.1, suggesting robust operational efficiency despite not outpacing industry growth rates of 49%. This promising trajectory reflects FMS's ability to navigate competitive landscapes effectively while maintaining high-quality earnings standards.

- Get an in-depth perspective on FMS Enterprises Migun's performance by reading our health report here.

Evaluate FMS Enterprises Migun's historical performance by accessing our past performance report.

Key Takeaways

- Unlock our comprehensive list of 245 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FBRT

FMS Enterprises Migun

Manufactures and sells ballistic protection raw materials and products worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)