Last Update 12 Dec 25

TAALEEM: Rising Dividend Payout Will Support Continued Share Price Upside

Analysts have modestly reaffirmed their view on Taaleem Holdings PJSC, keeping the AED 6.25 price target broadly unchanged, as slightly higher discount rate assumptions are offset by stable growth and margin expectations.

What's in the News

- Board meeting scheduled for November 28, 2025, to elect the Chairman and Vice Chairman, appoint board committees, and confirm the Board Secretary, signaling a refresh of key governance roles (company announcement)

- Additional board meeting set for November 26, 2025, indicating an active board calendar around year end (company announcement)

- Annual dividend increased to AED 0.1500 per share, with ex date on December 05, 2025, and record date on December 08, 2025, enhancing shareholder returns (company announcement)

- Board meeting on October 09, 2025, to approve audited financial statements for the year ended August 31, 2025, and set the agenda and timing for the annual general assembly, including opening nominations for board membership (company announcement)

Valuation Changes

- Fair Value Estimate: unchanged at AED 6.25 per share, indicating no revision to the overall intrinsic value assessment.

- Discount Rate: risen slightly from 19.97 percent to about 20.02 percent, reflecting a marginally higher required return.

- Revenue Growth: effectively unchanged at around 17.64 percent, suggesting stable expectations for top line expansion.

- Net Profit Margin: essentially flat at roughly 10.53 percent, indicating consistent profitability assumptions.

- Future P/E: edged up slightly from about 55.63x to 55.70x, signaling a marginal increase in the valuation multiple applied to future earnings.

Key Takeaways

- Expanding student capacity and premium market focus are expected to drive revenue growth and enhance profitability.

- Strategic funding through debt and IPO proceeds supports growth while maintaining a strong balance sheet and stable net debt levels.

- Expansion efforts and financial strategies, such as increased debt for acquisitions, expose the company to risks of lower revenue, net margins, and liquidity challenges.

Catalysts

About Taaleem Holdings PJSC- Provides and invests in education services in the United Arab Emirates.

- The acquisition of Lycée Libanais Francophone Privé and the expansion of Dubai British School Emirates Hills are expected to significantly increase enrollment and revenue growth over the coming years.

- The expansion in student capacity by around 10,000 seats between 2024 and 2026, through both mergers & acquisitions and greenfield projects, is likely to drive up future revenue.

- The ramp-up of newly opened schools, such as Dubai British School Jumeira and the Lycée Libanais, is expected to improve utilization rates and margins over time, enhancing future profitability.

- Taaleem’s focus on premium and super premium segments, characterized by resilient fee structures and high growth potential, is anticipated to support sustained revenue growth and margin expansion.

- The strategic use of debt and IPO proceeds to fund expansions and acquisitions while maintaining a strong balance sheet is expected to support growth in earnings without significantly impacting net debt levels.

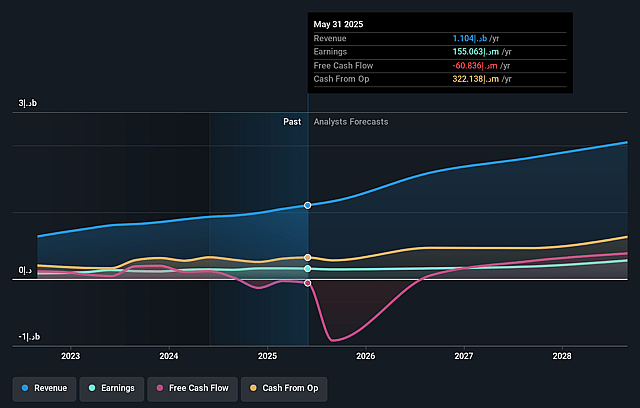

Taaleem Holdings PJSC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Taaleem Holdings PJSC's revenue will grow by 21.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.0% today to 12.9% in 3 years time.

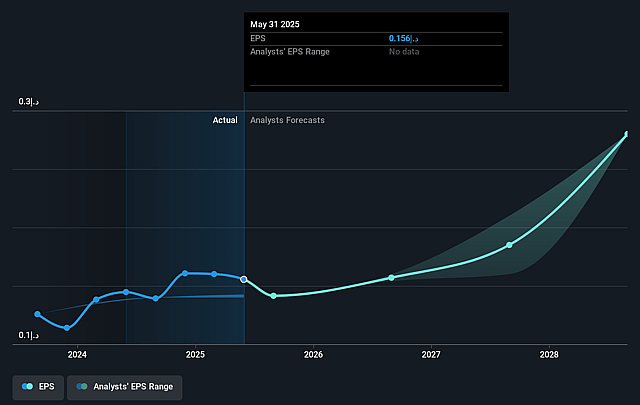

- Analysts expect earnings to reach AED 253.0 million (and earnings per share of AED 0.26) by about September 2028, up from AED 155.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.8x on those 2028 earnings, up from 30.0x today. This future PE is greater than the current PE for the AE Consumer Services industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.61%, as per the Simply Wall St company report.

Taaleem Holdings PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a noted decline in premium utilization due to the addition of significant new capacity without a corresponding immediate increase in enrollment, which could lead to lower revenue and net margins.

- The company is experiencing increased operating costs, particularly in staffing and utilities, attributed to its expansion, which can affect net margins and overall profitability.

- There is a negative free cash flow in Q1, suggestive of the company's cash flow seasonality and potential liquidity issues impacting the balance sheet, especially with the simultaneous execution of multiple capital-intensive projects.

- The increased debt burden used to finance acquisitions and growth might strain the company’s financial health, potentially affecting earnings if interest rates fluctuate unfavorably or if anticipated returns don't materialize.

- Dependence on external factors like regulatory changes in the academic year start and its impact on revenue recognition underscores risks in achieving earnings predictability and consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED5.95 for Taaleem Holdings PJSC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED6.5, and the most bearish reporting a price target of just AED5.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED2.0 billion, earnings will come to AED253.0 million, and it would be trading on a PE ratio of 40.8x, assuming you use a discount rate of 19.6%.

- Given the current share price of AED4.65, the analyst price target of AED5.95 is 21.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Taaleem Holdings PJSC?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.