- Israel

- /

- Aerospace & Defense

- /

- TASE:FBRT

3 Middle Eastern Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

As Gulf stocks face downward pressure due to falling oil prices and global market uncertainties, investors in the Middle East are closely monitoring dividend stocks for stable income streams. In this challenging environment, selecting dividend stocks with solid fundamentals and attractive yields can provide a buffer against market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.64% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.14% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.21% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.78% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.47% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.94% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.31% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.09% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.75% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fourth Milling (SASE:2286)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, producing flour, feed, bran, and wheat derivatives with a market cap of SAR1.95 billion.

Operations: Fourth Milling Company's revenue is primarily derived from its Food Processing segment, totaling SAR646.51 million.

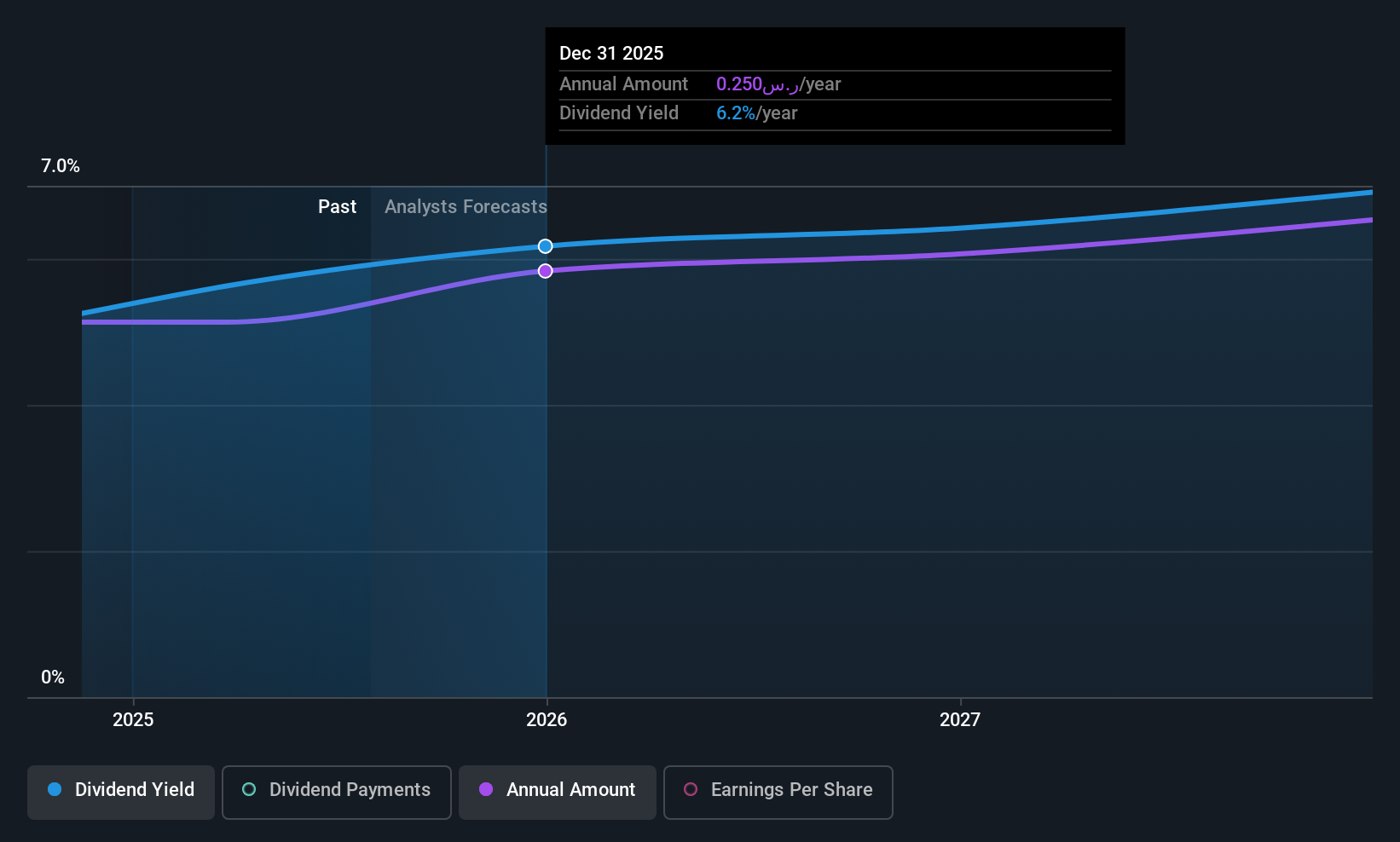

Dividend Yield: 6.1%

Fourth Milling's recent earnings report shows a solid performance with a 10.4% increase in net income over the past year, indicating robust financial health. The company is trading at 37.6% below its estimated fair value, suggesting potential undervaluation. Its dividends are covered by both earnings and cash flows, with payout ratios of 65.6% and 72.7%, respectively, placing it among the top dividend payers in Saudi Arabia with a yield of 6.09%.

- Take a closer look at Fourth Milling's potential here in our dividend report.

- Our expertly prepared valuation report Fourth Milling implies its share price may be lower than expected.

Saudi Telecom (SASE:7010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Telecom Company, along with its subsidiaries, offers telecommunications, information, media, and digital payment services both within Saudi Arabia and internationally, with a market cap of SAR211.77 billion.

Operations: Saudi Telecom Company's revenue segments include SAR50.77 billion from Saudi Telecom Company, SAR14.71 billion from Saudi Telecom Channels Company, SAR12.55 billion from Arabian Internet and Communications Services Company (Solutions), SAR4.19 billion from Kuwait Telecommunications Company (Stc Kuwait), SAR1.99 billion from STC Bahrain BSC (C) (Stc Bahrain), SAR1.98 billion from Digital Centers for Data and Telecommunications (Center3), SAR1.37 billion from STC Bank, with additional contributions of SAR0.85 billion from Advanced Technology and Cybersecurity Company (Sirar), SAR0.36 billion from Public Telecommunications Company (Specialized), and smaller amounts such as SAR0.30 billion from IoT and others like General Cloud Computing Company for Information Technology at SAR0.23 billion.

Dividend Yield: 9.9%

Saudi Telecom's dividend yield stands at 9.9%, placing it in the top 25% of Saudi Arabia's market, but its sustainability is questionable due to high payout ratios—92.4% from earnings and a cash payout ratio of 241.9%. Despite this, dividends have been stable over the past decade. Recent earnings showed a decline in net income to SAR 4.11 billion for Q3 2025, though sales increased slightly year-over-year to SAR 19.26 billion.

- Dive into the specifics of Saudi Telecom here with our thorough dividend report.

- The analysis detailed in our Saudi Telecom valuation report hints at an inflated share price compared to its estimated value.

FMS Enterprises Migun (TASE:FBRT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FMS Enterprises Migun Ltd, with a market cap of ₪1.91 billion, manufactures and sells ballistic protection raw materials and products globally.

Operations: FMS Enterprises Migun Ltd generates revenue of $120.37 million from its Aerospace & Defense segment, focusing on ballistic protection materials and products.

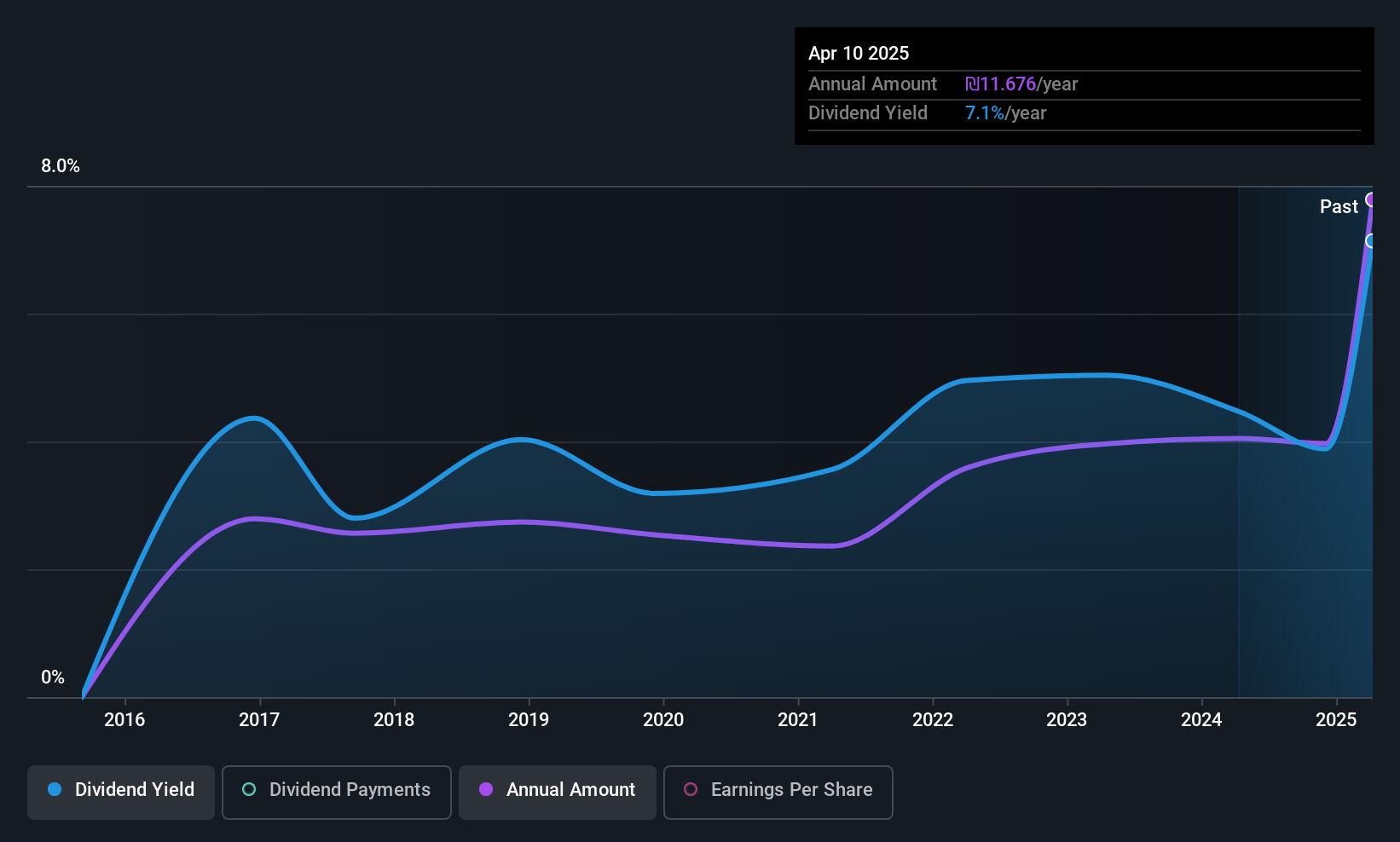

Dividend Yield: 6.8%

FMS Enterprises Migun offers a dividend yield of 6.77%, ranking it among the top 25% in the IL market, yet its sustainability is challenged by a high cash payout ratio of 254%. While dividends have been stable and growing over the past decade, they are not well-covered by free cash flows. Recent earnings reveal a slight decline in sales to US$30.36 million for Q3 2025, with net income rising to US$10.96 million year-over-year.

- Unlock comprehensive insights into our analysis of FMS Enterprises Migun stock in this dividend report.

- Our valuation report here indicates FMS Enterprises Migun may be overvalued.

Make It Happen

- Investigate our full lineup of 60 Top Middle Eastern Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FBRT

FMS Enterprises Migun

Manufactures and sells ballistic protection raw materials and products worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)