- Israel

- /

- Electrical

- /

- TASE:ELSPC

Impressive Earnings May Not Tell The Whole Story For Elspec Engineering (TLV:ELSPC)

Despite announcing strong earnings, Elspec Engineering Ltd's (TLV:ELSPC) stock was sluggish. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for Elspec Engineering

Examining Cashflow Against Elspec Engineering's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

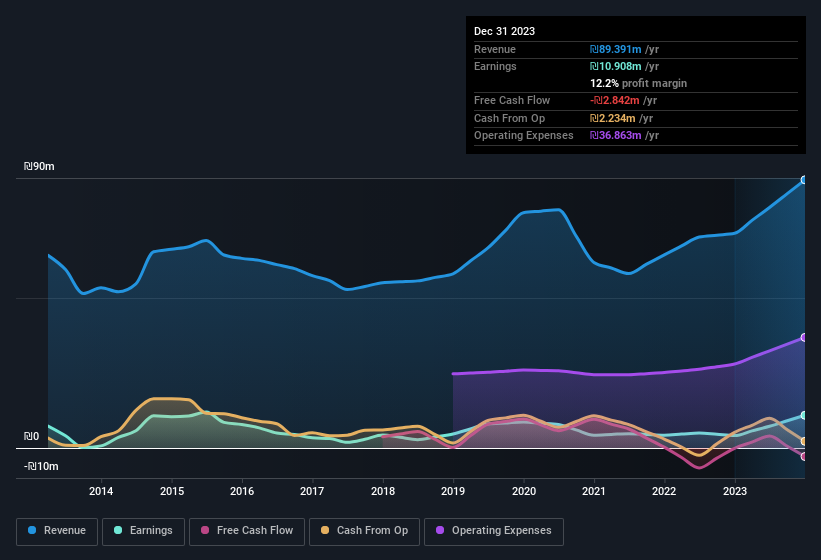

Elspec Engineering has an accrual ratio of 0.26 for the year to December 2023. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of ₪2.8m, in contrast to the aforementioned profit of ₪10.9m. We also note that Elspec Engineering's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₪2.8m.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Elspec Engineering.

Our Take On Elspec Engineering's Profit Performance

Elspec Engineering's accrual ratio for the last twelve months signifies cash conversion is less than ideal, which is a negative when it comes to our view of its earnings. Because of this, we think that it may be that Elspec Engineering's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Elspec Engineering, you'd also look into what risks it is currently facing. Our analysis shows 3 warning signs for Elspec Engineering (1 makes us a bit uncomfortable!) and we strongly recommend you look at them before investing.

This note has only looked at a single factor that sheds light on the nature of Elspec Engineering's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Elspec Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ELSPC

Elspec Engineering

Develops, manufactures, and markets power quality solutions and services to the industrial, commercial, and utility sectors worldwide.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026