Evaluating F.I.B.I. Holdings (TASE:FIBIH) After Dividend Declaration and FTSE All-World Index Inclusion

Reviewed by Simply Wall St

Dividend move and index inclusion draw fresh attention

F.I.B.I. Holdings (TASE:FIBIH) just paired a new cash dividend with entry into the FTSE All-World Index, a combination that quietly upgrades both its income profile and global visibility.

The dividend of ₪5.92 per share, backed by a payout ratio around 42%, suggests earnings still comfortably cover distributions. In addition, the FTSE inclusion can put the stock on the radar of index-tracking funds and international institutions.

See our latest analysis for F.I.B.I. Holdings.

Those developments are landing on top of robust share price momentum, with the stock now at ₪276.9 after a strong year to date share price return and an even stronger multi year total shareholder return that signals investors are steadily re rating its prospects.

If F.I.B.I. Holdings has piqued your interest, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership for other potential standouts.

Yet even after that rally and index upgrade, shares still trade at a discount to estimated fair value. This raises a key question: Is this a genuine mispricing, or is the market already baking in years of growth?

Price-to-Earnings of 8.8x: Is it justified?

F.I.B.I. Holdings trades on a price to earnings ratio of 8.8 times, which looks modest given its recent share price performance and quality profile.

The price to earnings multiple compares the company’s market value to its after tax profits, a core yardstick for banks where earnings power drives long term returns. For F.I.B.I. Holdings, this yardstick suggests investors are not paying an excessive premium for each shekel of profit, despite a strong five year earnings expansion.

What stands out is that the stock changes hands at 8.8 times earnings while peers on average sit around 10.3 times, and the broader Asian Banks industry is closer to 9.8 times. That discount hints the market is still pricing F.I.B.I. Holdings more conservatively than its regional banking peers, even though its earnings track record has been robust over the past half decade.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.8x (UNDERVALUED)

However, risks remain, including potential margin pressure if funding costs rise, and softer credit demand if Israel’s economic backdrop deteriorates.

Find out about the key risks to this F.I.B.I. Holdings narrative.

Another View: Cash Flows Point the Same Way

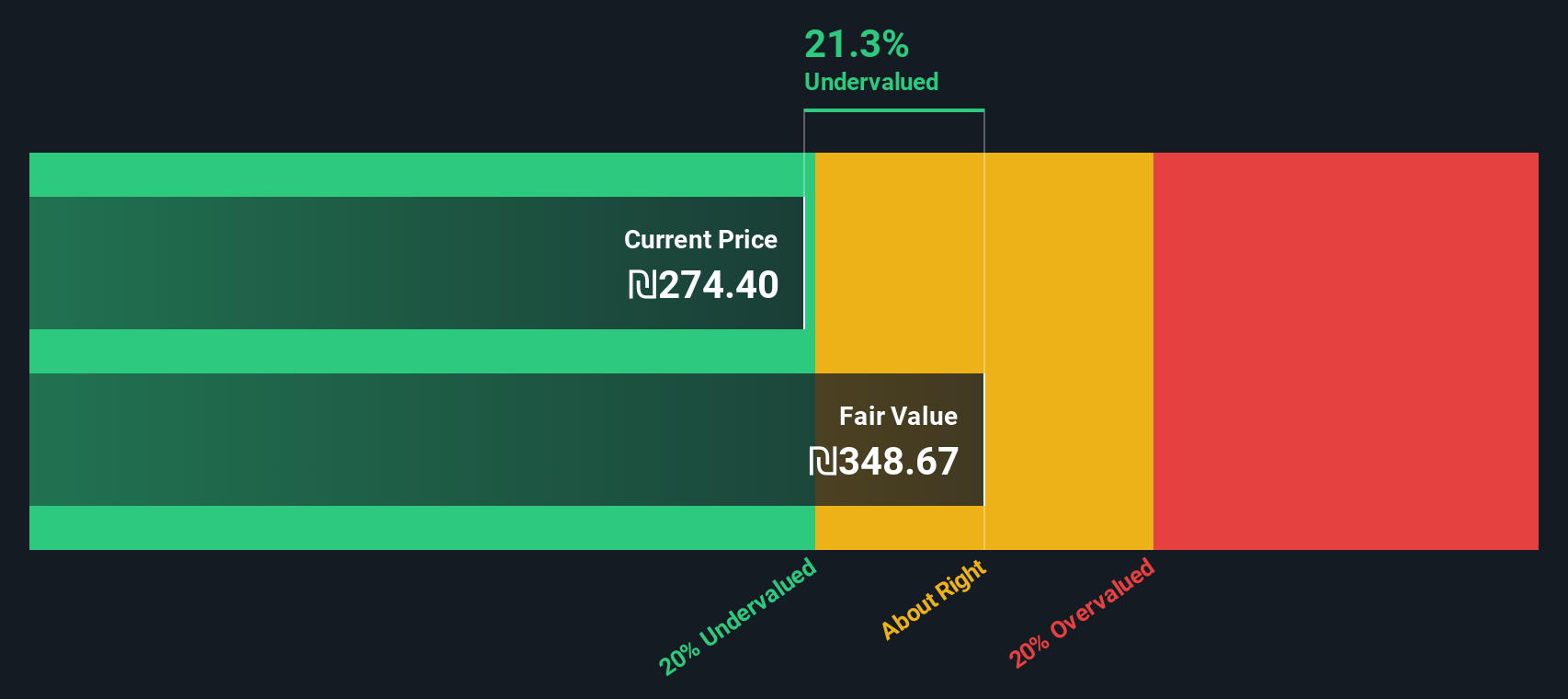

Our DCF model also suggests upside, with F.I.B.I. Holdings trading roughly 20.6% below an estimated fair value of ₪348.67. Price and cash flows are telling a similar story. The question is whether this gap represents a lasting opportunity or compensation for harder to see risks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out F.I.B.I. Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own F.I.B.I. Holdings Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your F.I.B.I. Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing ideas?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to quickly spot fresh ideas that fit your strategy and help you stay ahead of other investors.

- Capture income potential by scanning these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow while others overlook reliable payers.

- Capitalize on innovation by reviewing these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence and automation.

- Secure value opportunities by tracking these 908 undervalued stocks based on cash flows before the broader market fully recognizes their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FIBIH

F.I.B.I. Holdings

Operates as the holding company for The First International Bank of Israel Ltd.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)