- Israel

- /

- Auto Components

- /

- TASE:TGI

Middle Eastern Penny Stocks With At Least US$2M Market Cap

Reviewed by Simply Wall St

Most Gulf markets have recently ended lower, pressured by weak oil prices and investor anticipation of forthcoming corporate earnings reports. Despite these challenges, the Middle Eastern market continues to offer intriguing opportunities for investors, particularly in the realm of penny stocks. Although considered a somewhat outdated term, penny stocks refer to smaller or newer companies that can provide significant growth potential at lower price points. In this article, we explore three such promising stocks that combine strong financials with the potential for impressive returns.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.62 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.838 | ₪342.15M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.08 | AED2.16B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.40 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.21 | AED13.73B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.813 | AED3.53B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.832 | AED506.68M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.832 | ₪222.31M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Allmed Solutions (TASE:ALMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allmed Solutions Ltd develops, manufactures, and markets minimally invasive medical products across various disciplines both in Israel and internationally, with a market cap of ₪30.37 million.

Operations: There are no reported revenue segments for Allmed Solutions Ltd.

Market Cap: ₪30.37M

Allmed Solutions Ltd, a pre-revenue company with a market cap of ₪30.37 million, is making strides in medical innovation despite financial challenges. The company's recent breakthrough with the RoseDoc docking system marks a significant milestone in minimally invasive heart valve replacement technology, potentially transforming treatment for patients without open-heart surgery options. Although Allmed remains unprofitable and reported an increased net loss of ₪7 million for the first half of 2025, its experienced management and debt-free status provide some stability. The firm also boasts sufficient cash runway exceeding three years, supporting ongoing development efforts.

- Dive into the specifics of Allmed Solutions here with our thorough balance sheet health report.

- Gain insights into Allmed Solutions' historical outcomes by reviewing our past performance report.

Sonovia (TASE:SONO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sonovia Ltd. is an Israeli company focused on developing and producing anti-bacterial textile products, with a market cap of ₪9.19 million.

Operations: Sonovia Ltd. has not reported any revenue segments.

Market Cap: ₪9.19M

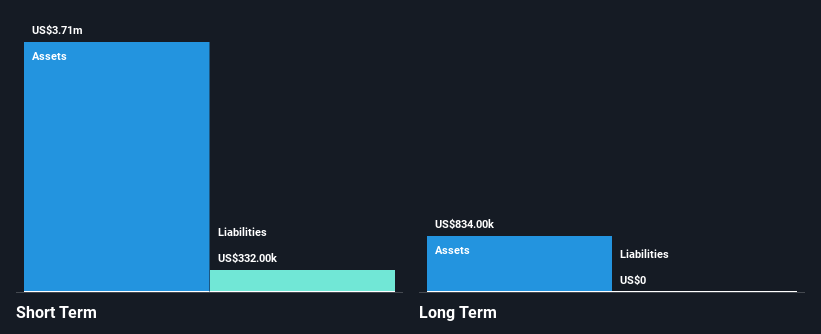

Sonovia Ltd., with a market cap of ₪9.19 million, is a pre-revenue company focused on anti-bacterial textile products. Despite facing financial challenges, including a net loss of US$1.04 million for the first half of 2025, Sonovia maintains a stable cash runway exceeding one year and remains debt-free. The company's experienced board and management team provide some stability amidst high share price volatility and negative return on equity (-76.29%). While short-term assets significantly cover liabilities, the lack of meaningful revenue underscores its speculative nature as an investment in penny stocks within the region.

- Click here and access our complete financial health analysis report to understand the dynamics of Sonovia.

- Understand Sonovia's track record by examining our performance history report.

Tgi Infrastructures (TASE:TGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tgi Infrastructures Ltd, along with its subsidiary, specializes in producing, processing, assembling, and marketing magnesium mechanical assemblies for the automotive industry in Israel and has a market cap of ₪222.31 million.

Operations: TASE:TGI generates revenue from two main segments: Infrastructure and Energy, which contributes ₪81.79 million, and The Metal and Electrical Industries, with revenue of ₪84.52 million.

Market Cap: ₪222.31M

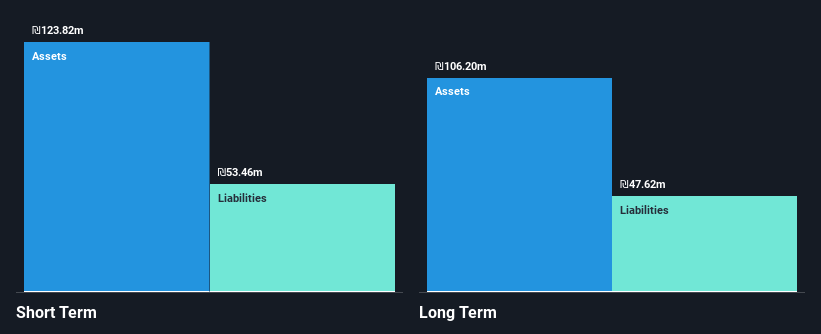

Tgi Infrastructures Ltd, with a market cap of ₪222.31 million, operates in the automotive sector and has shown financial resilience among penny stocks. The company reduced its debt to equity ratio significantly over five years, now at a satisfactory 30.9%, while its interest payments are well covered by EBIT. Despite high share price volatility and a low return on equity of 17.5%, TGI's earnings grew by 86.4% last year, surpassing industry averages and improving profit margins to 10.2%. However, its dividend yield of 7.62% is not well supported by earnings or free cash flow, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of Tgi Infrastructures stock in this financial health report.

- Review our historical performance report to gain insights into Tgi Infrastructures' track record.

Seize The Opportunity

- Access the full spectrum of 79 Middle Eastern Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tgi Infrastructures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TGI

Tgi Infrastructures

Together with its subsidiary, produces, processes, assembles, and markets mechanical assemblies made of magnesium for the automotive industry in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)