- Israel

- /

- Auto Components

- /

- TASE:FRSX

Here's Why We're Watching Foresight Autonomous Holdings' (TLV:FRSX) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Foresight Autonomous Holdings (TLV:FRSX) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Foresight Autonomous Holdings

How Long Is Foresight Autonomous Holdings' Cash Runway?

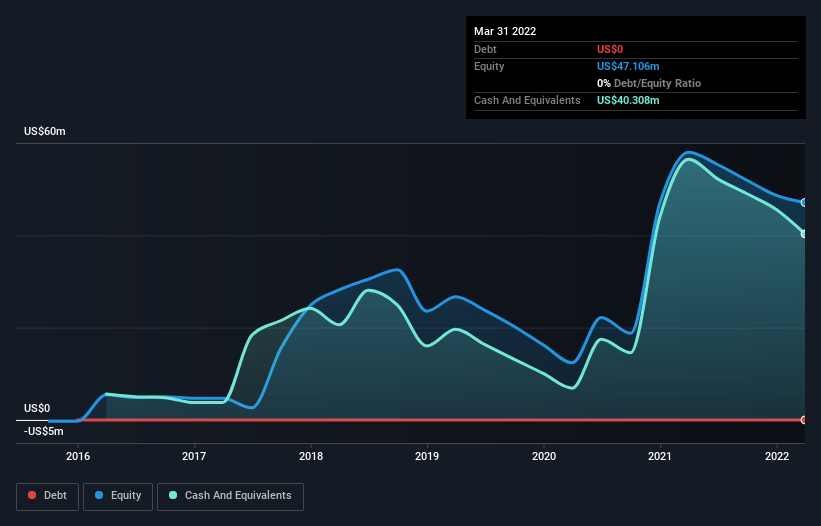

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Foresight Autonomous Holdings last reported its balance sheet in March 2022, it had zero debt and cash worth US$40m. Looking at the last year, the company burnt through US$16m. Therefore, from March 2022 it had 2.6 years of cash runway. That's decent, giving the company a couple years to develop its business. Depicted below, you can see how its cash holdings have changed over time.

How Is Foresight Autonomous Holdings' Cash Burn Changing Over Time?

In our view, Foresight Autonomous Holdings doesn't yet produce significant amounts of operating revenue, since it reported just US$155k in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. During the last twelve months, its cash burn actually ramped up 54%. Oftentimes, increased cash burn simply means a company is accelerating its business development, but one should always be mindful that this causes the cash runway to shrink. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Foresight Autonomous Holdings To Raise More Cash For Growth?

While Foresight Autonomous Holdings does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Foresight Autonomous Holdings' cash burn of US$16m is about 43% of its US$36m market capitalisation. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

How Risky Is Foresight Autonomous Holdings' Cash Burn Situation?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Foresight Autonomous Holdings' cash runway was relatively promising. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Foresight Autonomous Holdings' situation. On another note, Foresight Autonomous Holdings has 4 warning signs (and 1 which is potentially serious) we think you should know about.

Of course Foresight Autonomous Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:FRSX

Foresight Autonomous Holdings

A technology company, engages in the development of smart multi-spectral 3D vision software solutions and cellular-based applications for the automotive industry in Israel, Japan, the United States, and internationally.

Medium-low risk with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026