Ryanair (ISE:RYA) Valuation in Focus After Buyback Activity and FTSE All-World Index Inclusion

Reviewed by Kshitija Bhandaru

Ryanair Holdings (ISE:RYA) is back in the spotlight after announcing the purchase and cancellation of over 700,000 shares as part of its ongoing buyback programme for the week ending 19 September 2025. Moves like this are often interpreted as a show of confidence, hinting that management believes the shares may be undervalued or wants to return value directly to shareholders. In addition to this, Ryanair’s recent addition to the FTSE All-World Index has also caught investors’ eyes, since inclusion can mean increased demand from index funds and institutional players.

This combination of buyback activity and index inclusion adds another chapter to what’s already been an eventful year for the company. Over the year, Ryanair has delivered a 44% total return, easily outpacing many peers, even after a softer showing over the past month. Other recent developments, like the appointment of Capt. Ray Conway to the Board, signal ongoing changes both in leadership and operational strategy. Short-term momentum may show ups and downs, but the longer trend points to meaningful growth for shareholders who stayed the course.

But here’s the big question: with the stock stepping up its capital returns and attracting more institutional money, is there still real value to be had, or has the market already priced in Ryanair’s next phase of growth?

Price-to-Earnings of 11.9x: Is it justified?

Ryanair currently trades at a price-to-earnings (P/E) ratio of 11.9x, which places it above the global airline industry average of 9.7x. This suggests that the market is assigning a premium to Ryanair’s future earnings compared to many of its industry peers.

The price-to-earnings multiple is a fundamental measure of how much investors are willing to pay for each euro of a company’s earnings. For airlines, which tend to face cyclical revenues and significant operational risks, this multiple can signal the market’s confidence in profitability and consistency of performance relative to competitors.

For Ryanair, the current P/E premium may reflect its track record of strong earnings growth and efficient management. However, the higher multiple could also mean the stock is perceived as expensive in the context of the industry, so elevated expectations may already be reflected in the current price.

Result: Fair Value of €23.33 (ABOUT RIGHT)

See our latest analysis for Ryanair Holdings.However, persistent industry volatility and potential regulatory changes could quickly alter Ryanair’s trajectory. This underscores that growth stories are rarely straightforward.

Find out about the key risks to this Ryanair Holdings narrative.Another View: SWS DCF Model Perspective

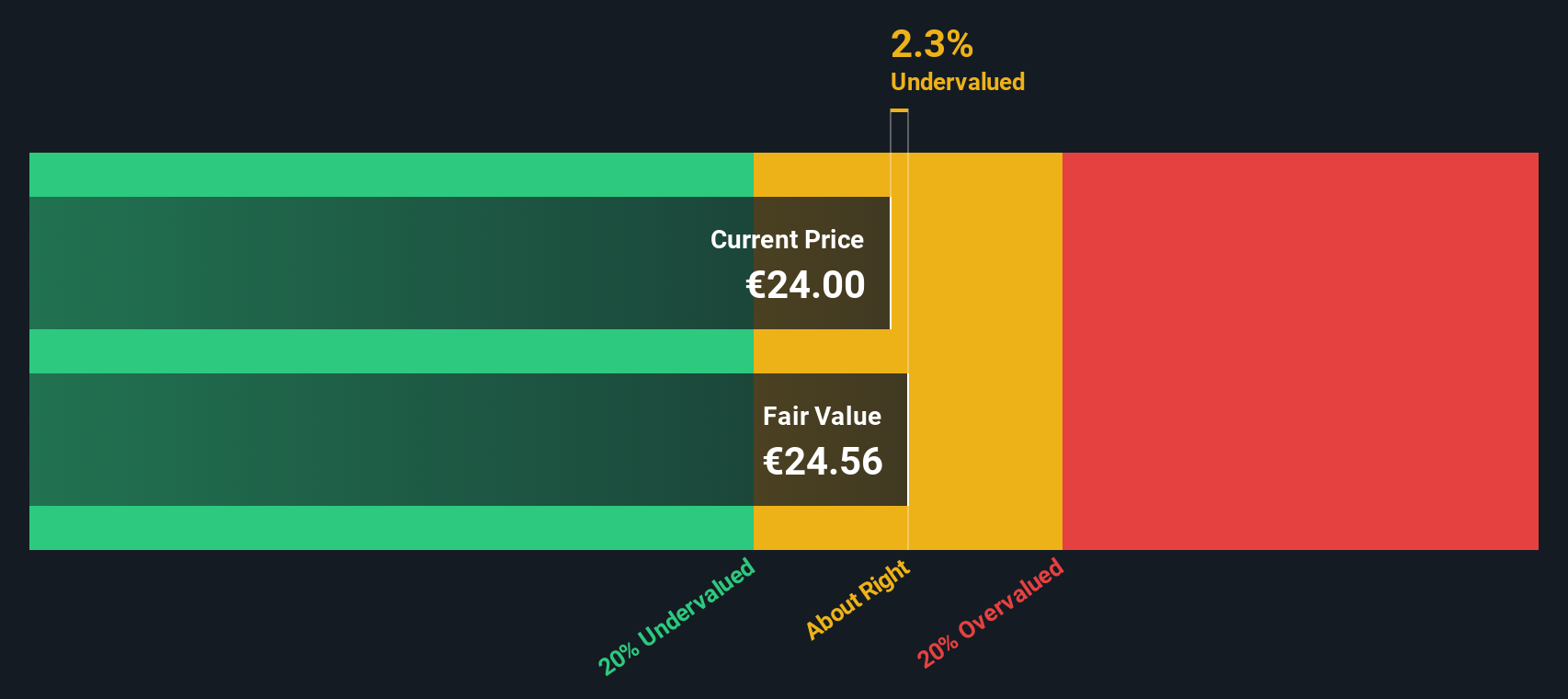

Taking a different approach, our DCF model looks beyond the current earnings multiple and estimates value based on the company’s future cash flows. This method suggests Ryanair might actually be undervalued. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Ryanair Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Ryanair Holdings Narrative

If you see things differently or want to check the numbers for yourself, you can put together your own perspective in just a few minutes, and even Do it your way.

A great starting point for your Ryanair Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Make your next smart move by searching for investments where innovation, value, or high yields could set you apart from the crowd.

- Uncover tomorrow’s tech giants by stepping into the world of AI penny stocks, where artificial intelligence is changing how we live and invest.

- Tap into reliable income streams and see which companies offer dividend stocks with yields > 3% that could help boost your long-term returns.

- Spot high-potential bargains others might miss as you scan for undervalued stocks based on cash flows that are trading for less than their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, Italy, Spain, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives