- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

Here's Why We Think Glenveagh Properties (ISE:GVR) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Glenveagh Properties (ISE:GVR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Glenveagh Properties' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Glenveagh Properties' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 60%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Glenveagh Properties shareholders is that EBIT margins have grown from 12% to 16% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

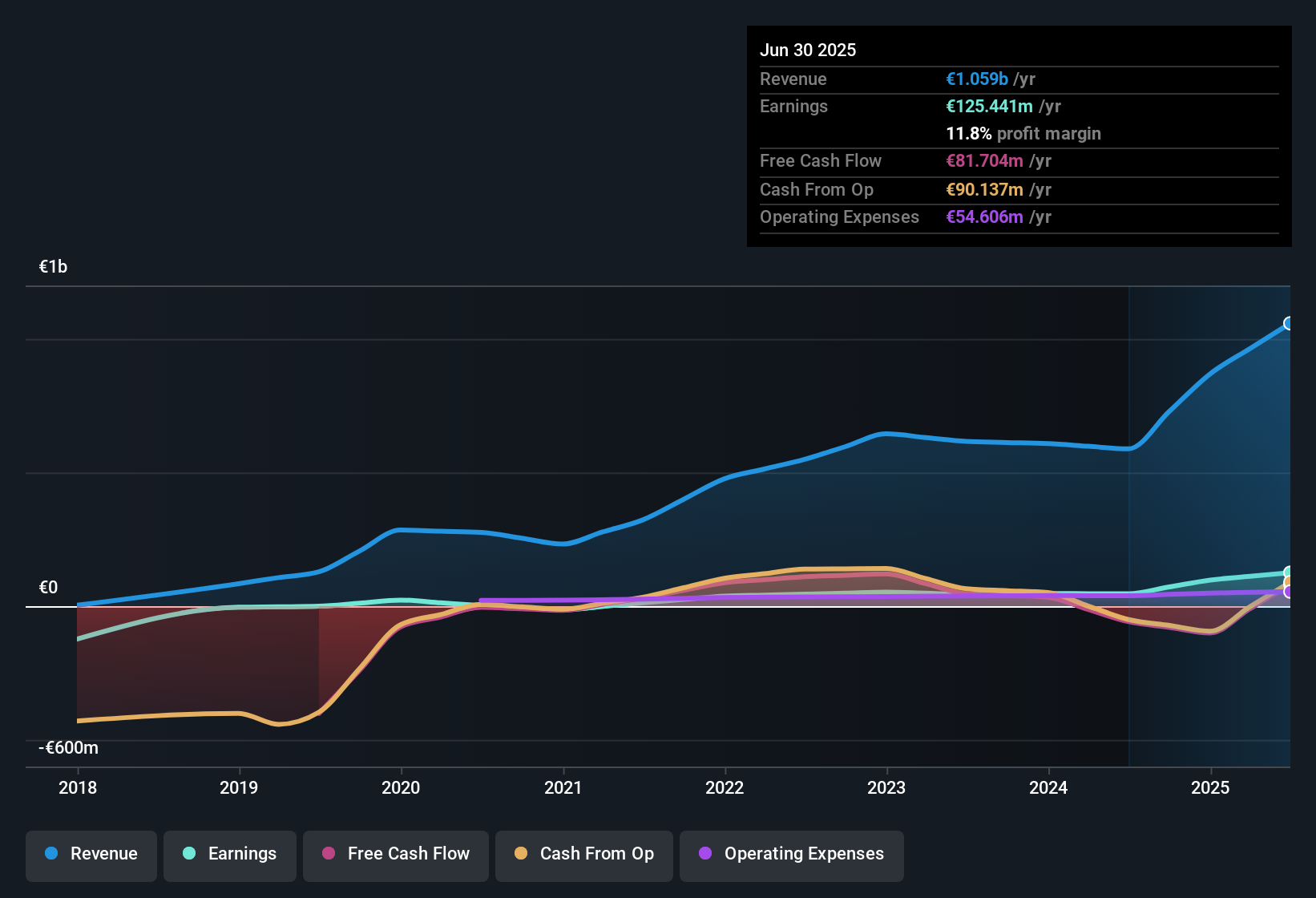

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Glenveagh Properties

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Glenveagh Properties.

Are Glenveagh Properties Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite €41k worth of sales, Glenveagh Properties insiders have overwhelmingly been buying the stock, spending €350k on purchases in the last twelve months. This overall confidence in the company at current the valuation signals their optimism. Zooming in, we can see that the biggest insider purchase was by Co-Founder Stephen Garvey for €309k worth of shares, at about €1.57 per share.

Along with the insider buying, another encouraging sign for Glenveagh Properties is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at €21m. This considerable investment should help drive long-term value in the business. Even though that's only about 2.2% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Glenveagh Properties To Your Watchlist?

Glenveagh Properties' earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Glenveagh Properties belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Glenveagh Properties you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Glenveagh Properties, you'll probably love this curated collection of companies in IE that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)