- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

Esprinet And 2 Other European Penny Stocks To Watch

Reviewed by Simply Wall St

Amid escalating trade tensions and a cautious approach from central banks, European markets have experienced heightened volatility, with major indices like Germany's DAX and France's CAC 40 seeing declines. Despite these challenges, there are opportunities for investors willing to explore lesser-known segments of the market. Penny stocks, often smaller or newer companies with strong financials, can offer unique growth potential and value that larger firms might overlook. In this article, we will examine several European penny stocks that exhibit promising financial strength and potential for long-term success.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.045 | SEK1.96B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.60 | SEK237.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.78 | SEK229.97M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.38 | PLN114.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.48 | €52.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.1605 | €24.09M | ✅ 3 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.93 | €18.42M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 425 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Esprinet (BIT:PRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Esprinet S.p.A. operates as a wholesale distributor of information technology products and consumer electronics across Italy, Spain, Portugal, and other parts of Europe with a market capitalization of €232.13 million.

Operations: The company's revenue is primarily derived from its IT and consumer electronics distribution operations, with €2.65 billion generated in Italy and €1.52 billion in the Iberian Peninsula.

Market Cap: €232.13M

Esprinet S.p.A. has recently transitioned to profitability, reporting a net income of €21.52 million for 2024, a significant improvement from the previous year's loss. The company operates with more cash than total debt and maintains strong short-term asset coverage over both long and short-term liabilities. Despite trading below estimated fair value, Esprinet's return on equity is low at 5.5%, and its dividend yield of 8.52% is not well covered by earnings or free cash flows, raising sustainability concerns. Analysts forecast earnings growth of nearly 20% annually, but debt coverage by operating cash flow remains inadequate at 2.3%.

- Click to explore a detailed breakdown of our findings in Esprinet's financial health report.

- Gain insights into Esprinet's outlook and expected performance with our report on the company's earnings estimates.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform for detecting disease risks across Finland, the United Kingdom, Europe, the United States, and internationally, with a market cap of €180.45 million.

Operations: The company generates revenue from its Medical Labs & Research segment, amounting to €4.95 million.

Market Cap: €180.45M

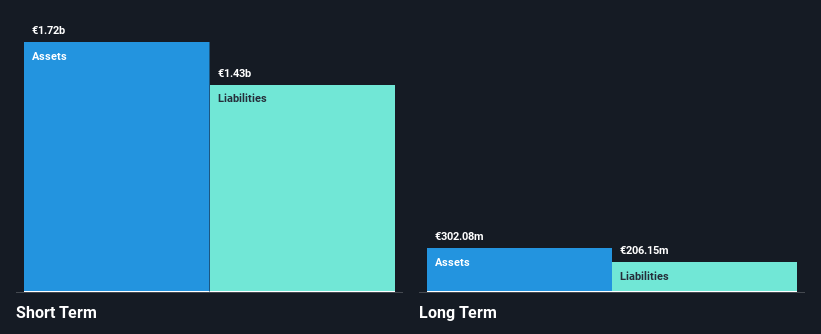

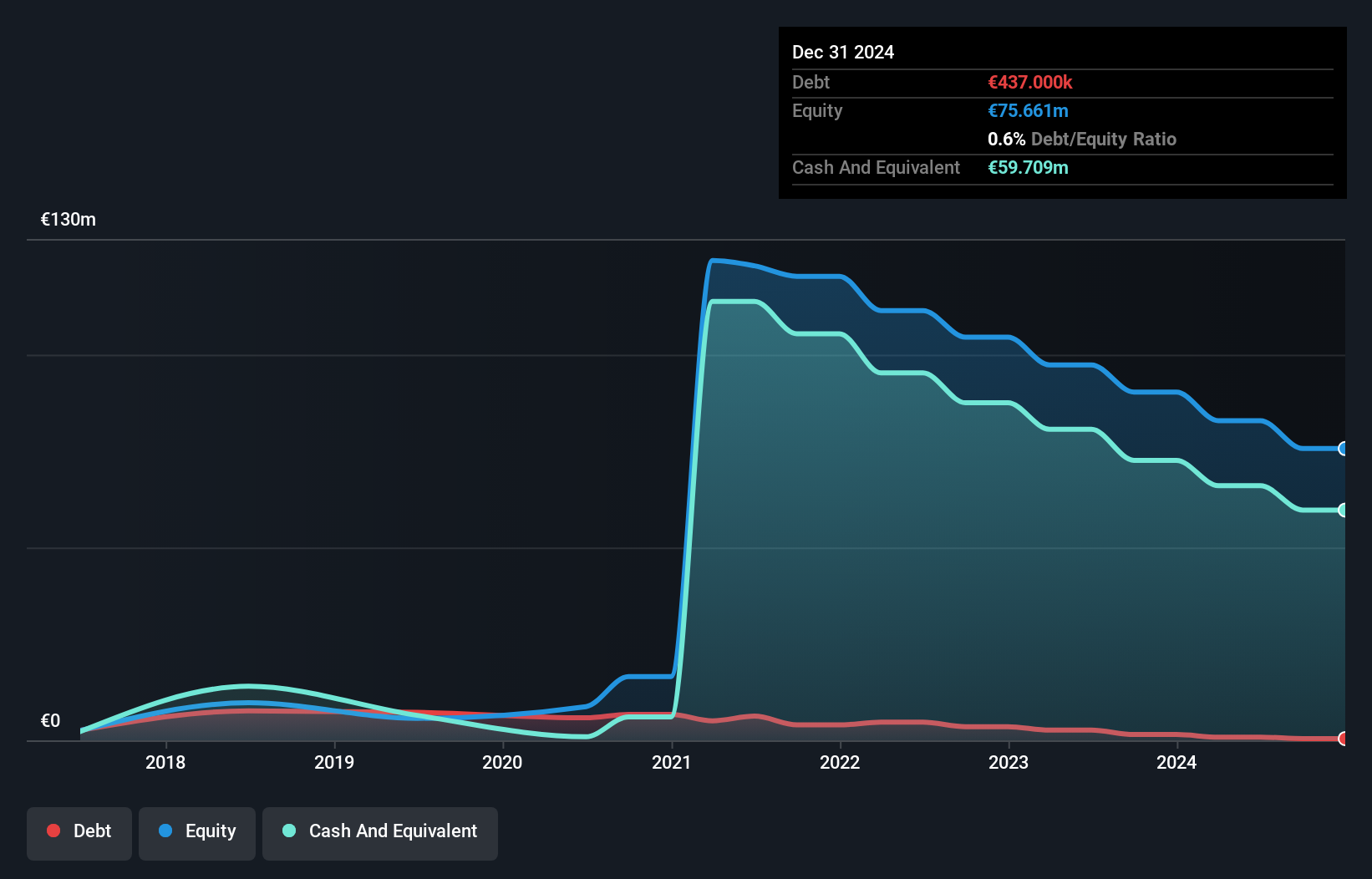

Nightingale Health Oyj, with a market cap of €180.45 million, is currently unprofitable and not expected to achieve profitability within the next three years. The company reported half-year sales of €2.31 million, up from €1.72 million the previous year, yet it remains challenged by a net loss of €8.2 million. Despite this, Nightingale boasts strong liquidity with short-term assets far exceeding both short and long-term liabilities and more cash than debt. Recent developments include its addition to the OMX Nordic indices and strategic expansion plans in the U.S., leveraging regulatory advantages in New York for accelerated service launches without immediate FDA premarket review requirements.

- Click here and access our complete financial health analysis report to understand the dynamics of Nightingale Health Oyj.

- Understand Nightingale Health Oyj's earnings outlook by examining our growth report.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, along with its subsidiaries, focuses on constructing and selling houses and apartments for private buyers, local authorities, and the private rental sector in Ireland, with a market cap of approximately €806.60 million.

Operations: There are no specific revenue segments reported for Glenveagh Properties PLC.

Market Cap: €806.6M

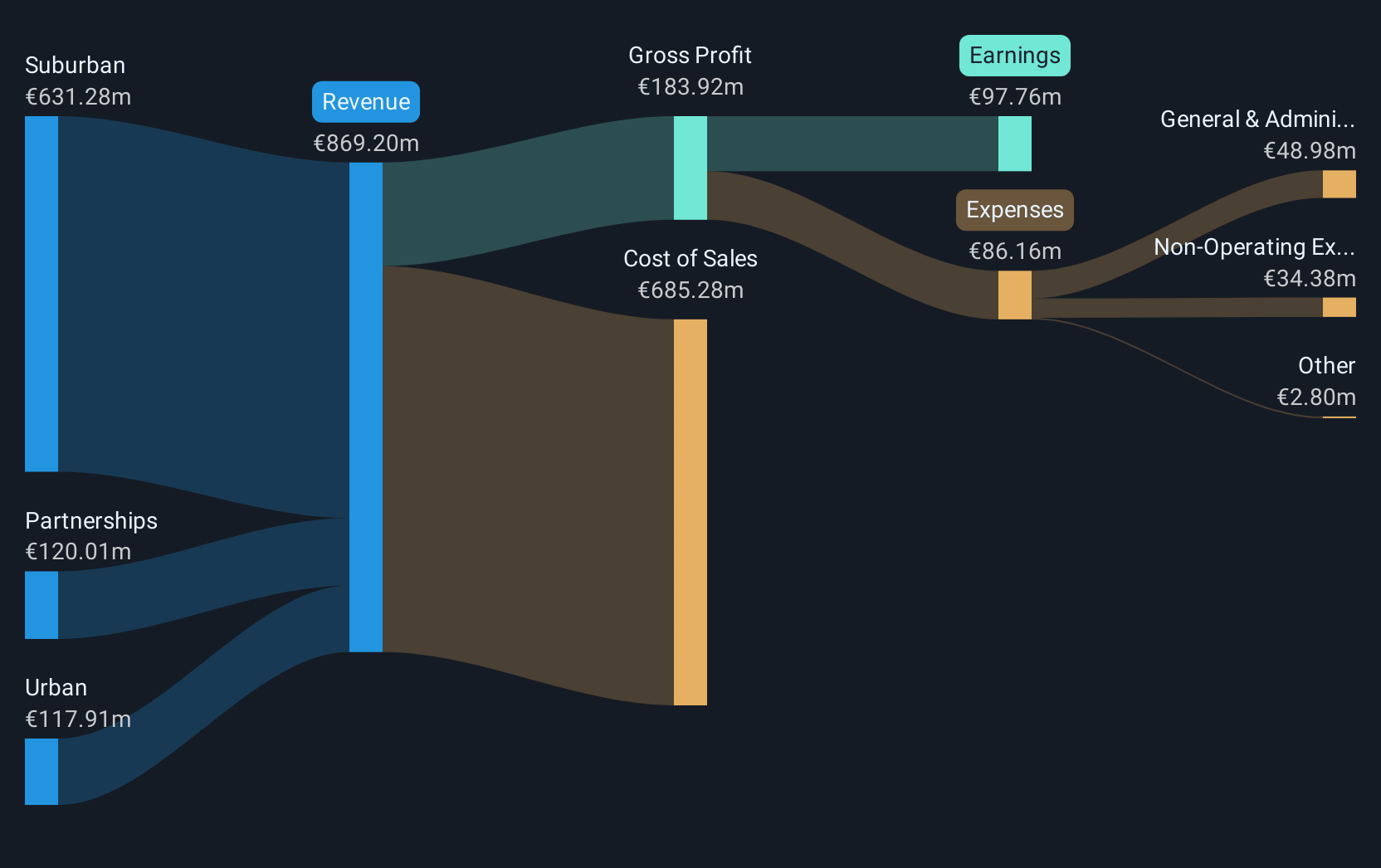

Glenveagh Properties, with a market cap of €806.60 million, has demonstrated robust growth, reporting a significant increase in earnings and sales over the past year. The company's net income rose to €97.76 million from €47.11 million previously, with basic earnings per share doubling to €0.17. Despite an increase in debt-to-equity ratio over five years, its short-term assets comfortably cover liabilities and interest payments are well-covered by EBIT at 6.9 times interest repayments. Recent strategic moves include completing a share buyback worth €44.3 million and securing lucrative partnerships for residential developments in Ireland's Cork Docklands and Dublin areas.

- Dive into the specifics of Glenveagh Properties here with our thorough balance sheet health report.

- Assess Glenveagh Properties' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Jump into our full catalog of 425 European Penny Stocks here.

- Looking For Alternative Opportunities? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives