With EPS Growth And More, Kingspan Group (ISE:KRX) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Kingspan Group (ISE:KRX), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kingspan Group with the means to add long-term value to shareholders.

Check out the opportunities and risks within the XX Building industry.

How Quickly Is Kingspan Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Kingspan Group has managed to grow EPS by 20% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

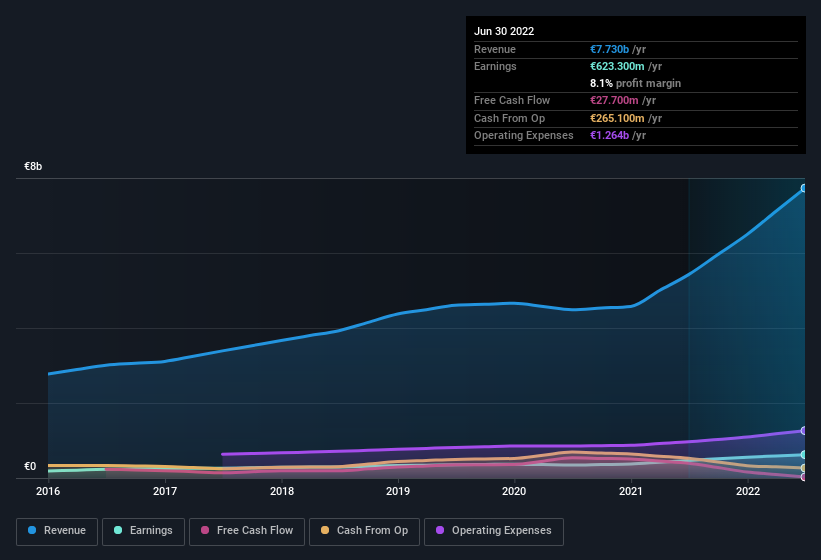

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Kingspan Group maintained stable EBIT margins over the last year, all while growing revenue 43% to €7.7b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Kingspan Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Kingspan Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the €152k that Independent Non-Executive Director Eimear Moloney spent buying shares (at an average price of about €75.78). Purchases like this clue us in to the to the faith management has in the business' future.

On top of the insider buying, it's good to see that Kingspan Group insiders have a valuable investment in the business. We note that their impressive stake in the company is worth €1.5b. This totals to 16% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Is Kingspan Group Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Kingspan Group's strong EPS growth. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. So it's fair to say that this stock may well deserve a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Kingspan Group that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Kingspan Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kingspan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:KRX

Kingspan Group

Provides insulation and building envelope solutions in Western and Southern Europe, Central and Northern Europe, the Americas, and internationally.

Excellent balance sheet with moderate growth potential.