- Indonesia

- /

- Entertainment

- /

- IDX:CNMA

Undiscovered Gems to Watch This September 2024

Reviewed by Simply Wall St

As global markets grapple with economic slowdowns and fluctuating indices, small-cap stocks have been particularly impacted by investor sentiment. Despite these challenges, this September presents an opportunity to uncover potential in lesser-known stocks that may offer resilience and growth amid broader market volatility. In the current climate, a good stock often demonstrates strong fundamentals, innovative business models, or niche market leadership—qualities that can help it stand out even when larger indices face pressure.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Chilanga Cement | NA | 12.53% | 25.20% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Orygen PerúA (BVL:ORYGENC1)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orygen Perú S.A.A. generates and sells electricity in Peru with a market cap of PEN7.05 billion.

Operations: Orygen Perú S.A.A. derives its revenue primarily from the sale of energy and power, amounting to PEN2.71 billion, with additional compensation income of PEN28.14 million.

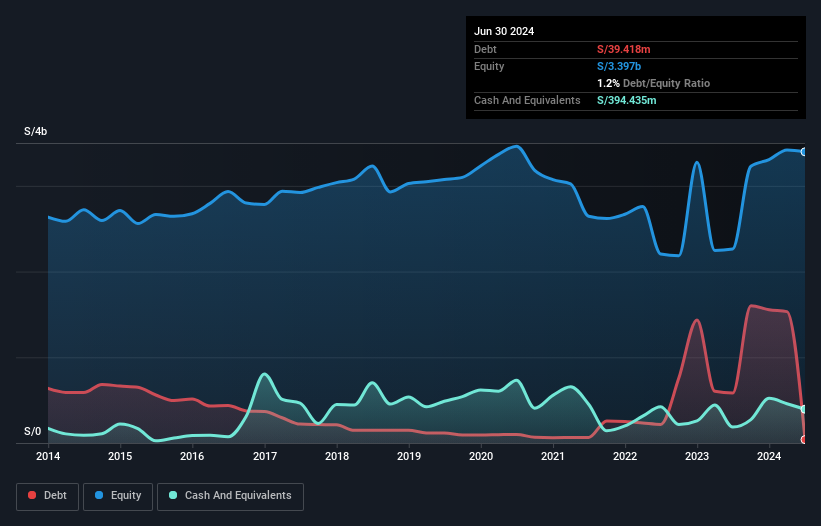

Orygen Perú has shown mixed performance recently, with second-quarter sales at PEN 650.72 million and net income of PEN 207.37 million, down from PEN 245.73 million a year ago. Trading at nearly 25% below estimated fair value, it offers potential upside. Despite negative earnings growth of -3.4% over the past year, its debt-to-equity ratio improved from 3.8 to 1.2 over five years, and interest payments are well covered by EBIT (34x).

- Unlock comprehensive insights into our analysis of Orygen PerúA stock in this health report.

Gain insights into Orygen PerúA's past trends and performance with our Past report.

Nusantara Sejahtera Raya (IDX:CNMA)

Simply Wall St Value Rating: ★★★★★★

Overview: PT Nusantara Sejahtera Raya Tbk, along with its subsidiaries, operates in the movie screening and restaurant sectors in Indonesia and has a market cap of IDR18.67 billion.

Operations: Nusantara Sejahtera Raya generates revenue primarily from its movie segment (IDR3.55 billion) and food and beverages segment (IDR1.97 billion).

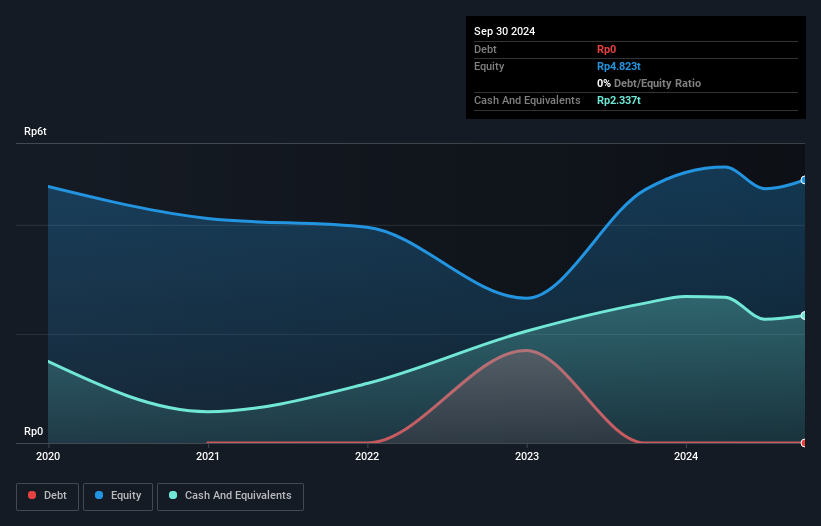

Nusantara Sejahtera Raya has shown impressive growth, with revenue reaching IDR 2.96 trillion for the half year ending June 30, 2024, up from IDR 2.43 trillion last year. Net income jumped to IDR 389 billion from IDR 201 billion in the same period. Basic earnings per share climbed to IDR 4.67 compared to last year's IDR 2.68, reflecting robust financial health and operational efficiency in a competitive entertainment industry with a P/E ratio of just 21x.

- Dive into the specifics of Nusantara Sejahtera Raya here with our thorough health report.

Assess Nusantara Sejahtera Raya's past performance with our detailed historical performance reports.

Dyna-Mac Holdings (SGX:NO4)

Simply Wall St Value Rating: ★★★★★★

Overview: Dyna-Mac Holdings Ltd. is an investment holding company that engineers, fabricates, and constructs offshore floating production storage offloading and floating storage offloading topside modules for the oil and gas industries, with a market cap of SGD552.11 million.

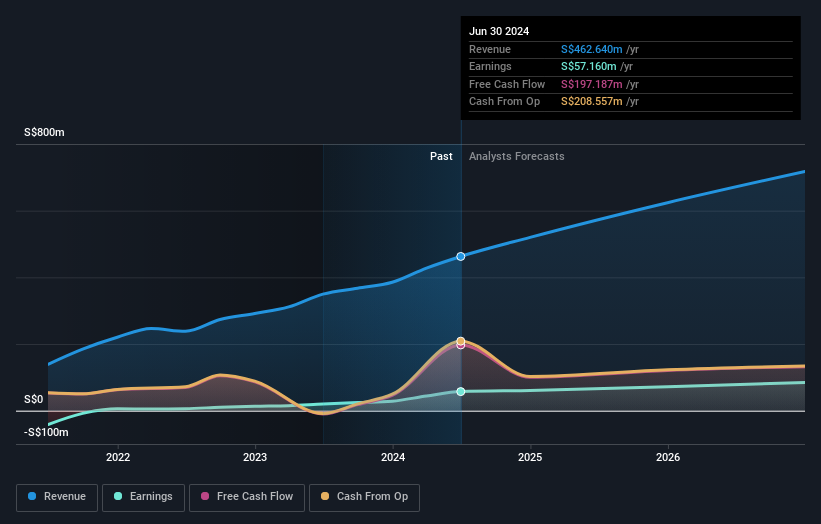

Operations: Dyna-Mac Holdings generates revenue primarily from its Module Business (SGD450.93 million) and Ad-Hoc Projects (SGD11.71 million). The Module Business is the major contributor to the company's revenue streams.

Dyna-Mac Holdings, a smaller player in the energy services sector, has seen its earnings grow by 185% over the past year, significantly outpacing industry growth. With no debt on its balance sheet now compared to a debt-to-equity ratio of 18.7% five years ago, it is trading at 63.1% below estimated fair value. Recent news includes Hanwha Aerospace and Hanwha Ocean's proposal to acquire an additional stake for SGD 170 million, valuing shares at SGD 0.6 each.

Make It Happen

- Unlock our comprehensive list of 4829 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nusantara Sejahtera Raya, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nusantara Sejahtera Raya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:CNMA

Nusantara Sejahtera Raya

Engages in the movie screening, restaurants; other management consulting activities; and venue rental; and organizing MICE activities and special events in Indonesia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives