Investors Who Bought Croatia osiguranje d.d (ZGSE:CROS) Shares Five Years Ago Are Now Up 20%

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Croatia osiguranje d.d. (ZGSE:CROS) shareholders have enjoyed a 20% share price rise over the last half decade, well in excess of the market return of around 14% (not including dividends).

See our latest analysis for Croatia osiguranje d.d

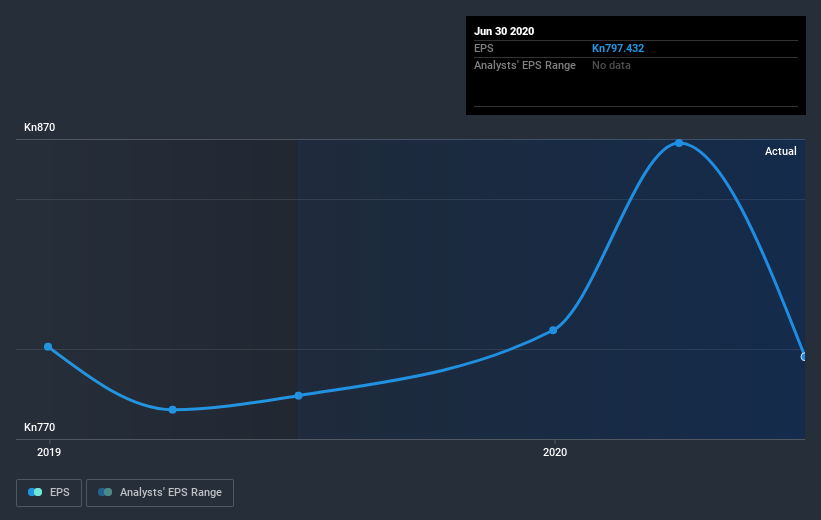

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Croatia osiguranje d.d moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Croatia osiguranje d.d's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Croatia osiguranje d.d's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Croatia osiguranje d.d's TSR of 22% over the last 5 years is better than the share price return.

A Different Perspective

Croatia osiguranje d.d shareholders are down 2.3% over twelve months, which isn't far from the market return of -2.2%. The silver lining is that longer term investors would have made a total return of 4% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. Before deciding if you like the current share price, check how Croatia osiguranje d.d scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HR exchanges.

If you’re looking to trade Croatia osiguranje d.d, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ZGSE:CROS

Croatia osiguranje d.d

Engages in the non-life and life insurance, and reinsurance businesses in the Republic of Croatia, Slovenia, territory of Northern Macedonia, Bosnia and Herzegovina, and Serbia.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives