- Hong Kong

- /

- Water Utilities

- /

- SEHK:855

With EPS Growth And More, China Water Affairs Group (HKG:855) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like China Water Affairs Group (HKG:855). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for China Water Affairs Group

China Water Affairs Group's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. We can see that in the last three years China Water Affairs Group grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

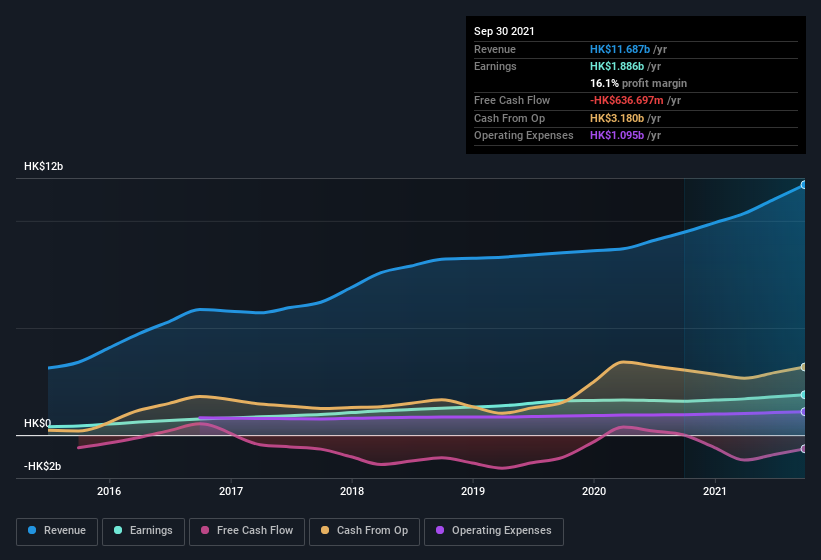

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note China Water Affairs Group's EBIT margins were flat over the last year, revenue grew by a solid 23% to HK$12b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future China Water Affairs Group EPS 100% free.

Are China Water Affairs Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell China Water Affairs Group shares in the last year. Even better, though, is that the Executive Chairman, Chuan Liang Duan, bought a whopping HK$1.6m worth of shares, paying about HK$10.38 per share, on average. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that China Water Affairs Group insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at HK$4.6b. Coming in at 33% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Is China Water Affairs Group Worth Keeping An Eye On?

One important encouraging feature of China Water Affairs Group is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with China Water Affairs Group (at least 1 which is significant) , and understanding them should be part of your investment process.

The good news is that China Water Affairs Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:855

China Water Affairs Group

An investment holding company, engages in the water supply, environmental protection, and property businesses in the People’s Republic of China.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives