- Hong Kong

- /

- Water Utilities

- /

- SEHK:855

China Water Affairs Group Limited (HKG:855) Shares Fly 26% But Investors Aren't Buying For Growth

China Water Affairs Group Limited (HKG:855) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

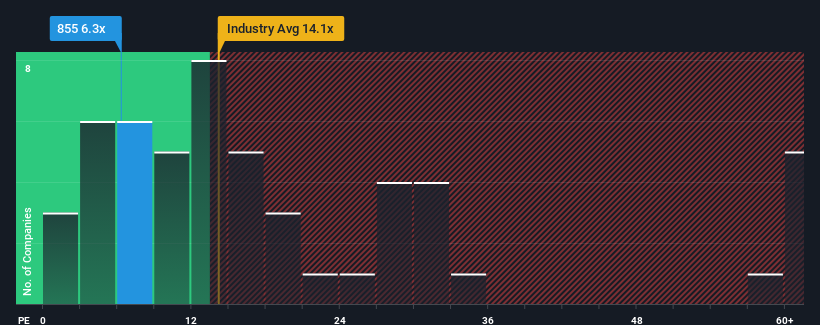

Even after such a large jump in price, China Water Affairs Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.3x, since almost half of all companies in Hong Kong have P/E ratios greater than 11x and even P/E's higher than 22x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

China Water Affairs Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for China Water Affairs Group

Is There Any Growth For China Water Affairs Group?

The only time you'd be truly comfortable seeing a P/E as low as China Water Affairs Group's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. The last three years don't look nice either as the company has shrunk EPS by 24% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 0.1% per year during the coming three years according to the two analysts following the company. With the market predicted to deliver 12% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that China Water Affairs Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From China Water Affairs Group's P/E?

China Water Affairs Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Water Affairs Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with China Water Affairs Group (at least 2 which don't sit too well with us), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:855

China Water Affairs Group

An investment holding company, engages in the water supply, environmental protection, and property businesses in the People’s Republic of China.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives