- Hong Kong

- /

- Gas Utilities

- /

- SEHK:8117

Is China Primary Energy Holdings (HKG:8117) Weighed On By Its Debt Load?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that China Primary Energy Holdings Limited (HKG:8117) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for China Primary Energy Holdings

What Is China Primary Energy Holdings's Net Debt?

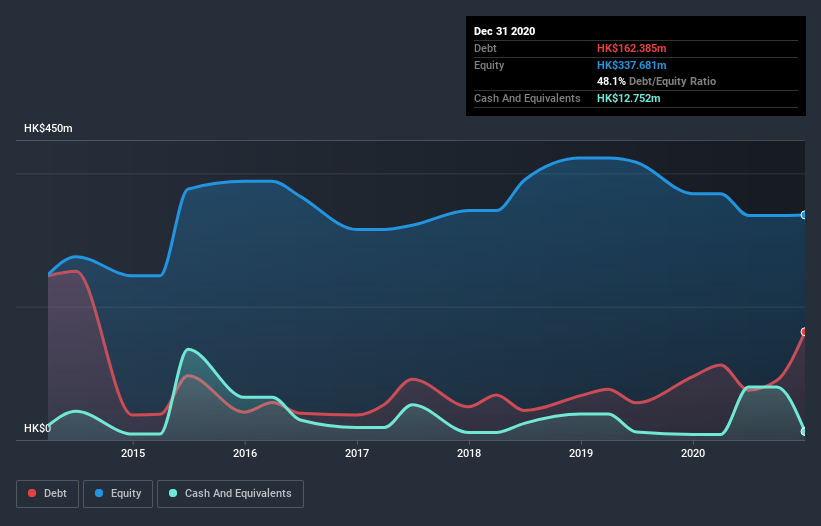

As you can see below, at the end of December 2020, China Primary Energy Holdings had HK$162.4m of debt, up from HK$95.0m a year ago. Click the image for more detail. However, it does have HK$12.8m in cash offsetting this, leading to net debt of about HK$149.6m.

A Look At China Primary Energy Holdings' Liabilities

According to the last reported balance sheet, China Primary Energy Holdings had liabilities of HK$167.0m due within 12 months, and liabilities of HK$103.5m due beyond 12 months. On the other hand, it had cash of HK$12.8m and HK$50.8m worth of receivables due within a year. So it has liabilities totalling HK$207.0m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of HK$174.1m, we think shareholders really should watch China Primary Energy Holdings's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since China Primary Energy Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year China Primary Energy Holdings's revenue was pretty flat, and it made a negative EBIT. While that hardly impresses, its not too bad either.

Caveat Emptor

Importantly, China Primary Energy Holdings had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping HK$31m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. But on the bright side the company actually produced a statutory profit of HK$10m and free cash flow of HK$134m. So one might argue that there's still a chance it can get things on the right track. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for China Primary Energy Holdings you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading China Primary Energy Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8117

China Primary Energy Holdings

An investment holding company, primarily transmits and distributes natural gas in the People’s Republic of China.

Slight risk and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026