- Hong Kong

- /

- Gas Utilities

- /

- SEHK:603

China Oil And Gas Group (HKG:603) Takes On Some Risk With Its Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that China Oil And Gas Group Limited (HKG:603) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for China Oil And Gas Group

What Is China Oil And Gas Group's Net Debt?

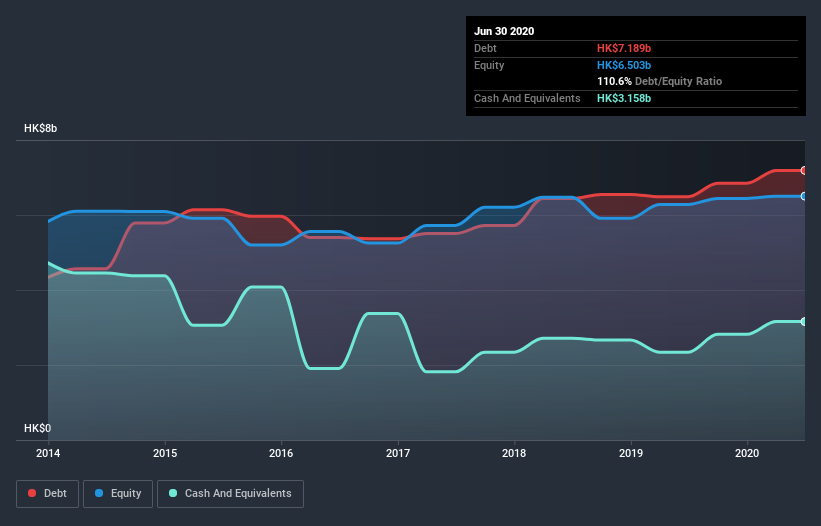

You can click the graphic below for the historical numbers, but it shows that as of June 2020 China Oil And Gas Group had HK$7.19b of debt, an increase on HK$6.49b, over one year. On the flip side, it has HK$3.16b in cash leading to net debt of about HK$4.03b.

How Strong Is China Oil And Gas Group's Balance Sheet?

We can see from the most recent balance sheet that China Oil And Gas Group had liabilities of HK$4.82b falling due within a year, and liabilities of HK$5.87b due beyond that. On the other hand, it had cash of HK$3.16b and HK$1.88b worth of receivables due within a year. So its liabilities total HK$5.65b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the HK$2.09b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, China Oil And Gas Group would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that China Oil And Gas Group's moderate net debt to EBITDA ratio ( being 2.5), indicates prudence when it comes to debt. And its strong interest cover of 13.4 times, makes us even more comfortable. If China Oil And Gas Group can keep growing EBIT at last year's rate of 17% over the last year, then it will find its debt load easier to manage. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since China Oil And Gas Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, China Oil And Gas Group recorded free cash flow of 46% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

China Oil And Gas Group's level of total liabilities and net debt to EBITDA definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. We should also note that Gas Utilities industry companies like China Oil And Gas Group commonly do use debt without problems. Taking the abovementioned factors together we do think China Oil And Gas Group's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with China Oil And Gas Group .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading China Oil And Gas Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:603

China Oil And Gas Group

An investment holding company, engages in the natural gas and energy-related businesses in Hong Kong, Mainland China, and Canada.

Good value with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion