- Hong Kong

- /

- Gas Utilities

- /

- SEHK:384

Fewer Investors Than Expected Jumping On China Gas Holdings Limited (HKG:384)

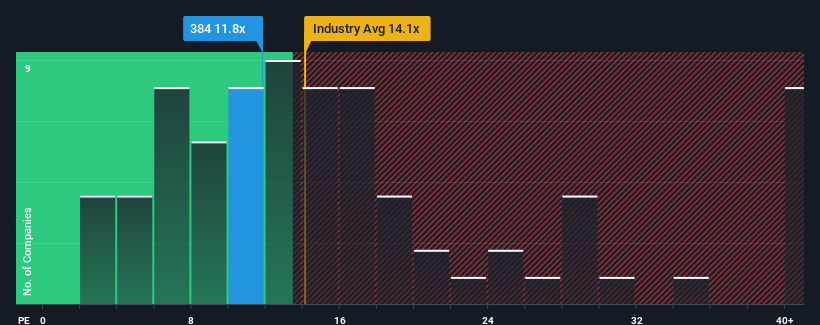

There wouldn't be many who think China Gas Holdings Limited's (HKG:384) price-to-earnings (or "P/E") ratio of 11.8x is worth a mention when the median P/E in Hong Kong is similar at about 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

China Gas Holdings could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for China Gas Holdings

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, China Gas Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 71% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 16% per annum over the next three years. That's shaping up to be materially higher than the 12% per year growth forecast for the broader market.

In light of this, it's curious that China Gas Holdings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of China Gas Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Gas Holdings (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on China Gas Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:384

China Gas Holdings

An investment holding company, operates as a gas operator and service provider in the People’s Republic of China.

Proven track record average dividend payer.

Market Insights

Community Narratives