- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Guangdong Investment (SEHK:270) Net Margin Surges to 24.4%, Supporting Bullish Valuation Narrative

Reviewed by Simply Wall St

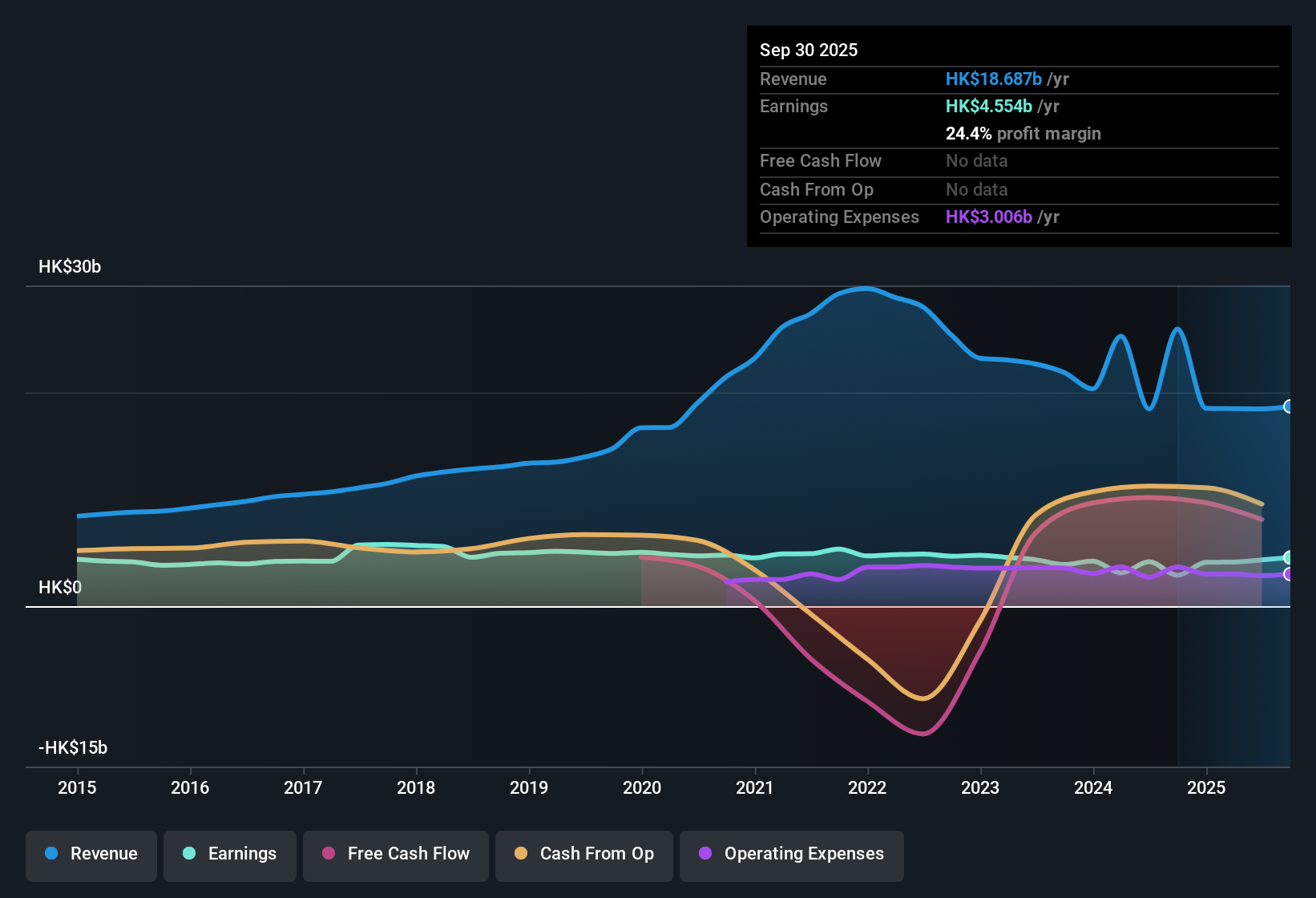

Guangdong Investment (SEHK:270) posted a sharp jump in net profit margin to 24.4%, up from 11.1% a year ago, with earnings growth of 57.7% reversing a five-year average decline of -5.2% per year. Despite a strong showing on profitability, future revenue is anticipated to edge down by 1% annually over the next three years, and earnings are projected to grow at just 1.6% per year, trailing the Hong Kong market’s forecasted 12.3% annual pace. The company’s current Price-to-Earnings Ratio stands at 10.6x, lower than the industry average of 16.3x and under its fair value estimate of HK$21.67, which could point to an attractive valuation. However, slower growth and dividend sustainability remain key concerns for investors.

See our full analysis for Guangdong Investment.Next, we’ll test these numbers against the dominant narratives in the market to see which expectations hold up and which are put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Surge While Revenue Set to Shrink

- Net profit margins have jumped to 24.4% from 11.1% last year. However, forward guidance points to a 1% annual decline in revenue for the next three years.

- Improved profitability strongly supports the case that Guangdong Investment can generate high-quality earnings even in a muted revenue environment.

- This strength stands out despite a previous five-year average profit decline of -5.2% per year, which shows the turnaround is recent and delicate.

- However, the projected earnings growth rate of just 1.6% per year lags well behind the Hong Kong market’s 12.3% pace and raises questions about momentum.

DCF Fair Value Shows Deep Discount

- The current share price of HK$7.40 trades well below the DCF fair value estimate of HK$21.67. This reveals a significant discount that could catch investor attention.

- Bulls argue this steep discount offers a compelling entry, with valuation multiples such as the 10.6x P/E placing Guangdong Investment below both its fair value and the industry average of 16.3x.

- Market sentiment around undervaluation is fueled by the margin improvement, which strengthens arguments for potential upside even if growth is tepid.

- Yet, the company is still priced higher than some peers despite being below the industry average, so the value argument is not completely clear-cut.

Dividend Sustainability Remains the Key Risk

- The biggest ongoing risk for investors centers on dividend sustainability, since the company’s muted earnings growth puts more pressure on future payouts.

- Critics highlight that, even with recent profitability improvements, Guangdong Investment’s slow forward earnings growth and declining revenue could challenge its ability to maintain or raise dividends over time.

- In the absence of accelerating growth, maintaining current distribution levels may become tougher if market conditions worsen.

- The reward of high-quality margins could be undermined if income investors lose confidence in the firm's dividend reliability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Guangdong Investment's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Guangdong Investment’s muted earnings growth and declining revenue signal challenges in delivering the stability and consistency that long-term investors often seek.

If you want steadier prospects, focus on stable growth stocks screener (2117 results) to discover companies with reliable earnings and revenue trends. This can provide greater confidence across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)