- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1600

Tian Lun Gas Holdings Limited's (HKG:1600) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Tian Lun Gas Holdings will host its Annual General Meeting on 28th of May

- CEO Zhenyuan Xian's total compensation includes salary of CN¥600.0k

- Total compensation is similar to the industry average

- Tian Lun Gas Holdings' EPS declined by 22% over the past three years while total shareholder loss over the past three years was 39%

The results at Tian Lun Gas Holdings Limited (HKG:1600) have been quite disappointing recently and CEO Zhenyuan Xian bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 28th of May. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Tian Lun Gas Holdings

How Does Total Compensation For Zhenyuan Xian Compare With Other Companies In The Industry?

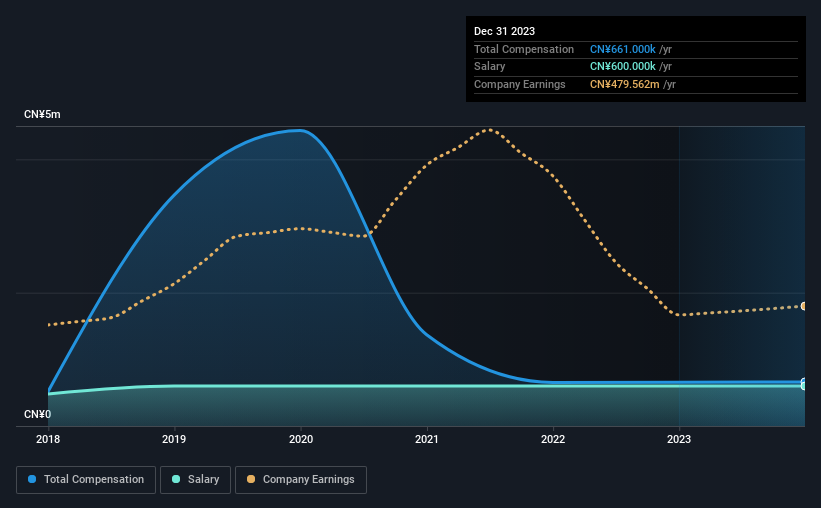

Our data indicates that Tian Lun Gas Holdings Limited has a market capitalization of HK$4.2b, and total annual CEO compensation was reported as CN¥661k for the year to December 2023. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at CN¥600.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Hong Kong Gas Utilities industry with market capitalizations between HK$1.6b and HK$6.2b, we discovered that the median CEO total compensation of that group was CN¥817k. From this we gather that Zhenyuan Xian is paid around the median for CEOs in the industry. Furthermore, Zhenyuan Xian directly owns HK$39m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥600k | CN¥600k | 91% |

| Other | CN¥61k | CN¥56k | 9% |

| Total Compensation | CN¥661k | CN¥656k | 100% |

On an industry level, around 67% of total compensation represents salary and 33% is other remuneration. It's interesting to note that Tian Lun Gas Holdings pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Tian Lun Gas Holdings Limited's Growth

Over the last three years, Tian Lun Gas Holdings Limited has shrunk its earnings per share by 22% per year. It achieved revenue growth of 2.4% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Tian Lun Gas Holdings Limited Been A Good Investment?

The return of -39% over three years would not have pleased Tian Lun Gas Holdings Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which is significant) in Tian Lun Gas Holdings we think you should know about.

Switching gears from Tian Lun Gas Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Tian Lun Gas Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1600

Tian Lun Gas Holdings

Engages in the transportation, distribution, and sale of natural gas and compressed natural gas through its gas pipeline connections in the People’ Republic of China.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026