- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1257

Would Shareholders Who Purchased China Everbright Greentech's (HKG:1257) Stock Three Years Be Happy With The Share price Today?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term China Everbright Greentech Limited (HKG:1257) shareholders have had that experience, with the share price dropping 48% in three years, versus a market decline of about 7.4%.

View our latest analysis for China Everbright Greentech

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, China Everbright Greentech actually managed to grow EPS by 15% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that China Everbright Greentech has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

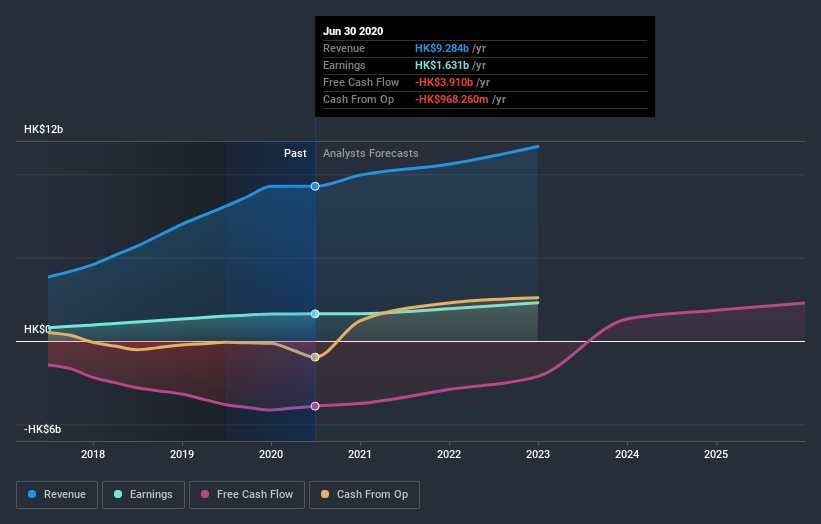

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

China Everbright Greentech is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think China Everbright Greentech will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, China Everbright Greentech's TSR for the last 3 years was -43%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

The last twelve months weren't great for China Everbright Greentech shares, which cost holders 7.0%, including dividends, while the market was up about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, the longer term story isn't pretty, with investment losses running at 13% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand China Everbright Greentech better, we need to consider many other factors. For instance, we've identified 3 warning signs for China Everbright Greentech (2 are a bit concerning) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Everbright Greentech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1257

China Everbright Greentech

An investment holding company, engages in the design, construction, operation, and maintenance of integrated biomass and waste-to-energy projects in China.

Undervalued with moderate growth potential.